- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to {{verificationEmail}}.

Please check your inbox.

An account with your email already exists.

Two trends to watch in FY22

- Fri 02 July 2021

Keep an eye on Covid stock winners and losers as consumption habits change.

For the most part, the 12 months to 30 June 2021 have been a year the market “climbed the wall of worry” following the Covid crash. The speed of the crash and the recovery was remarkable.

Despite prominent “voices of gloom” in the media warning that the crash had just been a taste of what was to come, the market rose relatively steadily. Central banks and governments responded as usual by doing whatever they needed to kick the can down the road. Record-low interest rates supported asset prices, and record-high government borrowing supported the unemployed and those whose income was disrupted by lockdowns.

The lockdowns quickened the trend of consumers and businesses buying and communicating online. This had major ramifications for stocks.

“Covid winners” were businesses that could supply their customers at home; the “Covid losers” were those that couldn’t. The worst-affected businesses were those that ran into cash-flow problems and were forced to raise more equity at low share prices. This meant they were permanently diluting their earnings per share [by increasing issued share capital].

There were lots of examples: retail property trusts versus on-line stores such as Kogan.com (ASX: KGN), or meal-delivery businesses such as Marley Spoon (ASX: MMM) and Domino’s Pizza Enterprises (ASX: DMP) versus businesses that had fewer customers, such as Transurban (ASX: TCL) or G8 Education (ASX: GEM).

Travel Stocks

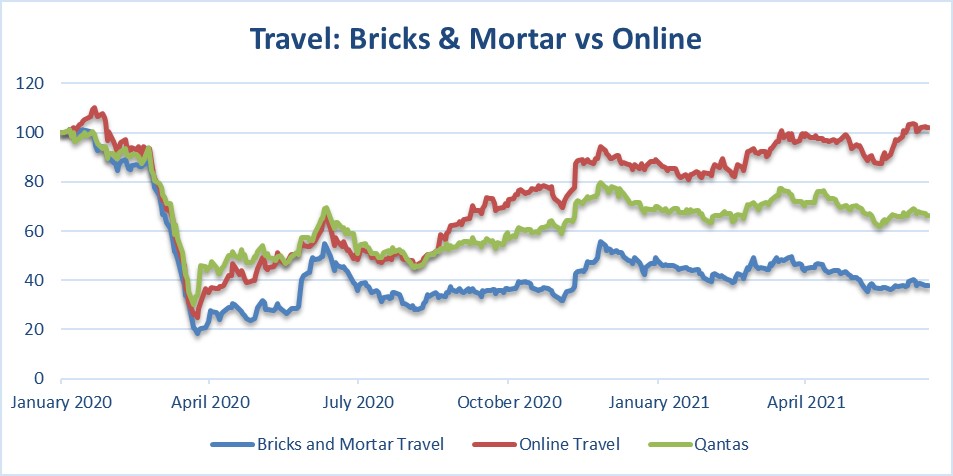

Travel stocks were a great illustration of this for Covid winners and losers.

There are two types of travel agents: those that are predominately bricks-and-mortar based, such as Flight Centre (ASX: FLT) and Helloworld (ASX: HLO); and those providing online services, such as Webjet (ASX: WEB) and Serko (ASX: SKO). Prior to the pandemic, bricks-and-mortar travel businesses had been steadily losing share to online businesses and had been trying to become more web-based themselves.

When Covid hit, the physically based businesses started rapidly bleeding cash as they still had rent to pay, and generally had much less cost variability than the technology-based businesses. They needed to raise cash quickly and did so on depressed earnings and stressed balance sheets, permanently compromising their ability to recover on an earnings-per-share basis.

Qantas Airways (ASX: QAN), with its fleet of aircraft and supporting infrastructure of physical assets, maintenance facilities and staff, was in a similar position to other businesses with less flexible cost structures, although it was protected to some extent domestically by being the dominant player in a duopoly.

As you can see in the following chart, the sharemarket performance of these stocks bears this out. The chart starts at 1 January 2020, with all stocks at a common base of 100. The difference in their performance was not all that marked in February and March as the market collapsed but became more and more evident over time.

The chart also shows it has been such a difficult period for travel stocks that even the online-based businesses have only just recovered their share prices over the last 18 months.

Source: Monash Investors.

Trends to watch

There are two main trends to watch this year: value versus growth, and inflation and interest rates.

As the pace of technology change has accelerated, and economies have become more flexible, “old economy” businesses have been growth laggards. The market has put lower price multiples on them, and they are considered value stocks. High-growth businesses, in particular tech stocks, have been much better performers over the last 20 years, despite looking expensive on near-term multiples.

