- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to {{verificationEmail}}.

Please check your inbox.

An account with your email already exists.

ASX review of sharemarket floats

- Fri 08 February 2019

Australia in global top five for Initial Public Offerings in 2018.

Last year saw the largest value of ASX listings in more than a decade, dominated by two companies: the $17.1-billion spin-off of supermarket chain Coles from Wesfarmers in November and the $9.7-billion listing of Unibail Rodamco as a result of the takeover of Westfield.

Continuing the trend in 2017, the resources sector dominated initial public offering (IPO) activity with a mix of early-stage companies and a handful of larger floats.

There were 132 new listings, which put ASX among the top five exchanges globally for the number of new listings in 2018.

Viva Energy was the largest IPO of the year, listing in July with a $4.9-billion market capitalisation and a capital raising of $2.65 billion.

Total IPO capital raised was $8.5 billion, an increase from $6.4 billion in 2017.

Source: ASX

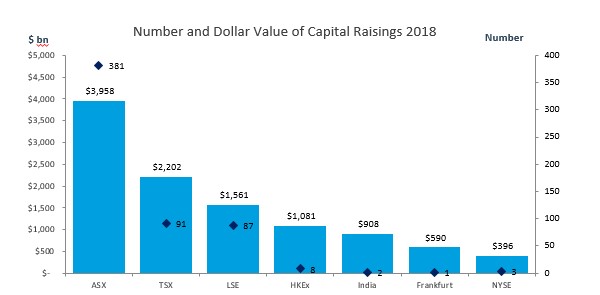

ASX further cemented its position as a world leader in resources capital raising. Among global exchanges ASX was the dominant venue by both number and dollar value for IPOs and follow-on capital raisings.

The high-profile resources listings in the year were Viva Energy, Coronado Global Resources (one of the world’s largest producers of high-quality metallurgical coal, based in the US), Jupiter Mines and Nickel Mines.

Source: Dealogic, 31st December 2018. TSX includes TSX-V and LSE includes AIM.

Listed Investment Trusts (LITs) and Listed Investment Companies (LICs) continued their strong momentum, raising more than $3.3 billion.

This reflects broad recognition from fund managers of the benefits of listing their products on ASX to gain wider investor reach. LITs and LICs occupied three of the top five IPO spots in 2018: L1 Capital, Hearts and Minds, and Wilson Asset Management raising the largest amount of funds.

Tech and international listings continue to strengthen

The tech sector again ranked among the most active sectors for IPOs. Two notable cross-border IPOs were US-based semi-conductor technology businesses Pivotal Systems and Revasum.

Pivotal Systems was the largest tech IPO raising of 2018; San Francisco-based student loan business Credible Labs was the largest in 2017. This reflects the success of ASX’s US listing strategy, with a total of 45 US companies now listed on ASX and six new listings in 2018.

ASX has a compelling case for attracting cross-border listings of companies valued between $50 million and $1 billion. Underpinning this is the world’s fourth-largest pension pool, an investor base that supports growth companies and earlier access to globally recognised indices.

An ASX listing provides an opportunity to go public earlier in the company’s life cycle and an alternative path to private funding. This is particularly valuable to businesses based in markets where the IPO opportunity is closed to companies with market capitalisations of less than $1 billion.

Consolidation of Xero on ASX

An important milestone for the ASX-listed tech sector was Xero’s consolidation to a sole ASX listing in Australia in February. This reflected the depth and quality of global institutional investment that can be achieved from inclusion in key ASX indices.

Xero, a market leader in accounting software, dual listed on ASX in 2012 after starting its listed life on the New Zealand exchange in 2007. A sole ASX listing saw it elevated to the S&P/ASX 100 index. Ahead of the announcement to consolidate on ASX, Xero was open in its assessment of the international listing options available as a multi-billion-dollar tech company.

In the end, Xero was satisfied that ASX provided access to a deep capital market, liquidity and a broader base of potential investors interested in growth companies.

In domestic tech, The Data Exchange Network listed in April and raised $15 million. It is the first manufacturer of modular data centres in Australia and joins a strong data centre peer group on ASX led by NextDC, which listed with a market cap of $80 million in 2010 and now has a market value of $2.5 billion. ASX expects to see continued interest in this sector.

Growth of pre-IPO funding

Pre-IPO funding has become a popular route to public markets, especially for cross-border listings. It can help facilitate some familiarity with the local market and secure local cornerstone investors ahead of the IPO process. Two tech IPOs in 2018 that followed this route were Revasum, which completed a $10-million pre-IPO round in August, and New Zealand company Straker Translations.

One of the potential challenges to the IPO market highlighted in the 2017 IPO review in ASX Investor Update was an increase in trade sales, especially in a low-interest environment, where large incumbents are looking to sweep up smaller innovators and disruptors. We saw this play out in 2018.

After much speculation, PEXA, the online property exchange network, pushed ahead with an IPO in October but was eventually sold to a Link Market Services and CBA consortium after encountering increasingly volatile market conditions.

In 2018 we also saw possible IPO candidates Quadrant Energy sold to Santos; Colonial First State Global Asset Management (CFSGAM) sold to Mitsubishi UFJ Trust and Banking Corporation; and Sapura Energy enter into a joint venture with Austrian firm OMV.

The last quarter of the year is ordinarily a busy time for listings looking to take advantage of the IPO window between reporting season and year-end. But macro-economic fears and the US-China trade war tensions in October saw global market volatility spike. This uncertainty caused many planned IPOs to be put on ice.

Outlook for 2019

Notwithstanding a good outlook for listings in 2019, global political uncertainty and market volatility will continue to weigh on the IPO market as book builds are imperilled by investor capital remaining on the sidelines.

That said, Australia continues to boast the unique advantage of a deep capital pool, institutional investors that are willing to back small and mid-cap companies, and a market with strong peer groups across all sectors.

Interest from domestic and international companies that see the benefits of accessing the Australian capital market remains strong.

About the author

Kate Galpin, ASX

Kate Galpin is Business Development Manager, Listings, at ASX.