References and Notes

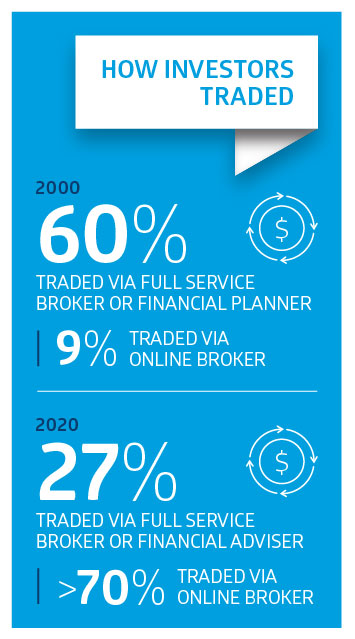

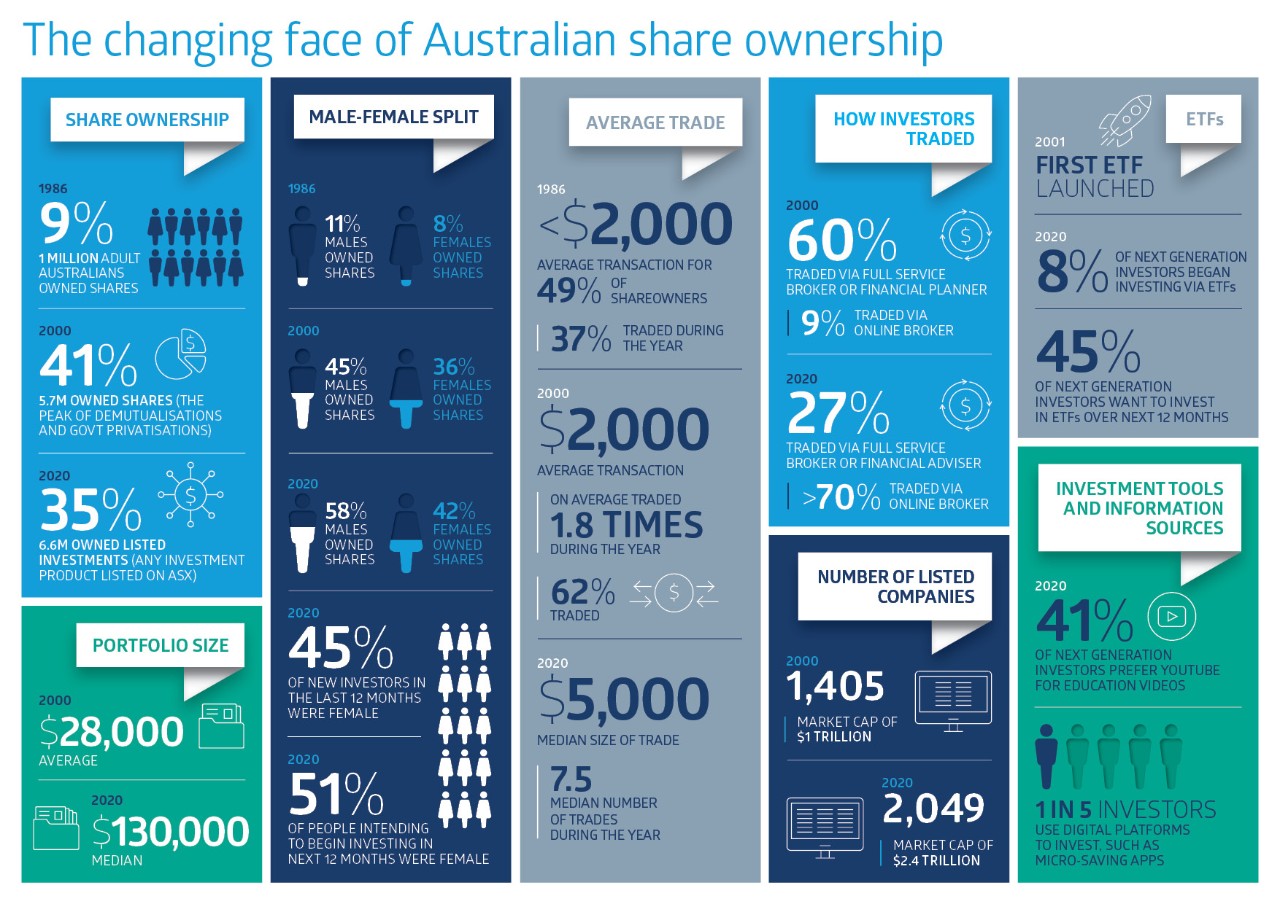

[1] Australian Stock Exchange, “2000 Australian Share Ownership Study.” P19.

[2] ibid. P19.

[3] ibid. P19

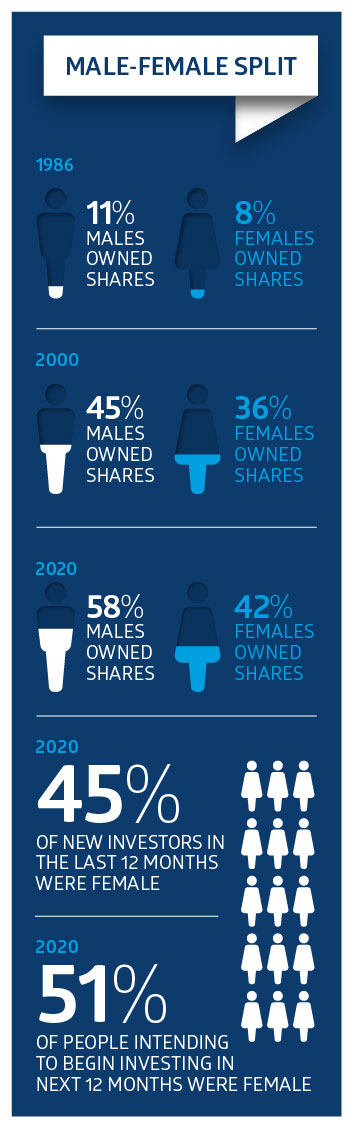

[4] 59 per cent of Australian adult males held shares directly versus 41 per cent for females. Australian Stock Exchange, “2000 Australian Share Ownership Study.” P19

[5] On average, retail investors trade around two times a year. Almost two thirds traded only once (or not at all) during a 12-month period. Source: Australian Stock Exchange, “2000 Australian Share Ownership Study.” P5.

