[Editor’s Note: Do not base investment decisions on this assessment of the outlook for the Australian economy. Views on local and global economies can change quickly as economic data changes. Also, stock valuations might already reflect the market’s assessment of future economic conditions. Do further research of your own or talk to a licensed financial adviser before acting on themes in this article].

Just like in 2023, financial markets, investors and borrowers around the world are still firmly focused on what will happen to official interest rates.

But unlike last year, when central banks were raising rates at a rapid pace, 2024 is very much a story about when, how quickly, and how sharply they will start cutting rates.

Rising expectations around looming cuts to interest rates – a signal that central banks believe surging inflation levels are being brought back under control – provided a strong tailwind for sharemarkets in 2023.

Four months into 2024 (to end-April), that market’s tailwind is still there and has propelled markets to new highs. But it has eased off slightly as investors continue to ponder how central banks will manage interest-rate settings in an environment where high inflation levels remain sticky.

A resilient economy

It is Vanguard’s opinion that the Australian economy has shown modest signs of progress since the start of the year and is proving to be broadly resilient.

Vanguard continues to expect that Australia will just avoid a recession in 2024, with a forecast economic growth rate below trend at around 1%.

Recently, the key drivers of inflation have been domestic in nature. Productivity growth has been low, leaving unit labour costs growing at a rate above what would be consistent with the Reserve Bank of Australia’s (RBA) 2%-3% inflation target.

Vanguard’s view is that the pace of both headline and core inflation is expected to fall year-on-year to around 3% by the end of 2024.

Business confidence has significantly improved this year, and the Federal Government is running a modest fiscal deficit to fund investments in key sectors.

Vanguard’s view is that the lifting of certain trade restrictions by China on Australian exports, particularly on a range of agricultural commodities and goods, could provide a boost to the Australian economy over time.

That said, the Chinese economy is still being buffeted by persistent headwinds, including a prolonged property downturn and subdued business confidence.

However, as a major commodities producer and trading partner with China, Australia potentially stands to gain the most of any country from a recovery in China’s domestic demand in 2024. Vanguard hold the view that, stronger infrastructure and manufacturing investment could help cushion the impact from China’s persistent housing downturn.

Inflation challenges remain

Australia has seen economic growth moderating this year, which has been the intended outcome from policy tightening.

Still, inflation is poised to remain elevated, in Vanguard’s view, buoyed by incremental increases in real household income, the resurgence in the housing market, and sustained investments in key sectors such as education, healthcare, and transportation, facilitated by a modest fiscal deficit.

Although the unemployment rate has ticked up of late, strong wages growth and slow productivity gains have led to a slower disinflation process than expected.

As productivity growth has lagged, unit labour costs have outpaced levels consistent with the RBA's inflation target band, reflecting some of the “sticky” components of inflation, as the chart below shows.

Moreover, inward migration has added to housing demand, feeding into sticky price pressures via higher rents.

Vanguard’s forecast is that Australia’s inflation rate may gradually ease back to 3% by the end of 2024, which is at the top end of the RBA’s target, and could then inch down further in 2025.

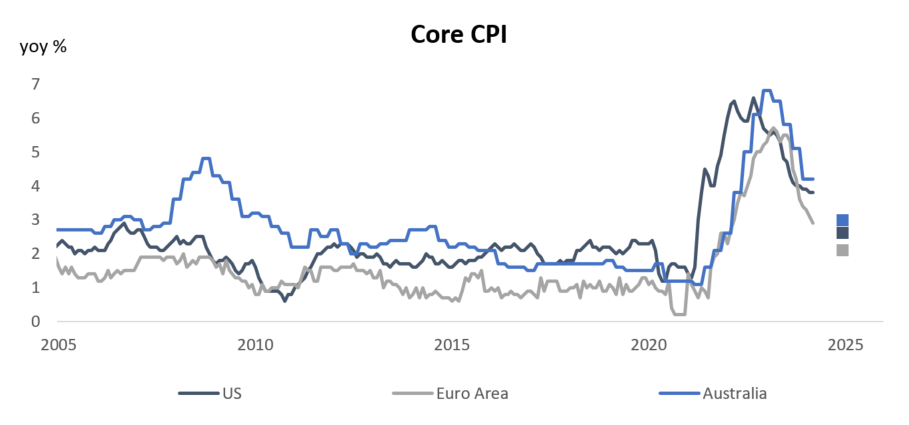

Core inflation is stubbornly sticky

Notes: Monthly data are from Dec. 2004 through Mar. 2024. Forecasts thereafter run through year-end 2025. Source: Vanguard calculations, based on data from Bloomberg, as of 31 March 2024

The lower rates road remains long

Central banks, such as the US Federal Reserve Bank and the RBA, are continuing to hold their rate cards close to their chests, indicating they are in no hurry to play their hand anytime soon [with rate cuts].

In Australia the labour market is still at a historically tight level, with the employment-to-population ratio close to a multi-decade high, meaning the path to eventual rates policy easing could be longer in Vanguard’s opinion.

Vanguard expects the unemployment rate may rise to around 4.6% by the end of 2024 as financial conditions tighten in an environment of elevated interest rates.

So, Vanguard’s baseline view is that the RBA is expected to keep its current policy rate the same for some time.

In fact, Vanguard’s view is that Australia may be one of the last of the developed countries to cut its rates. This is simply because Australian inflation did not rise as high as it did in the US and Europe, and hence our lower interest-rate peak here means the RBA could be likely to wait for other central banks to move first.

In the case of the RBA, if inflation moderates and returns to more sustainable levels, Vanguard expects the door will open for monetary policy easing in late 2024. Vanguard expects that the cash rate may be reduced from the current 4.35% to 3.85% by the end of 2024 and could eventually settle in a range of 3%-4%.

In other words, Vanguard holds the view that interest rates could remain at a higher level and may not fall back to the record lows Australia experienced during the peak of the COVID-19 pandemic, as the chart below shows.

Interest rates – higher for longer

Source: Vanguard

Lower inflation positive for real returns

The persistence of positive real interest rates [when the nominal interest rate exceeds inflation] provides a solid foundation for long-term risk-adjusted investment returns over the next decade, in Vanguard’s opinion.

Vanguard forecasts that the spread between global equity and global bond returns is expected to be 0-2 percentage points annualised over the next 10 years. As such, Vanguard expects return outcomes for diversified investors to be more balanced over the next decade.

Below is a summary of Vanguard’s latest forecasts generated by the Vanguard Capital Markets Model®.

- In the decade ahead, Vanguard’s forecast is for annualised earnings growth of 1.5% for Australian equities and 4.1% for global ex-Australia equities, supported by an expected growth rate in the U.S. that is well below that of past years but still higher than elsewhere.

- Vanguard’s bond return expectations have increased substantially. Vanguard now expects Australian bonds to return an annualised 4.3%-5.3% over the next decade, compared with the 1.3%-2.3% 10-year annualised returns we expected before the rate-hiking cycle began.

- Similarly, for global bonds, Vanguard expects annualised returns of 4.5%–5.5% over the next decade, compared with a forecast of 1.6%-2.6% when policy rates were low or, in some cases, negative.

DISCLAIMER

This article has been prepared by Vanguard Investments Australia Pty Ltd (VIA) ABN 72 072 881 086 AFSL 227263. It has been prepared without taking into account your objectives, financial situation or needs. Because of this you should, before making a financial decision based on this information, consider its appropriateness having regard to your individual objectives, financial situation or needs and consult a suitably qualified financial adviser. This information is for educational purposes only, does not constitute financial advice and is not to be regarded as a securities recommendation.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.