- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to {{verificationEmail}}.

Please check your inbox.

An account with your email already exists.

ASX Investment Products review

- Fri 05 February 2021

Strong growth in mFunds and Exchange Traded Products in 2020.

In an unprecedented year in terms of market volatility due to COVID-19 pandemic, we highlight some of the interesting trends in ASX Investment Products in 2020. They include:

- mFunds

- Listed Investment Companies/Listed Investment Trusts (LICs/LITs)

- Exchange Traded Products (ETPs)

[Editor’s note: The ASX Investment Products monthly update provides information on ETPs, mFunds, LICs, LITs, A-REITs and infrastructure funds.]

Steady year for mFunds

Investors poured more than $232 million into mFunds, with total assets under management at an all-time high of $1.14 billion, up 21.7 per cent since the beginning of the year.

There were 15 new mFund admissions covering sectors such as global equities, mixed-asset class and domestic equities.

International equity mFunds lead flows

The 2020 data showed the majority of new money heading into international equity mFunds, which perhaps reflected that investors saw value in global equities over domestic equities and global fixed income as a result of the growing prospect of a COVID-19 vaccine and increasing optimism for growth.

Led by the Hyperion Global Growth Companies Fund (Class B Units) (HYN04), investors added $77 million into international equity mFunds, outpacing the $70.8 million into domestic equity mFunds and the $57 million into global fixed-income mFunds.

Other popular international equity mFunds included the Munro Global Growth Fund and ational equity mFunds lead flowsWalter Scott Global Equity Fund, both of which saw their funds under management grow by at least 100 per cent since the beginning of the year.

Domestic fixed income mFunds growing the fastest in 2020

While international equity mFunds led the way in terms of flows, domestic fixed-income mFunds were the fastest-growing asset class in 2020.

Total funds under management for fixed income grew by 45.5 per cent since the beginning of the year, surpassing the growth in international equity, domestic equity and global fixed-income mFunds, and showing the growing popularity of domestic fixed-income mFunds.

mFund Yearly Flows by Asset Class^

| Asset Class | Net Flows ($, millions) | FUM ($, millions) |

| Equity - Australia | 70.84 | 362.34 |

| Equity - Global | 77.86 | 352.12 |

| Fixed Income - Australia | 37.70 | 121.88 |

| Fixed Income - Global | 57.61 | 402.96 |

| Infrastructure/Property | 1.36 | 83.27 |

| Mixed | 13.21 | 70.14 |

mfund - Top10 Net Flows^

| ASX Code | Fund Name | Net flows ($, 000s) | FUM ($, 000s) | FUM % change |

| HYN04 | Hyperion Global Growth Companies Fund (Class B Units) | 33.67 | 53.67 | 393.43% |

| PMF03 | PIMCO Global Bond Fund Wholesale Class | 12.40 | 78.85 | 21.13% |

| MUN01 | Munro Global Growth Fund | 11.75 | 22.42 | 186.89% |

| MIM01 | Macquarie Income Opportunities Fund | 11.66 | 29.55 | 60.21% |

| FIL26 | Fidelity Future Leaders | 11.59 | 28.79 | 96.31% |

| BAE01 | Bennelong Australian Equities | 11.27 | 17.55 | 267.18% |

| MPS04 | Walter Scott Global Equity Fund | 9.53 | 18.88 | 133.84% |

| PMF02 | PIMCO Diversified Fixed Interest Fund Wholesale Class | 9.37 | 67.32 | 18.54% |

| JHI02 | Janus Henderson Tactical Income Fund | 9.26 | 28.54 | 48.93% |

| FIL08 | Fidelity Australian Equities | 9.07 | 31.75 | 42.62% |

Source: ASX FUM = Funds Under Management

Relatively subdued year for LICs/LITs

Amid the heightened volatility and sell-off in 2020, it was a relatively subdued year for LICs/LITs as demand for them fell.

At 31 December 2020, the market capitalisation of the LIC/LIT sector was $52.8 billion, down -0.6 per cent in 12 months. The heightened volatility and the market sell-off also proved tough for product launches, with no new listings in 2020.

Domestic LICs / LITs still the largest but not the most traded

Domestic equity LICs/LITs were the biggest asset class and represented 62 per cent of the entire LIC/LIT market (at December 30, 2020).