[6] Full service/advice brokers had been used by almost half (44 percent) of those with a broker relationship. Australian Stock Exchange, “2000 Australian Share Ownership Study. P23

[7] The average dollar value of share parcels traded was $5,500 with 4 in 10 shareowners

(38 percent) with an average transaction size of up to $2,000. Australian Stock Exchange, “2000 Australian Share Ownership Study. P19.

[8] The Australian Securities Exchange was known as the Australian Stock Exchange at the time.

[9] ASX demutualised on October 13, 1998. It listed on ASX on October 14, 1998. It was known as the Australian Stock Exchange at the time.

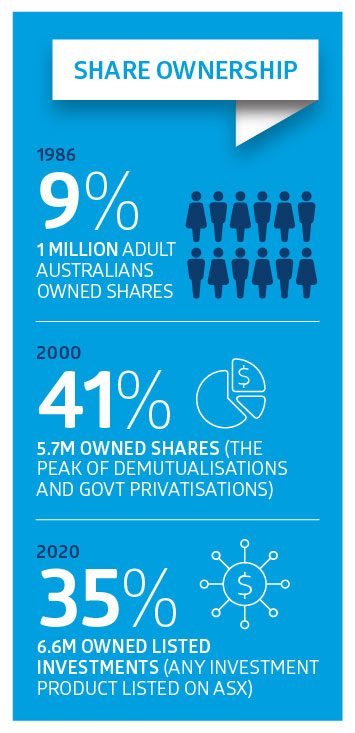

[10] Australian Stock Exchange, “2000 Australian Share Ownership Study.” P4.

