[Editor’s Note: Do not read this article as a recommendation to invest in small-cap stocks or funds that invest in them. Small-cap stocks, on average, have higher risk than large-cap stocks. Small-caps can have fewer financial, operational and managerial resources compared to large-caps; less diversification in their operations; and higher relative exposure to the Australian economy. Some small stocks can also how lower liquidity, meaning there is less buying and selling in their shares. Talk to a financial adviser or do further research of your own before article on themes in this article. Small-cap stocks typically suit growth-focused investors, although every investor is different. For conservative long-term investors, small-caps typically only have a small asset allocation within portfolios.]

Small-cap stocks have fallen pretty hard in the last 18 months. Over calendar year 2022 and up to 30 August 2023, they are down 19% on a price basis [1]. By contrast over the same period, the S&P/ASX 100 price index is flat.

In this article, we look at why small-cap stocks have fallen, the possibility that some will begin to recover, and the sectors to focus on.

What is a small-cap stock?

Stocks outside of the top 100 stocks listed on the ASX are known as small-cap stocks. They have their own index, the S&P/ASX Small Ordinaries Index, which comprises the next largest 200 stocks on the market.

To give an idea about how big these companies are - the largest 10 per cent of small-cap stocks have a market capitalisation greater than $3 billion each, the median stock size is about $1 billion and the smallest 10% drop to below $400 million each, according to Monash analysis.

Small-caps hit hardest by rising rates and uncertainty

The rapid rise in inflation and interest rates that occurred during 2022 hit small-cap stocks harder than the top 100. This is consistent with history: small-caps tend to get hit harder when the economy is weakening, and the market is selling off.

On average, smaller stocks have less dominant positions within their industries, much lower profit margins and less pricing power to pass on rising costs.

Small-cap stocks also tend to have higher forecast growth than large-cap stocks. In the same way that the price of a bond falls as interest rates rise, the present value of a high-growth stock is reduced more by rising rates than that of a low-growth stock.

Finally, small-cap stocks are less liquid than large-cap stocks. In times of uncertainty there is a flight to liquidity, which tends to reduce the demand by investors for smaller stocks.