Although domestic equity LICs/LITs were the biggest asset class, global equity LICs/LITs were the most frequently traded.

The most frequently traded global equity LIC/LIT was the L1 Long Short Fund Limited (ASX: LSF), followed by WAM Leaders Limited (ASX: WLE) and Magellan Global Trust (ASX: MGG). All saw their trading volumes increase by least 10 per cent from their 2019 levels.

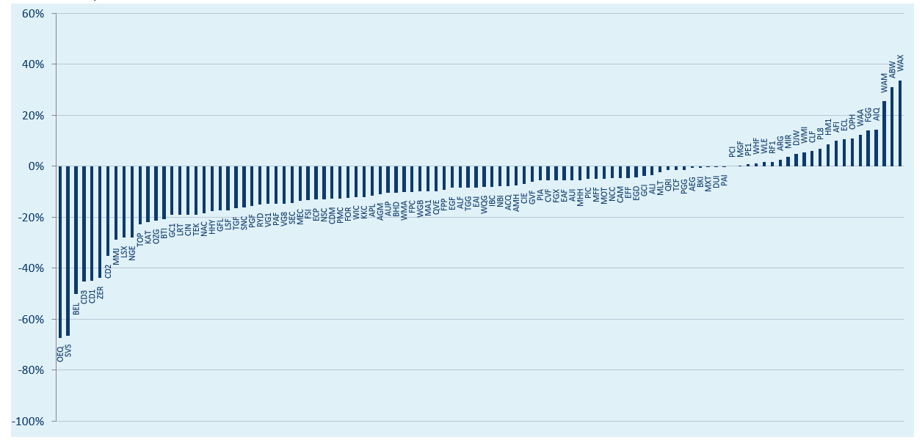

Marginal rise in number of LICs / LITs trading at a discount

The number of LICs/LITs trading at a discount in 2020 increased slightly in 2020. At 30 November 2020, 78.1 per cent of LICs/LITs were trading at a discount compared to 76.3 per cent a year earlier.

Notably, global equity LICs/LITs tended to trade at greater discounts than fixed-income and domestic equity LICs/LITs.

LICs/LITs - Yearly Asset Class breakdown^

| Asset Class | Market Cap ($, billions) | Total Trading Volume (billions) |

| Equity - Australia | 32.78 | 2.68 |

| Equity - Global | 14.67 | 2.90 |

| Fixed Income - Australia | 2.42 | 0.41 |

| Fixed Income - Global | 2.63 | 0.42 |

| Infrastructure/Property | 0.34 | 0.06 |

Source: ASX

LICs/LITs - Premium/Discount to NTA at 30 November 2020^

Source: ASX

Top 10 Traded LICs/LITs^

| ASX Code | Fund Name | Total Traded Volume (2020) (millions) | Total Traded Volume (2019) (millions) |

| LSF | L1 Long Short Fund Limited | 380.25 | 246.31 |

| WLE | WAM Leaders Limited | 324.37 | 245.47 |

| MGG | Magellan Global Trust | 319.68 | 290.27 |

| WAM | WAM Capital Limited | 260.14 | 203.89 |

| MXT | Mcp Master Income Trust | 245.92 | 254.08 |

| APL | Antipodes Global Investment Company Ltd | 215.77 | 185.85 |

| MHH | Magellan High Conviction Trust | 208.19 | 29.70 |

| MMJ | MMJ Group Holdings Limited | 159.01 | 127.43 |

| AFI | Australian Foundation Investment Company Limited | 157.47 | 117.83 |

| CDM | Cadence Capital Limited | 134.46 | 112.51 |

(Source: ASX)

ETPs shine brightly in 2020*

In 2020, investors poured a record $20 billion into ETPs, shattering the yearly inflow record of 2019 by 49 per cent.

Total funds under management for ETPs were $82.7 billion (or $94.44 billion if you include CHESS and SRN holdings for MGOC), up 34 per cent since the beginning of the year.

There were also 23 new ETP admissions covering sectors such as global and domestic equities.

International Equity ETPs Lead Inflows for seventh Year*

For the seventh straight year, international equity ETPs were the most popular asset class among investors.

