- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to {{verificationEmail}}.

Please check your inbox.

An account with your email already exists.

Ausbil: Banks, resources to lead market higher

- Fri 02 July 2021

Local, global economies will run “hot” for some time, with the support of policymakers.

The world is in the process of controlling Covid with a range of tested vaccines just over a year from the original declaration by the World Health Organisation on 11 March 2020 that the Covid outbreak was officially designated a pandemic. This is a remarkable achievement even though control of the virus remains a challenge.

We expect to see an acceleration in global growth to 6.6% in 2021, with the United States set to grow 7% in 2021.

China was the first nation to emerge from lockdown in 2020. China is consolidating growth in the domestic economy and is expected to print an economic growth figure of 8.2% in 2021.

Advanced economies are forecast to grow at multiples of their 10-year average, with Europe emerging from a double-dip recession caused by its second lockdown. Ausbil is expecting the Eurozone to grow by 4.7% in 2021.

Of all the pandemic stimulus packages, that of the US was far and away the largest, with the level of US fiscal support during the pandemic so far totalling US$5.2 trillion, 24.6% of nominal GDP, or three times the fiscal support given during the 2008 financial crisis.

In addition, the Federal Reserve’s open-ended Quantitative Easing (QE) program is providing monetary support to the tune of 11% of nominal GDP to date.

Ausbil’s current economic outlook is summarised in the table below.

Paul Xirades, Executive Chairman and Chief Investment Officer

The economy: Ausbil v consensus outlook

| Real GDP % year average 27 April 2021 | 10-year average 2010 to 2019 % | Pandemic Actual 2020 % | Ausbil 2021 (f) % | Official Sector Consensus 2021 (f) % |

United States | 2.2 | -3.5 | 7.0 | 6.6 |

Japan | 1.1 | -4.8 | 3.7 | 3.4 |

Eurozone | 1.2 | -6.6 | 4.7 | 4.2 |

China | 7.7 | +2.3 | 8.2 | 8.1 |

Australia | 2.6 | -2.4 | 4.9 | 4.5 |

Global GDP | 3.7 | -3.3 | 6.6 | 6.1 |

Source: FactSet, Ausbil, 2021, (f) = forecast

Risks

There are several risks to Ausbil’s outlook. Recently, markets have been concerned about a permanent rise in inflation; what the recent rises in bond yields might mean for more persistent inflation; and the risk posed to interest-rate levels.

These fears are also caught up with concerns around any earlier-than-expected Fed response, or any tapering of QE sooner than expected. That is, before the 2024 milestone, which has been set based on the emphatic and repeated comments by both the Fed and the RBA. These risks are associated with an economic rebound that is too successful, or successful too quickly.

There are three conditions required before there is a lift-off in rates:

- There needs to be a labour market that is at maximum employment

- Inflation needs to have been at around 2% for at least a year

- The level of inflation needs to be on track to exceed the 2% level “for some time,” as noted by the US Federal Reserve.

These three conditions have never been simultaneously met in recent history.

Another risk is that economic growth underperforms, and the rebound is less than successful due to new Covid variants outpacing the efficacy of the current stable of vaccines.

Jim Chronis, Chief economist

There also remains unquantifiable geopolitical and trade risks around the world, including the potential for regional conflicts in Iran/Israel, China/Taiwan, Russia/Ukraine, and now with actual conflict in the Middle East.

Ausbil’s view is that economies will run “hot” for some time, with the support of policymakers, and are delivering the best growth figures since 1983, across a multi-year growth profile, as illustrated in the table above.

Although inflation will remain an ongoing source of worry as the perennial flipside to growth, it is important to understand when inflation spikes are intermittent or if they are moves to a higher sustained level. It is our view, and indeed that of most global central banks, that inflation will not be a problem for some years as the world economy returns to health.

We see inflation remaining within target ranges for some years, and cash rates on hold until 2024, with long-bond yields to adjust over these years in an orderly fashion.

Australia’s economic growth, and the current resources boom, will underpin the Australian dollar, with Ausbil forecasting the AUD/USD in an up-trend: 75-80c for 2021, 80-85c in 2022, and 85-90c in 2023.

This low-rate environment, and the multi-year economic growth outlook, are supportive of an underlying multi-year growth outlook for equities, especially in cyclical sectors, banks, and resources as world demand grows.

Banks, resources to lead earnings surprises

(Editor’s note: Do not read the following ideas as stock recommendations. Do further research on your own or talk to a financial adviser before acting on themes in this article).

Two key sectors where we see further earnings surprises are banks and resources.

Banks, which offer primary exposure to a recovering economy, entered the pandemic after a heavy barrage from the Hayne Inquiry and having already been sold down.

The pandemic saw them sold down further on fears that the recession and Covid job losses would affect their lending books. All the banks made major provisions for the potential of credit loss, and the Australian Prudential Regulation Authority (ARPA) further enforced capital retention by limiting the dividends they were allowed to pay.

Looking at the banks in the 2021 new financial year, it was evident that the bad and doubtful debt experience was nowhere near predictions, and that the banks had over-provisioned for losses.

With APRA allowing a return to more commercial dividend levels, and the economy resurging from the 2020 lows, we could see banks were in a position to reduce these provisions and grow their books further in a renewing real estate market.

The result is that over the next few years, the unwinding of this over-provisioning will see a rerating of earnings, ahead of the consensus expectation at the time we began up-weighting into banks.

