- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to {{verificationEmail}}.

Please check your inbox.

An account with your email already exists.

Getting the lowdown on small-cap stocks

- Fri 05 February 2021

ASX Equity Research Scheme supporting broker research on small companies

At one point or another, many investors will find themselves facing the arduous task of identifying the numerous investment opportunities in the ASX-listed small-cap space.

[Editor’s note: You can access free broker reports on small-cap stocks by subscribing to the ASX Equity Research Scheme].

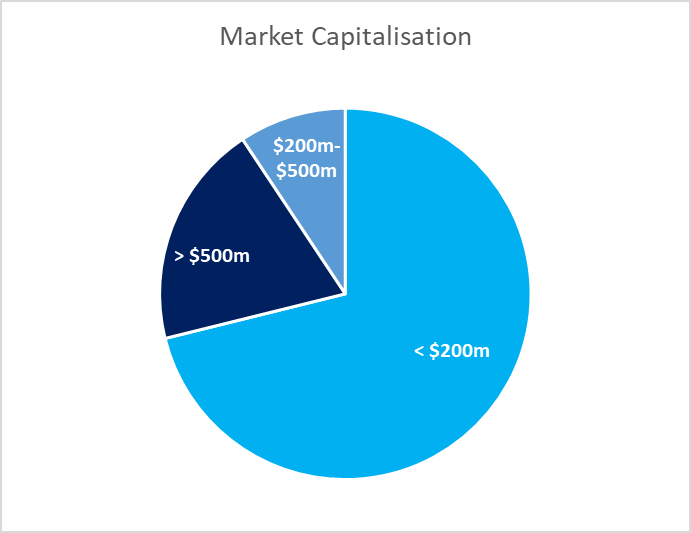

Of the approximately 2,000 entities listed on ASX, just over 1,400, or 70 per cent, are below $200 million in market capitalisation.

Of these, 867 are even smaller with a market capitalisation below $50 million.

Whether it be word-of-mouth, social media and digital content or direct from the company itself, researching a little-known or recently listed entity can take a certain level of market acumen and experience. This is especially true when considering the sheer number of investment opportunities in this market sector.

ASX recognises that reliable equity research plays a crucial role in the fair valuation of listed companies. By providing information to the market, research enables pricing efficiency through disseminating company valuation data, qualitative information, and financial modelling.

Small-cap companies are chronically under-covered by high-quality, independent researchers that examine the company’s operations, financial performance, strategy and execution. Equity research further assists investors by providing analyst forecasts, valuations and price targets.

Source: ASX

Small-cap companies generally carry a greater risk profile but often have the potential for higher returns than their large-cap counterparts. It is for this reason that quality research is important in an active and transparent market, allowing investors to make well-informed decisions and derive value from all market segments.

ASX Equity Research Scheme

ASX introduced the ASX Equity Research Scheme in 2012 to support the production of high-quality, independent research for under-covered ASX-listed small-cap companies.

The Scheme subsidises equity research on eligible companies over the financial year by partnering with a number of well-established research brokers working in the small- and mid-cap space, driving liquidity and awareness of these smaller stocks.

Since its inception, ASX has been facilitating access to these research reports to the wider market, and in 2018, ASX began to distribute all scheme reports via an email list that all investors can subscribe to here.

The Scheme covers approximately 100 listed companies per financial year that meet specific eligibility criteria, including a market capitalisation between $30 million and $1 billion and sitting outside the S&P/ASX 300. These criteria capture approximately 500 companies - almost 25 per cent of the total issuer population. Companies must also be covered by two or fewer analysts.

Research partners choose the companies they wish to cover for the year. Currently, 91 companies with a median market cap of $140 million are being covered in FY21. This accounts for roughly 20 per cent of the pool of eligible companies.

Susan Antoun, Head of Compliance and Operations at Taylor Collison, says: “The Scheme helps to keep independent research available in the market. Research broadens the information available to investors about companies and exposes them to companies they may not have been aware of – particularly small- to mid-cap stocks.

“In our case, the effect of the Scheme is to increase the number of companies we are able to cover each year, which is a benefit to investors and the companies involved.”

Hundreds of companies covered

Since its inception, the Scheme has covered 449 unique companies – many of which no longer qualify due to growth and/or increase in analyst coverage. Just shy of 20% are now included in the S&P/ASX 300 and S&P/ASX 200 indices.

Jumbo Interactive Limited (ASX: JIN) was first covered under the Scheme by Morgans in FY17 with a share price of $1.50 and then again in FY18.

In September 2018, with a share price around $6, Jumbo presented at the ASX Small- and Mid-Cap conference, an ASX retail investor-focused program designed to support the awareness of emerging small- to mid-cap companies.

By 2020, Jumbo was well on its way out of the small-cap arena, graduating into the S&P/ASX 300 and presenting at the mid- to large-cap ASX CEO Connect program with a share price of $12.05 and a market capitalisation of over $1 billion.

Of course, companies such as Jumbo only succeed when their own performance in growing revenue and executing on strategy creates value, and there are many additional factors to research that contribute to share-price growth.

However, the example of Jumbo Interactive highlights ASX’s role in supporting companies in their on-market journey and helping investors become aware of investment opportunities.

Other stand-out companies that have been covered under the Scheme include Altium (ASX: ALT), Afterpay (ASX: APT), Vocus Group (ASX: VOC) and Nearmap (ASX: NEA).

Research from the ASX Equity Research Scheme is published in a weekly email bulletin on Friday afternoons with an average of six research reports per week.

You can subscribe to the bulletin and access more information about the scheme on the ASX website.

About the author

Giri Tenneti, Senior Manager Issuer Services, ASX

Senior Manager, Issuer Services