The charts tell the story

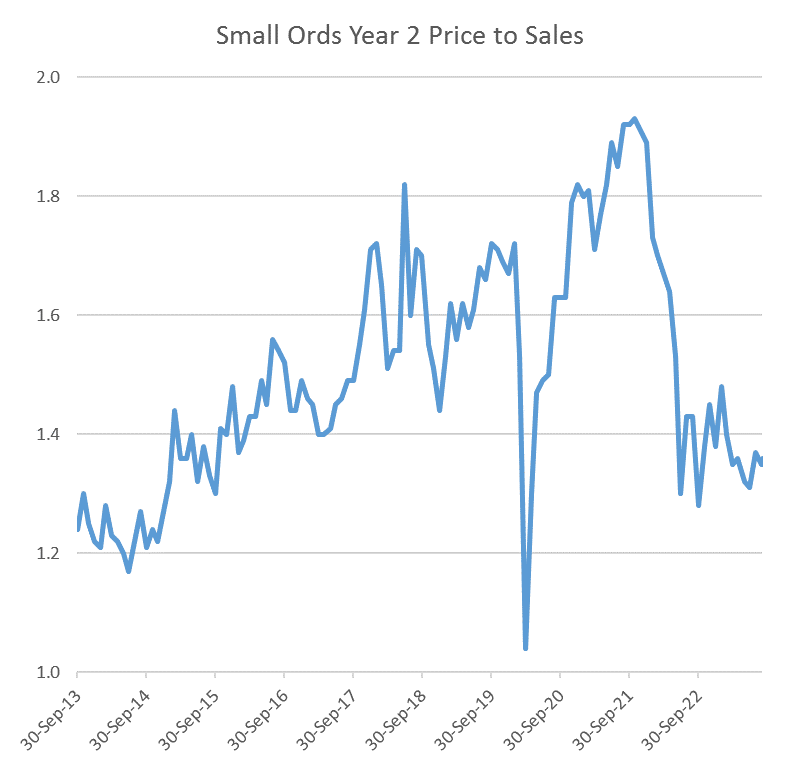

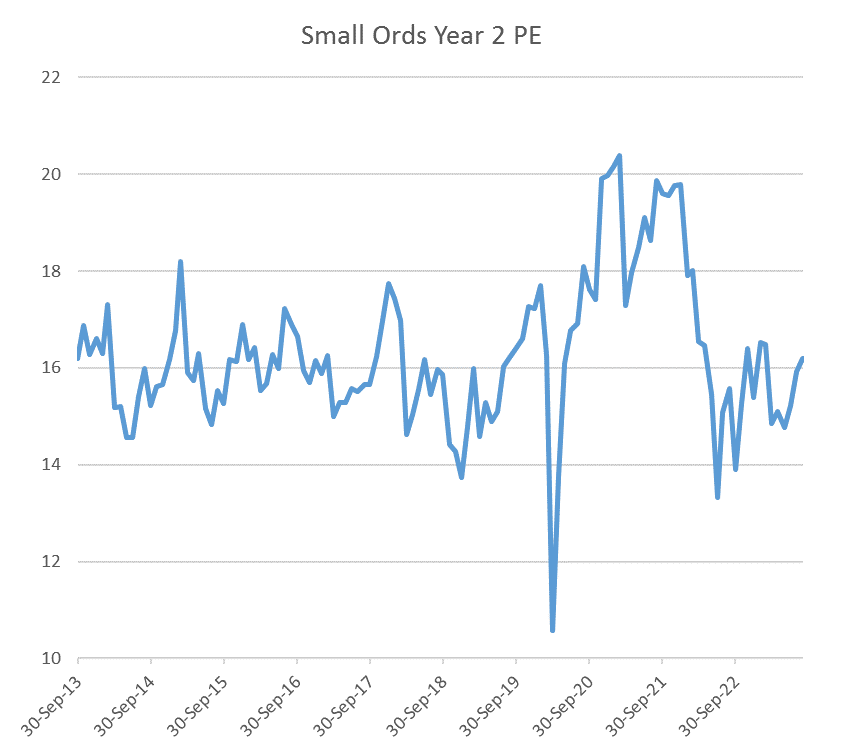

The two charts below show different ways to measure the value of the companies in the Small Ords as a group. Monash is using equity analyst consensus forecasts for sales and earnings two years in the future. This provides a measure of the underlying expected profitability of the businesses.

Chart 1: Price-to-sales

Source: FactSet

The price-to-sales chart above measures the market value of a company compared to its total sales revenue. Excluding the dramatic drop and recovery in share prices during the early stages of the COVID-19 pandemic, the current price to sales ratio is around as low as it was as the world was emerging from the Global Financial Crisis bear market [in 2008-09]. The fall in the chart since the 2021 peak is very large, and there has been no recovery yet.

Chart 2: Price to Earnings ratio

Source: FactSet

The price to earnings (P/E ratio) chart above is less dramatic at face value. While the P/E ratios are well down since 2021, they are at the average of the seven years prior to COVID-19.

That difference in the two charts is a result of the after-tax profit margins of the small cap stocks being squeezed in the last two years. As earnings recover, the P/E ratio declines indicating small-caps are potentially undervalued, in Monash’s opinion.

Potential positives for small-caps

Australia is now seeing a fall from peak inflation and a stabilisation of interest rates. This sets the conditions for reversing the underperformance of undervalued small-cap stocks, in Monash’s opinion.

Private Equity fund managers and corporates appear to recognise this. They have been picking up the pace of take-overs for small cap stocks this year. It could suggest that they believe the prices of these stocks are attractive and demonstrate their confidence to buy them at this point in the market cycle, in Monash’s opinion. We have even seen instances of bidding wars for stocks. They are like the early adopters of a new product, and they give other investors confidence by setting a valuation floor.

As the economy improves, some small-cap stocks could recover the profit margins that they lost. And with less uncertainty, there could be a flight to growth by some investors. That could improve the liquidity of small-cap stocks, making them more investible.

Sectors that could benefit

The stocks most likely to outperform as the economy improves have characteristics of accelerating sales growth and increasing profit margins, in Monash’s opinion. The most likely sectors to find stocks like these are the Consumer Discretionary, Industrials and Information Technology sectors.

The consumer discretionary sector is one of the largest in the Small Ords, and its stocks are typically the most volatile each reporting season. The sector has suffered significant margin contraction due to lags in being able to pass on cost inflation to its customers, though their latest results were generally better than expected.

Risks: What could go wrong?

Any investment carries risks. If inflation was to start tracking up again, forcing a rise in interest rates by the Reserve Bank to dampen the economy, the recovery in small cap stocks would at the very least be delayed.

Despite the impact of higher rates over the last 18 months, and some weakness in the economy, we haven’t seen much deterioration in employment. If unemployment was to rise significantly that would particularly hurt the discretionary retail stocks.

Ways to invest in small caps on ASX

[Editor’s Note: Do not read the information below as a recommendation to invest in small-cap ETFs or ETMFs. Small-cap ETFs that replicate an index can include small-cap winners and losers. Like all active funds, small-cap ETMFs can at times underperform their benchmark index and charge higher fees.]

You can invest individually into small cap stocks on the ASX or you can also make a portfolio investment on the ASX by buying an Exchange Traded Fund or an Exchange Traded Managed Fund (ETMF).

Small-cap ETFs provide a passive exposure to the small cap index. On the other hand, an ETMF is actively managed by a fund manager.

---------------

[1] Based on S&P/ASX Small Ordinaries Index

DISCLAIMER

Issued by Monash Investors Pty Limited ABN 67 153 180 333, AFSL 417 201 (“Monash Investors”) for general advice only and does not take account the objectives, financial situation or needs of investors. All investments contain risk and may lose value. For more information visit www.monashinvestors.com

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.