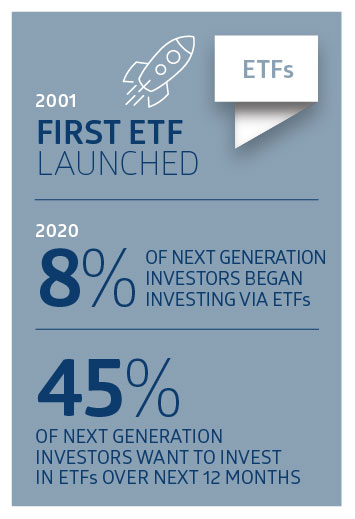

[11] Australian Securities Exchange, “ASX Australian Investor Study 2020. P15.

[12] At 41 percent, the level of direct share ownership in Australia ranked higher than other

major nations studied – the U.S.A., New Zealand, U.K., Canada and Germany. Australian Stock Exchange, “2000 Australian Share Ownership Study.” P26.

[13] Australian Securities Exchange, “ASX Australian Investor Study 2020”, P15.

[14] ibid. P13.

[15] ibid. P48.

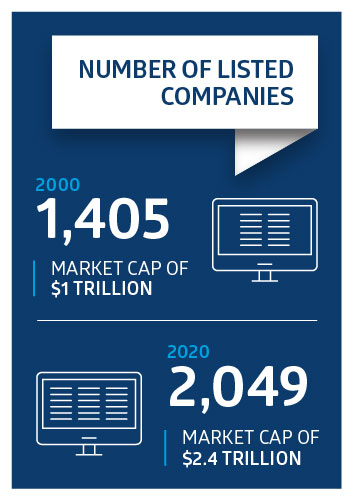

[16] ASX internal data.

[17] Annual average of new listings on ASX from 2014 to 2020.

[18] In 2019. Source: Bloomberg.

[19] ASX internal data. 2000 was the year when the All Ordinaries index changed from including approximately 250 companies to 500.

[20] ASX internal data. The combined market capitalisation of ASX-listed entities at end-December 2000 was $1,005,569 million. In 2020, it was $2,398,668 million. 2000 was the year when the All Ords changed from including approximately 250 companies to including 500.

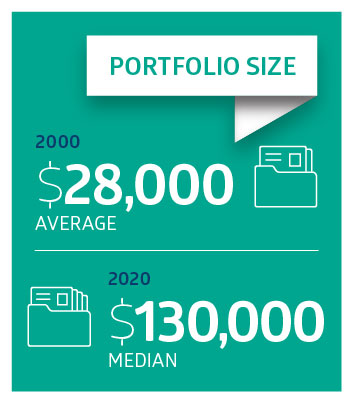

[21] Ibid. P16. Comparisons with portfolio values between 2020 and 2000 are not valid. The 2000 survey recorded average portfolio size, whereas the 2020 survey records median portfolio size.

[22] Care is needed with different comparisons between portfolio size. The 2000 figure is based on an average, whereas the 2020 figure uses a median measure.

[23] Australian Securities Exchange, “ASX Australian Investor Study 2020, P18.

[24] ibid. P15.

[25] Australian Bureau of Statistics, 2019.

[26] Australian Securities Exchange, “ASX Australian Investor Study 2020, P14.

[27] ibid, P9

[28] 54% made changes to their portfolio due to COVID-19. ASX Australian Investor Study 2020. P5.

[29] Australian Stock Exchange, “2000 Australian Share Ownership Study.” P5.

[30] Australian Securities Exchange, “ASX Australian Investor Study 2020. P12.

[31] Ibid. P51.

[32] Ibid. p43. Based on May 2020 survey.

[33] Australian Securities Exchange, “ASX Australian Investor Study 2020. P12.

[34] Ibid. P6

[35] Ibid. P6

[36] Australian Stock Exchange, “2000 Australian Share Ownership Study.” P25.

[37] Australian Securities Exchange, “ASX Australian Investor Study 2020. P42

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.