- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to {{verificationEmail}}.

Please check your inbox.

An account with your email already exists.

Time to review portfolios as economies recover

- Thu 01 April 2021

Andrew Tang, Morgans

Morgans’ Andrew Tang considers the implications of higher sharemarket volatility, while Bell Potter’s Martyn Rose outlines investment strategies as bond yields rise.

Andrew Tang, Morgans

A portfolio is simply a range of assets that an individual or group holds. These assets can be individual securities, such as stocks and bonds, or professionally run pooled investment vehicles, such as managed funds, Listed Investment Companies (LICs) or Exchange Traded Funds (ETFs).

In addition to financial assets, an investment portfolio can contain real estate investments, direct investments in businesses, direct loans or even esoteric assets such as investments in art.

Each of these individual assets placed in a portfolio has its sources of risk and drivers of returns. The range of risk can vary over different time periods but returns appear less volatile with longer holding periods.

Over the long term, periods of high returns tend to offset periods of low returns. With the passage of time, these offsetting periods result in the dispersion of returns converging towards the average.

In other words, while returns may fluctuate widely from year to year, holding the portfolio for longer periods results in a decrease in volatility.

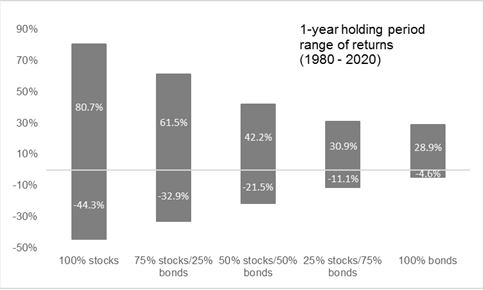

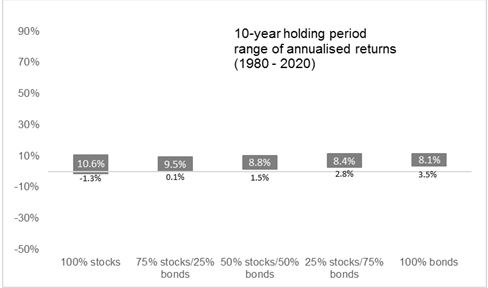

The graphs below illustrate the range of compound annual returns for various portfolios over 1- and 10-year holding periods.

On a 1-year rolling basis since 1980, the returns of a 50% stock, 50% bond portfolio have ranged from a high of 42.2% to a low of minus 21.5%.

For longer holding periods, however, the picture changes. The average returns range between 8.8% and 1.5% over 10-year periods.

During the worst 10-year period since 1980, the portfolio still posted a positive 10-year compound annual return.

However, remember that holding stocks for the long term does not ensure a profitable outcome and that investing in stocks always involves risk, including the possibility of losing the entire investment.

Government bonds are guaranteed by the government's full faith and credit as to the timely payment of principal and interest. Corporate bonds are backed by the credit of corporations. Stocks are not guaranteed and have been more volatile than the other asset classes.

Diversification does not eliminate the risk of experiencing investment losses. Risk is measured by standard deviation, which measures the fluctuation of returns around the arithmetic average return of the investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns.

Considerations for 2021

While historical measures of return and risk vary over time, the impact of low bond yields on portfolios presents a unique challenge for investors.

In the current environment, investors need to choose to take on additional risk for the same level of return they have been accustomed to or accept lower returns for the same level of risk.

Strategies to enhance traditional “balanced” portfolios such as small-cap equities exposure, corporate high-yield bonds and alternative investments can help achieve return objectives.

Speak to a financial adviser for more information.

Source: Morgans, Factset.

Source: Morgans, Factset.

Martyn Rose, Bell Potter

Martyn Rose, Bell Potter

As the COVID-19 vaccine roll-out gathers pace and economic recovery is underway, now is a good time for investors to review their portfolios and rebalance if necessary.

Since Pfizer announced its successful COVID-19 vaccine, the MSCI AC World Value index has risen by 22% and the Growth index is up only 8%.

The rotation to value investing has been driven by hopes of a global recovery in 2021, as governments extend fiscal support for their economies.

Bond markets have moved in tandem with the move into more cyclical value stocks. Government bond yields have continued to rise with 10 year US treasuries now 1.6%, up from 0.5% back in August last year. This reflects concerns about continued fiscal expansion together with rising inflation and the potential tightening of monetary policy. The increase in real bond yields, from –1.1% to –0.6% has started to put equity markets under pressure.

Growth stocks are particularly sensitive to higher real bond yields. Falling real yields helped re-rate the MSCI AC World Growth index to a Price Earnings (PE) multiple of 31 times. Real yields at 0% would be consistent with the index trading back down towards 23 times.

The most vulnerable broad market indices will be those that have a heavier weighting towards Growth sectors and/or trade on higher multiples, such as the US and Emerging Markets including Taiwan, Korea and China. On a sector level, Global Information Technology, Consumer Discretionary and Communications Services are exposed.

The MSCI AC World Value index trades on 15 times, leaving it less vulnerable to rising real yields. Value-tilted sectors and regions should enjoy premium earnings-per-share growth as the global economy rebounds.

What this means for your portfolio

So with this information at hand, how should you go about reviewing and rebalancing your portfolio?

The first step is to work out whether your investment objectives and strategy are still relevant to your personal situation and circumstances. It is also important to establish how much risk you are comfortable with, while recognising that failing to accept some degree of risk can limit your investment’s potential growth and return.

Next, determine whether your portfolio is appropriately diversified across asset classes, geographies and industry sectors.

Is your portfolio weighted too heavily in growth? Should you consider switching into cyclical value stocks? You might gain exposure to value through a range of investments such as direct equities, Listed Investment Companies or trusts, or ETFs.

The consensus view is that value investing will continue to outperform growth investing while bond yields rise.

Watch US 10-year real yields – if they fall backwards, growth stocks may outperform again.

Investors should also keep an eye on the success of the COVID-19 vaccine roll-out as it will largely shape financial markets in the near future.

About the author

Andrew Tang, Martyn Rose , Various firms

Andrew Tang is a co-head of investment strategy at Morgans.

Martyn Rose is an adviser at Bell Potter Securities in Melbourne.

Morgans and Bell Potter are presenting at the upcoming ASX Investor Day.