Resources

Metals and mining are in the midst of two fundamental themes in global resources investing. The first is the super-cycle demand for Australia’s bulk commodities, including iron ore, from China in terms of building and infrastructure demand, and as a function of the growth path of the world economy. This theme is expected to drive earnings in companies such as BHP, Rio Tinto, and Fortescue Metals.

The second is the fundamental shift in the energy transition to renewable energy, and the rapid adoption of electric vehicles, which is sparking a secular demand for bulk, base, and battery materials (copper, lithium, cobalt, zinc, manganese, and rare earths) that is expected to last for decades, underwriting the fundamentals of a strong resources market.

This long secular “electrification” demand is forecast to drive earnings in companies such as Galaxy Resources (ASX: GXY), Orocobre (ASX: ORE) and IGO in lithium (ASX: IGO), OZ Minerals in copper (ASX: OZL), and Lynas Rare Earths (ASX: LYC).

Ausbil has been overweight banks and resources (metals and mining) for some time. These overweights remain in place across our portfolios and have driven outperformance across our different strategies.

Importantly, we are still in the early stages of the economic cycle, with a positive growth outlook for multiple years that is expected to drive performance in these mega-sectors.

The portfolio is also tilted towards rebound stocks in travel and recreation, such as Qantas Airways (ASX: QAN) and Webjet (ASX: WEB), the earnings of which are returning following the implementation of global vaccinations, as well as high-quality industrials and healthcare names, such as Ramsay Health Care (ASX: RHC), that are primary beneficiaries of economic recovery.

Where next?

Since the historic reversal in consensus across the February reporting season that saw the FY21 consensus earnings outlook for the broad market rebound from -1.6% to +15.6%, consensus earnings outlook for both indices has rerated to +19.08% (S&P/ASX 200) and +19.02% (S&P/ASX 300).

While these earnings figures are strong, Ausbil’s view is that consensus is still underestimating the rebound in earnings that will occur in the prevailing economic conditions, with rates to remain low, and with the world economy providing a tailwind to Australia’s current expansion.

In terms of the market itself, three important observations can be made when looking at the earnings growth and levels:

1. The consensus earnings outlook regularly misses the actual earnings by some margin (as shown in the red and blue bars) in the chart below.

Moreover, in the expansion phase of 2004-2007, consensus significantly and consistently undershot actual EPS growth. What is interesting about this period is that it shows the multi-year expansion of year-on-year positive earnings-per-share (EPS) growth that could be similar to the period of earnings expansion we have just entered in 2021.

2. Since the GFC, aggregate earnings have moved sideways, within a range.

Market performance has been driven by significant Price/Earnings (PE) expansion in this time rather than earnings expansion. Ausbil’s outlook is for the return of strong multi-year earnings over the next 2-3 years, and possibly beyond.

3. Markets are volatile and can rise and fall on anticipated and unanticipated information.

However, comparing the market and EPS levels over time shows that markets tend to rise when earnings are in a rising pattern, or conversely, the market is unlikely to fall significantly when it is in an earnings upgrade cycle.

Ausbil’s portfolios have been positioned for a clear path to recovery, but with some volatility and uncertainty along the way. We are expecting a multi-year earnings growth cycle, and we maintain the position that investors are compelled to participate.

While we maintain a positive outlook on earnings, this is still a time to invest in only the best-quality companies that exhibit superior underlying earnings growth and strength, to achieve longer-term outperformance.

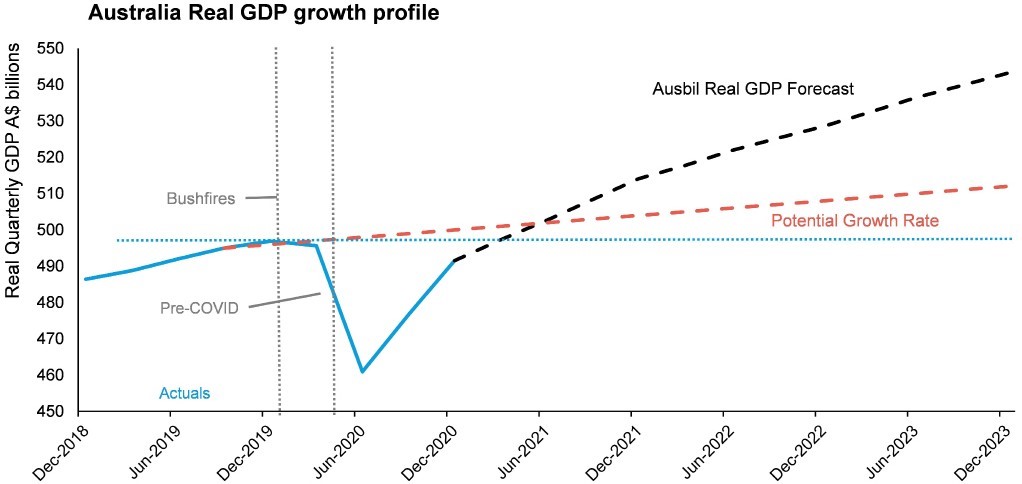

Australia’s recovery growth path

Source: FactSet, Ausbil, 2021

About the author

Paul Xiradis and Jim Chronis , Ausbil

Paul Xiradis is Executive Chairman and Chief Investment Officer of Ausbil Investment Management. Jim Chronis is Chief Economist at Ausbil. Ausbil is a leading Australia-based investment manager.

Several Ausbil managed funds are available via mFund.

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.