Led by the Magellan Global Fund (Open Class) (Managed Fund) (ASX: MGOC), investors added $7.56 billion into international equity ETPs, which outpaced the $7.18 billion into domestic equity ETPs, the $1.9 billion into domestic fixed-income ETPs and the $1.4 billion into commodity ETPs.

Other popular international equity ETPs included the VanEck Vectors MSCI World ex Australia Quality ETF (ASX: QUAL), Nasdaq 100 ETF (ASX: NDQ), the BetaShares Global Sustainability Leaders ETF (ETHI) and the Vanguard MSCI Index International Shares (Hedged) ETF (ASX: VGAD), each seeing at least $400 million flowing in since the beginning of the year.

Domestic Broad-based Equity ETPs remain the most popular among investors*

Although overall international equity ETPs were the most popular in 2020, domestic broad-based equity ETPs dominated the most popular ETP rankings, which could have been a sign that investors were moving to local markets amid the uncertainty of the Coronavirus pandemic.

The most popular ETP in 2020 was the Vanguard Australian Shares Index ETF (ASX: VAS), followed by the iShares Core S&P/ASX 200 ETF (ASX: IOZ), with each seeing at least $1.5 billion in inflows and becoming the first-ever ETPs to accumulate over $1 billion in inflows in a year.

Other popular broad-based domestic equity ETPs included the SPDR S&P/ASX 200 Fund (ASX: STW) and BetaShares Australia 200 ETF (ASX: A200), with both ranking in the top 20 most popular ETPs in 2020 and each seeing at least $250 million in inflows since the beginning of the year.

ETPs - Yearly Asset Class breakdown^

| Asset Class | Net flows ($, billions) | FUM ($, billions) | FUM % change |

| Cash | 0.40 | 2.95 | 15% |

| Commodity | 1.49 | 3.46 | 100% |

| Currency | -0.08 | 0.19 | -37% |

| Equity - Australia | 7.18 | 26.17 | 42% |

| Equity - Global* | 7.56 | 33.41 | 31% |

| Fixed Income - Australia | 1.93 | 8.41 | 24% |

| Fixed Income - Global | 0.46 | 2.18 | 45% |

| Infrastructure/Property | 0.98 | 4.53 | 14% |

| Mixed | 0.63 | 1.58 | 74% |

Source: ASX

ETPs - Top 10- Net flows^

| ASX Code | Fund name | Net flows ($, billions) | AUM ($, billions) |

| VAS | Vanguard Australian Shares Index ETF | 2.29 | 7.17 |

| IOZ | iShares Core S&P/ASX 200 ETF | 1.64 | 3.68 |

| GOLD | ETFS Physical Gold | 0.83 | 2.04 |

| MGOC* | Magellan Global Fund (Open Class) (Managed Fund) | 0.71 | 1.61 |

| QUAL | VanEck Vectors MSCI World Ex-Australia Quality ETF | 0.57 | 1.53 |

| NDQ | BetaShares NASDAQ 100 ETF | 0.55 | 1.45 |

| IAF | Shares Core Composite Bond ETF | 0.52 | 1.65 |

| STW | SPDR S&P/ASX 200 | 0.51 | 4.22 |

| ETHI | BetaShares Global Sustainability Leaders ETF | 0.50 | 1.07 |

| VGAD | Vanguard MSCI Index International Shares (Hedged) ETF | 0.42 | 1.37 |

Source: ASX

* In November 2020, Magellan merged its unlisted open-ended Magellan Global Fund, its listed open-ended Magellan Global Equities Fund (MGE) and its listed closed-ended Magellan Global Trust (MGG). As a result of the merger, this created the Magellan Global Fund (Open Class) (Managed Fund) (MGOC). For the purposes of this article, the figures stated only include the quoted units on ASX relating to MGOC.

^ Source: ASX Investment Products Monthly Report & ASX CHESS data.

About the author

Martin Dinh , Senior Investment Product Specialist, investment Products, ASX

Martin is the Senior Investment Product Specialist for Investment Products at ASX and has been in this role since 2013. He is responsible for the admission of exchange-traded products, warrants and mFunds as well as managing the exchange’s relationship with existing and prospective fund managers. Martin has played a key role in the growth of ASX’s Investment Product market including facilitating the admission of over 150 Investment Products since 2013.