Making explicit market predictions for the next calendar year is fraught with risk, largely because there is almost 100% certainty that those predictions will be wrong.

There are, however, a few broad trends emerging concerning market sentiment, valuation, and company operating cadence that Airlie Funds Management believes could deliver opportunities for keen investors and active institutional managers alike in 2024.

Witnessing a return to normality (whatever that is…)

At its simplest, Airlie’s macroeconomic ethos is that economies are inherently complex systems and thus consistently unpredictable. Volatility is normal. A decade of gradual interest rate declines and relative global peace led many to forget that markets, their participants and their externalities are, in fact, difficult to control – and monetary policy is not a silver bullet.

Moreover, very recent history generally tends to be a poor guide to the future. While many commentators lament the increased market “uncertainty” ahead that is supposedly a function of higher rates and the re-emergence of broad-based inflation, Airlie believes equity valuations and implied levels of risk and reward across the ASX at the moment finally reflect a return to normal.

While the ascent of interest rates in Australia over the last 12 months has been remarkably rapid, the absolute level at which they sit now is hardly egregious relative to the last 30 years as the chart below shows.

*Source: Reserve Bank of Australia

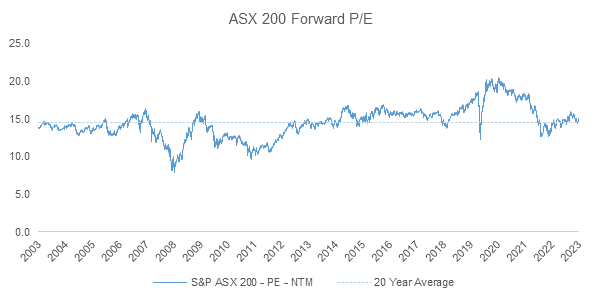

ASX valuations have returned to more or less the average of their last 20 years, as this chart shows.

*Source: Airlie Funds Management

From a company-specific perspective, there is a general sense that Australia are returning to a more normal operating cadence for many businesses, in Airlie’s opinion.

Airlie sees 2024 as the return of “normal”, which for Airlie means a normal, healthy level of uncertainty. Uncertainty makes a market; it means dislocations and thus the potential for excellent investment opportunities.

Airlie looks to two simple tenets of its investment process to continue to drive its decision-making:

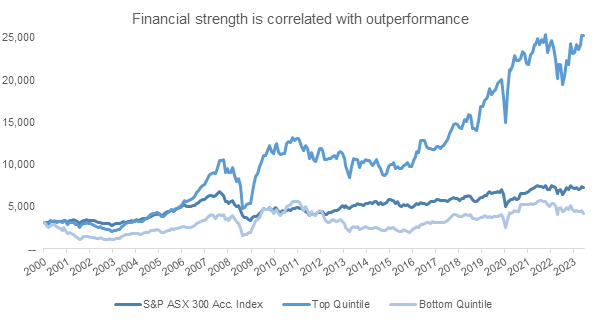

1. Healthy balance sheets can be correlated with outperformance over the long term

In the era of low- to zero interest rates, balance sheet health was not heavily influenced by the quantum of debt, as the cost of that debt was negligible.

As we enter 2024 with the RBA cash rate back over 4%, Airlie expects businesses with superior balance sheets to outperform their more highly geared counterparts.

The chart below shows that companies in the top quintile for balance sheet strength (as measured by net debt to earnings) have dramatically outperformed the market.

*Source: Macquarie, Airlie Funds Management

2. Pricing power is about product differentiation and market position (i.e., business quality), not passing through rising costs

The dizzying return of inflation has seen companies across many sectors jump at the opportunity to raise their prices, particularly as demand remained surprisingly resilient.

In this environment it is easy to confuse prices rising with pricing power, and thus extrapolate periods of excessive profitability well into the future.

From Airlie’s perspective, the most reliable indicator of business quality through the cycle is a consistently high return on capital which is often a function of pricing power, and Airlie sees no reason for this to change in the new year.

Unloved small caps?

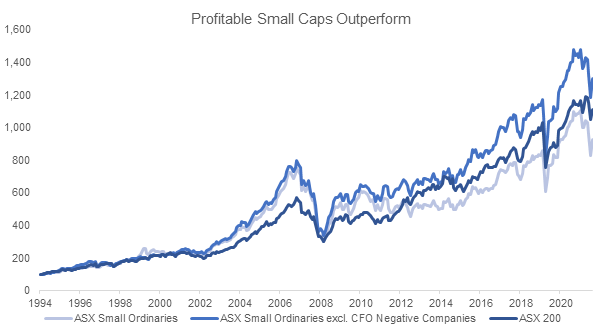

Finally, one area of the market that Airlie believes could potentially offer opportunities is the small-cap sector. It’s the part of the market that can function as a relief valve when investors decide to go ‘risk-off’, which means plenty of good companies and investment opportunities can get sold down in unison with lower equality companies in the index.

Given the S&P/ASX Small Ordinaries has underperformed the ASX 200 by around 20% over the past three years, Airlie sees 2024 as having potential for performance reversion, as long as investors steer clear of “concept” companies, businesses with excessive gearing and overly promotional management teams.

As an idea of how Airlie thinks about investing in small caps, Airlie back-tested the performance of the Small Ordinaries, excluding from the index all companies that had negative cash flow from operations (i.e., loss-making businesses) over the previous 12 months.

This bespoke index outperformed both the standard ASX Small Ordinaries index and, surprisingly, the ASX 200 over 20 years.

While a fairly simple rule of thumb, it should not be overlooked that the most heavily promoted stocks are often those in the most need of capital.

*Source: Macquarie, Airlie Funds Management

Conclusion

While there is no ‘Eureka!’ moment as to what 2024 will hold for the Australian share market, at Airlie we believe diligent application of sensible investment principles amidst an uncertain macroeconomic environment will help identify attractive investment opportunities that can yield outperformance.

DISCLAIMER

Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management (‘Airlie’). This material is issued by Airlie and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any fund, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Airlie will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Further information regarding any benchmark referred to herein can be found at www.airliefundsmanagement.com.au/benchmark-information/. Any third-party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third-party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.