- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to {{verificationEmail}}.

Please check your inbox.

An account with your email already exists.

ASX markets flare on secondary capital raisings

- Tue 23 June 2020

Executive Summary:

- After the severe economic shock in March, markets rebounded strongly in April and volatility has declined from extreme levels, but is still elevated.

- COVID-19 has directly impacted global IPO activity.

- Since 1 March 2020:

- ASX is the most active exchange globally by total number of secondary offerings.

- ASX is the second most active exchange globally by secondary capital raised.

- Whilst COVID-19 has continued to spread globally, Australia and New Zealand has seen daily infection rates slow and are planning to gradually reopen their economies.

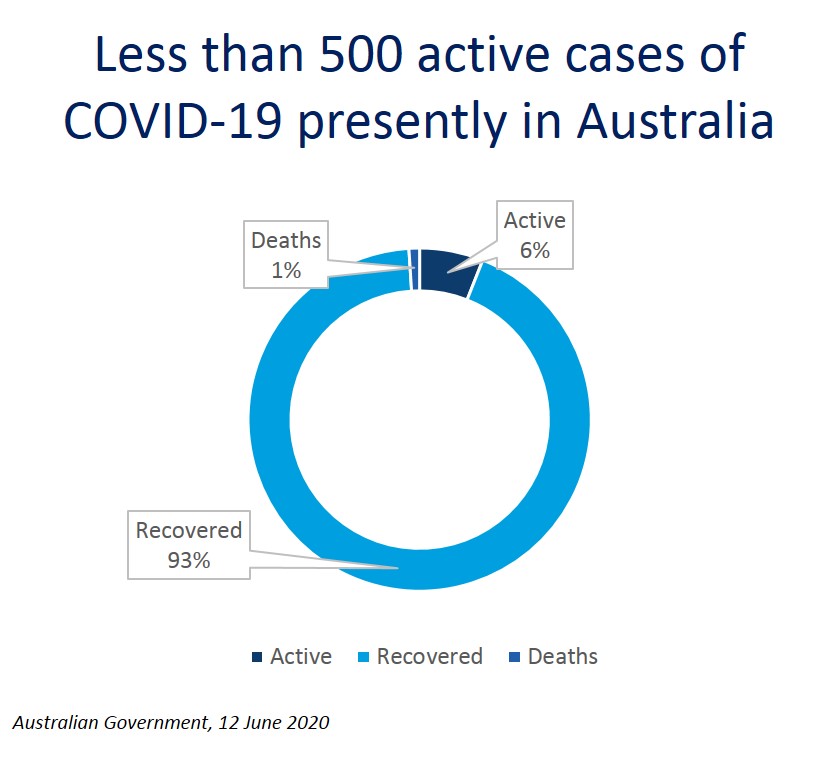

Australia has been very fortunate in the face of a global pandemic and its impact on the health care system, businesses, and the nation’s economy. To-date, the world’s total active cases of COVID-19 is close to four and a half million people, with Australia contributing roughly 0.01% to that figure.

In Australia, from the peak of the pandemic in late March when there were nearly 500 new cases a day, the daily increase since the beginning of June is now fewer than 20. Ninety percent of these were a direct consequence of importation, a pathway that has essentially been halted due to quarantining travellers and closing country borders.

Global initial public offerings largely deferred

However, as Australia has taken measures to stabilise its economy, COVID-19 has subdued global IPO activity and ASX has been no exception.

The exchange welcomed 25 new listings in 2020 year-to-date, but the number of new listings has declined in both quantum and value. Since 20 February 2020, ASX has listed five companies: Atomo Diagnostics (ASX:AT1), InteliCare Holdings (ASX:ICR), AML3D (ASX:AL3), United Malt Group (ASX:UMG), and Kaiser Reef (ASX:KAU).

Recent floats on US markets (such as ZoomInfo Technologies and Warner Music Group) suggest that corporate advisers and companies are beginning to feel more confident in their valuations and ability to price an IPO. A trend that, if continued, may point to the IPO window re-opening sooner than expected in Australia.

