- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to {{verificationEmail}}.

Please check your inbox.

An account with your email already exists.

Improving outlook for property yield

- Fri 04 June 2021

Despite the rapidly changing environment due to COVID-19, income levels for most A-REITs remained steady.

Record-low interest rates present a significant challenge for investors and their advisers seeking a healthy income yield, particularly for those depending on income from investments in retirement.

With interest rates expected to remain “lower for longer”, Australian Real Estate Investment Trusts (A-REITs) are well placed to generate reliable levels of income, with the potential for capital growth.

The past year was one for the record books and many asset classes experienced volatility. In real estate, structural changes underway were amplified, with industrial and logistics properties supported by record levels of online retail and non-discretionary retail buoyed by panic buying across supermarket chains.

Large malls, with a heavy focus on discretionary retail, were negatively affected by government-enforced closures, as were CBD retail outlets as office workers stayed home over health fears.

Pleasingly, despite the rapidly changing environment, income levels for most A-REITs remained steady.

Earnings across the sector fell 5% in FY21 compared to FY20 and are expected to grow 9% into FY22. This directly affects the distributions paid by A-REITs to investors. Distribution rates in FY21 fell 6% from FY20 levels and in FY22 are expected to grow by 11%.

Features and benefits of A-REITs

A-REITs provide a diversified and liquid investment in commercial property with a minimal initial investment amount. Institutional managers select assets to provide investors with access to a wide range of commercial property sectors, including office buildings, shopping centres, industrial facilities, plus non-traditional asset classes like service stations, childcare centres, manufactured housing, pubs, self-storage, data centres and farmland exposure.

Like all property investments, investors should have a medium to long-term investment horizon when investing in A-REITs. However, as they are listed on the ASX, A-REITs can be bought and sold at any time.

Distributions relatively high and increasing

Investors can expect an income yield of approximately 4.1% in FY22, based on current pricing levels, with this income backed by contractual income obligations. This is a “yield premium” over the current RBA cash rate of 400 basis points [the RBA cash target rate was 10 basis points, at May 2021].

The distribution rate compares to the earnings yield of 5.9%, which implies A-REITs are paying out only around 70% of earnings to investors.

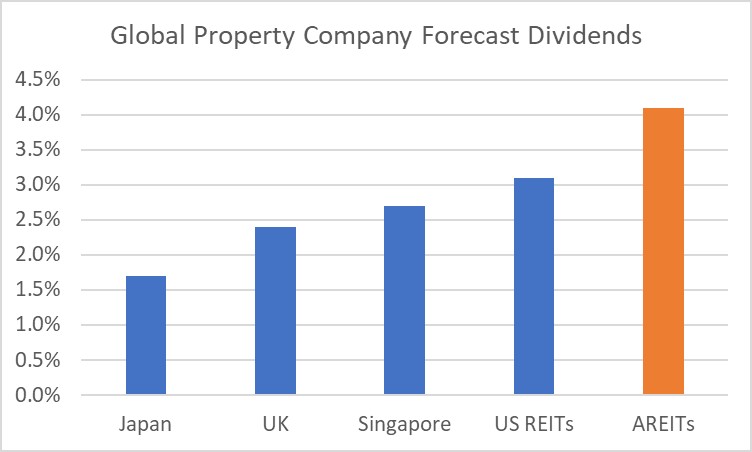

This ratio is expected to rise as companies become less risk averse. The ratio is expected to climb closer to 75% in FY22, back to pre-pandemic levels. Globally, A-REIT yields are compelling, as the chart below shows.

Source: UBS Global Real Estate: Key Valuation Metrics. At 3 May 2021

Solid property fundamentals

While the Australian economy has been affected by recent events, it's in much better shape than many global peers. Australia’s GDP fell -1.1% during 2020, well ahead of other developed nations such as the UK, which fell -9.9%.

Our population growth is also expected to be strong over the long term, given our handling of the crisis. Strong population growth drives positive property-market fundamentals as demand for food, clothing and accommodation increase. On the supply side, most of the underlying property sectors are well positioned.

Debt and gearing have not been issues in the recent economic downturn. A-REITs took the opportunity after the global financial crisis (GFC) to “blend and extend” debt facilities. That is, extend the expiry date of loans and diversify away from the big-four Aussie banks.

Average gearing levels (debt to assets) are around 24% and interest cover is around 5.5 times. The better management teams in property have been selling non-core assets to reduce debt even further.

The ‘lucky country’

While Australia has always attracted offshore capital and investment, the handling of the pandemic has received global attention and led to intense interest from global pension funds. With the Australian dollar currently trading at around 77c versus the US dollar, offshore investors not only get a higher yield but also pay less to receive it.

Global demand for yield is strong and while Australia isn't the biggest market, there are high yields, a relatively stable economy and, importantly, excellent transparency. This is exemplified by global group ESR’s purchase of Blackstone’s Milestone Logistics portfolio for $3.8 billion in what is the biggest ever direct property transaction in Australia.

Potential risks

The biggest risk to valuations is rising bond yields. As bond yields rise, this signals the economy is improving and ultimately leads to a switch from “defensives” to “growth”.

In this environment, the broader equities market would be expected to outperform A-REITs. This occurred when 10-year Government bond yields moved from 1.0% in early January 2021 to 1.9% by the end of February 2021 due to the perception of a global recovery. Bond-yield movements during the rest of 2021 are not expected to be as rapid.

Low inflation

Lower CPI means lower rental growth for those leases linked to CPI. However, if interest rates remain low, return expectations should also moderate, supporting underlying property valuations.

Bankruptcies

Bankruptcy is a part of the business cycle. This is par for the course and A-REIT management teams have staff monitoring the solvency levels of every tenant. Most tenants pay a rental bond or bank guarantee upfront, similar to a housing bond, which protects property owners in the case of default. As A-REITs are highly diversified, the impact of any one tenant event is minimal.

Conclusion

The A-REITs sector benefits from solid operating fundamentals, low gearing and strong interest cover, good distribution coverage and strong demand for institutional-grade real estate. A continuation of low interest rates, reasonable consumer confidence, and corporate activity/M&A will support the sector. The lower Australian dollar adds to the appeal for offshore investors.

In a “lower for longer” rate environment, A-REITs remain an attractive option for investors seeking income-generating investments.

About the author

Patrick Barrett, Charter Hall

Patrick Barrett is Portfolio Manager of Charter Hall Maxim Property Securities Fund. Charter Hall Group is an ASX A-REIT (ASX: CHC)

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.