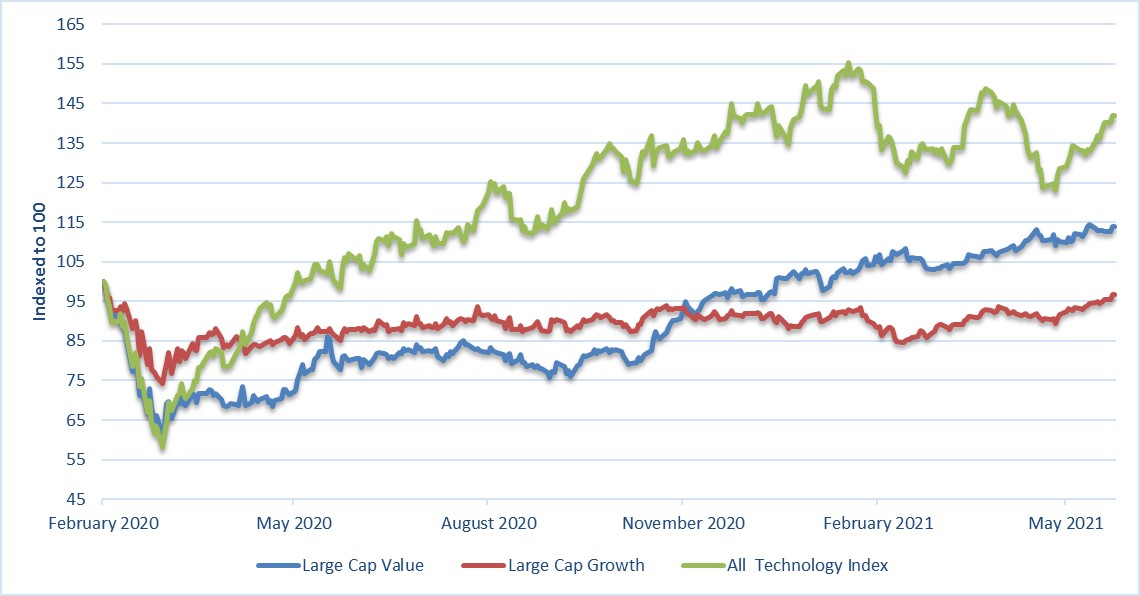

The next chart shows an interesting turn of events for growth versus value, breaking with this trend in the short term. It starts with the first day of the new S&P/ASX All Technology Index (ASX: XTX), which was created just as Covid was beginning to bite the sharemarket in late February 2020.

In general, the growth stocks did much better than value stocks even in the teeth of the crash, and they continued to do better than the value stocks for the majority of calendar year 2020. But then the value stocks started to outperform. Paradoxically, this was because of the strong pickup in GDP as our economy recovered and the development of vaccines was successfully fast-tracked.

Given how tied the value stocks generally are to the economy, and many of them are cyclical, a strong increase in GDP growth means growth is no longer scarce on ASX. With more companies providing growth there is more choice for investors, and so less competition between investors to buy the high-growth stocks.

Since about November last year, value stocks have been the outperformers as investors have turned their attention towards them. Overall, value stocks have outperformed growth stocks in the Covid recovery, which is quite a turnaround from the last decade.

Source: Monash Investors

Tech stocks generally have the highest growth rates of all the stocks, and while they have been the biggest winners since the pandemic, they have done little since November. So, the first major trend to watch for in the coming financial year is whether the growth stocks start to outperform again.

For what it’s worth, I think they will. It is hard to see an easing off in the changes in technology and consumer preferences that have been benefiting the growth businesses, and ultimately the growth in their earnings per share will trump a medium-term de-rating.

The second trend to watch is on inflation and interest rates. Interest rates have generally supported the stock market and asset prices. This has assisted asset-price inflation, but not inflation for the price of goods and services. A lower interest rate also reduces interest expenses for companies and consumers.

It would be a big concern for equity markets if interest rates were to rise significantly. Many commentators are concerned that low rates and quantitative easing [a form of monetary policy by central banks] will “leak” into higher prices, which will require interest rates to rise.

Once inflation expectations set in, they can be hard to diminish, as we found out in the 1970s and 1980s. We have at least seen some short-term pricing pressures in computer chips and building materials.

Historically, increased money supply led to higher inflation; however, inflation appears to have become much less sensitive to monetary policy over time. It’s worth getting back to first principles on inflation to explain this.

Prices for goods and services rise when demand pushes against the envelope of supply. Businesses respond to increased consumer demand by putting up prices if they can get away with it. But it’s hard to get away with it when the customers can search for alternative products easily using smartphones, and modern technology has increased the speed at which competitors can identify demand and ramp up production if they see an opportunity to take share.

So, increased technology and automation have generally kept goods and services inflation low. I don’t foresee a change in this trend in the medium term.

Covid has caused understandable disruptions to global supply chains, which has caused the inflation we now are seeing in the economy. These disruptions will be addressed and inflation will moderate once more.

So, while interest rates will rise as quantitative easing and central-bank suppression ends, I don’t expect inflation will cause interest rates to rise so greatly and rapidly over the medium term that there will be another crash.

In the near term, the Covid winners may lag the losers as economies reopen after vaccine roll-outs, prior to resuming. However, an acceleration of the trends in behaviour due to the pandemic by consumers, business and government has firmly entrenched a cohort of Covid winners and losers for some time to come.

About the author

Simon Shields, Monash Investors

Simon Shields is a director and co-founder of Monash Investors. The Monash Absolute Active Trust (Hedge Fund) recently listed on ASX as an Exchange Traded Managed Fund. (ASX: MAAT).

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.