At present, many deals are on hold or postponed, as opposed to being cancelled altogether. IPO candidates are effectively using this time to conduct due diligence, assess timelines, and revise forecasts to reflect short- and medium-term impacts of COVID-19 with a view to move forward taking external risks into consideration.

From a macroeconomic perspective, Australia has successfully ‘flattened the curve’ and is in a better position than other major markets to further ease restrictions and slowly reopen the economy.

The ASX IPO pipeline remains strong, contingent on a potential window reopening in 2020.

ASX secondary capital raisings have soared

As Australia was moving swiftly to contain COVID-19 outbreaks, its capital markets were moving just as fast in response.

On 31 March 2020, ASX was one of the first exchanges in the world to implement temporary rule changes to facilitate emergency capital raisings against the backdrop of the COVID-19 pandemic. These changes included:

- accommodating back-to-back trading halts, in recognition that deals were generally taking longer to execute

- increasing the placement capacity from 15% to 25%, acknowledging that heavily depressed prices had caused the dollar value of a placement capacity to contract. Therefore, 15% may not be enough capacity given the steep decreases in companies’ market capitalisations. This was conditional on an accelerated pro rata entitlement offer or SPP offer also being undertaken, which helped support retail investor participation

- removing the 1:1 cap for non-renounceable entitlement offers, allowing issuers maximum flexibility to elect a fair and reasonable offer ratio that met their capital needs.

Source: Dealogic

From March to May 2020, more than $20 billion in secondary capital raisings were announced by over 200 ASX-listed companies. ASX ranked second globally for follow-on offerings, and has had more companies access its market for secondary capital than NYSE and Nasdaq combined.

As at 23 June 2020, this figure is over $27 billion.

By comparison, ASX averages approximately $40 billion in secondary issuances annually.

This success has been underpinned by Australia’s A$3 trillion pension pool – the fourth largest in the world – a robust but flexible regulatory regime, and efficient capital raising methods, such as placements which can be completed within 48 hours.

Coupled with a supportive investor base, the ability to mobilise capital quickly has provided a much-needed lifeline to ASX-listed companies at a crucial time.

Between March to June 2020 capital raisings have been undertaken by a wide range of companies. Notably, materials companies have been the most active with 113 companies tapping the ASX market for a total of $3.1 billion , followed by healthcare (31 companies raising $3.1 billion) and information technology (31 companies raising $1.6 billion).

Healthcare and technology businesses have remained resilient

Listed companies in sectors such as healthcare and technology have mostly remained resilient to the impact of COVID-19.

As some companies have raised capital to support the business during macroeconomic uncertainty, others – whose businesses have benefited from the crisis – have raised capital to provide optionality and pursue growth strategies.

The largest capital raising from the tech sector was NextDC (ASX:NXT), which completed its $863 million raising to fund a new data facility in Sydney and make data site acquisitions.

Cochlear (ASX:COH) completed the largest capital raising from the medtech space, raising $1.1 billion to enhance its balance sheet and financial flexibility.

In terms of IPOs, InteliCare Holdings (ASX:ICR), an Australian technology company focused on aged care in-home monitoring products, listed on ASX on 21 May 2020. It was the only listing in May and found favourable conditions during the COVID-19 pandemic, as its products can be utilised by the Australian community during social distancing measures.

And Atomo Diagnostics (ASX:AT1) has found success in its products’ ability to be used for COVID-19 testing.

Conclusion

As Australian markets remain vigilant, clearly a full economic recovery is dependent on the country being able to successfully control a potential ‘second wave’ of COVID-19 and adapting society to function until a vaccine or effective treatment is found.

Notwithstanding macroeconomic uncertainties, general consensus currently points to an opportunity for the IPO window to reopen later in 2020, with companies who have deferred their IPOs expected to be the first to go to the market.

About the author

Listings Business Development, ASX