With fiscal-year 2025 having just ended, most global equity markets are close to or at all-time highs - a testament to the enduring adage that markets climb a “wall of worry”.

There's always something for investors to worry about in equity markets. Put it down to human nature; we are wired to feel the pain of loss twice as much as the pleasure of gain [1]. And the year ahead looks to be no different.

So, let's start with the markets’ negative bear concerns - and leave the optimistic bull case until last in this article.

1. The Bear case

There are several significant geopolitical challenges afoot; be it the Russia-Ukraine war in Europe, ongoing and new conflict in the Middle East, or China flexing its muscles in Asia. And of course, other geopolitical issues may emerge.

The key point is that the world has enjoyed a long period of relative peace from being unipolar - with the United States seated at the centre of power – but geopolitics are shifting.

Due to a combination of reasons, many investors may feel like we are tilting toward a multipolar world. It's uncertain what that looks like and the path to get there, potentially introducing a higher risk premium into global capital markets.

Turning to economic factors, this is where inflation and tariffs take centre stage. The COVID-19 pandemic ushered in the largest co-ordinated fiscal and monetary stimulus the world has seen. Governments and economies are still weaning themselves off those days of easy money, and although inflation has come down, it remains stubbornly high in many countries.

Moreover, President Trump’s tariffs risk slowing global trade and economic growth, plus have the potential to reignite inflation.

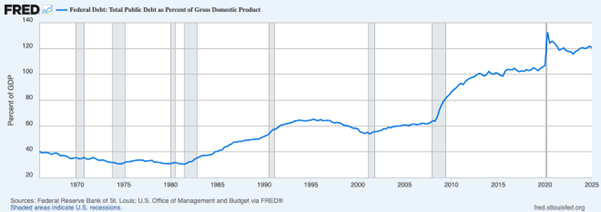

There are also growing concerns about the United States’ fiscal position where debt-to-GDP is running at historically high 122%, or US$36 trillion, as the chart below shows. This is some US$13 trillion, or 56%, more than just five years ago, based on Federal Reserve Bank of St Louis data.

With little clarity on how the US balance sheet will be reined in, bond markets have been pressing long-term interest rates higher to compensate for their growing concern about the size of US debt.

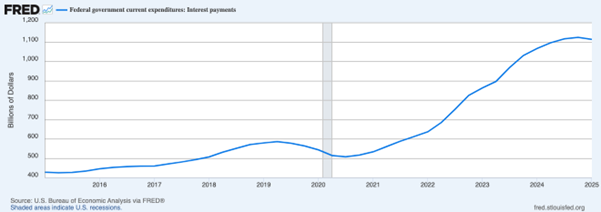

Higher rates have the potential to be self-reinforcing, given that the US government is adding more than US$1 trillion in interest expense to its balance sheet annually to maintain the existing debt load, as the next chart shows.

Finally, elevated valuation multiples in some equity markets may potentially pose a risk. According to FactSet*, a financial data provider, the forward Price-to-Earnings (P/E) ratio for the S&P 500 Index in the US is approximately 23 times, which is well above its 10-year average of 19 times and its 20-year average of 16 times.

Lakehouse Capital believes that, in essence, current forward P/E ratios suggest that investors are paying a higher price for anticipated future earnings in US and other global equity markets compared to historical norms.

2. The Bull case

Amid the uncertainty, there are also reasons for optimism suggesting that the "wall of worry" may indeed continue to be climbed by sharemarkets.

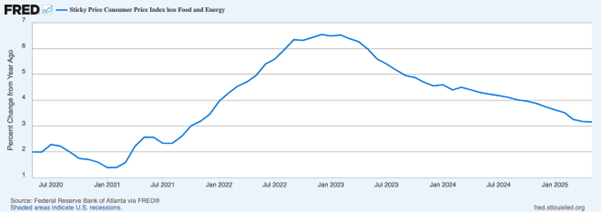

The global economy has remained remarkably resilient over the last few years despite higher interest rates. Although global inflation has proven more stubborn than initially hoped, particularly in the US, it continues to moderate, as the chart below shows. Lakehouse Capital notes the consensus market view that this disinflationary trend will persist through FY26.

Headline (total inflation) and core inflation (excludes food and energy prices) are expected to continue their gradual descent towards central bank targets for inflation, which in turn, can grant central banks, especially those outside the US, increased flexibility to cut interest rates.

Lower borrowing costs can stimulate economic activity, with the potential to reduce the cost of capital for businesses and make equity valuations more appealing relative to the less attractive yields on fixed-income investments.

In Lakehouse Capital’s opinion, even if the US Federal Reserve delays its rate cuts until later in FY26, the anticipated shift towards lower interest rates could potentially be a tailwind for equity markets, providing a psychological and fundamental boost for investors.

Additionally, corporate earnings are continuing to grow at a healthy rate. Despite all the headlines of doom and gloom, for the most recent quarter (Q1 2025), S&P 500 companies in the US reported average growth in earnings of 12.9% year-on-year, according to FactSet data.

But investors need not focus only on broad market indexes in FY26 -- research shows only a narrow subset of businesses drive the entirety of returns.

Consider the 2018 finding by Hendrik Bessembinder, an economist, that an extremely narrow group of stocks - around 4.3% - drove all of the US equity market returns above treasury bills in the period from 1926 to 2016. Bessembinder repeated this study across 42 countries over the period from 1990 to 2018 and found just 1.3% of businesses accounted for all the net global wealth creation.

Although the US is home to the broadest and deepest capital markets in the world – accounting for around two-thirds of global equity index value according to FactSet data – there are other global markets, like Japan and Europe, that may not be as exposed to some of the same risks as the US. These markets could potentially benefit from capital flows out of the US and are trading on lower valuation multiples compared to the larger US market.

According to FactSet data, the forward Price-to-Earnings (P/E) for Japan’s Nikkei 225 is approximately 18 times, and for Germany it’s approximately 16 times, both less than 23 times of the US. Thus, global investors may potentially find better opportunities outside their traditional hunting ground of US equities.

Conclusion

Navigating global equity markets in FY26 will require a nuanced approach. While geopolitical shifts, persistent inflation, elevated valuations, and US fiscal challenges present genuine concerns, there are grounds for optimism in the remarkable resilience of the global economy, the continuing moderation of inflation, resilient earnings growth demonstrated by select businesses, and opportunities outside the US market.

Success may be found through diligent research and a commitment to identifying those high-quality businesses capable of success regardless of evolving market conditions.

---------------------------

[1] Kahneman & Tversky, 1979

*Subscription based, closed-ended financial data system that investment managers use for analysis. You can’t link to it without a subscription.

DISCLAIMER

Equity Trustees Limited (‘Equity Trustees’) ABN 46 004 031 298 | AFSL 240975, is the Responsible Entity for the Lakehouse Global Growth Fund Active ETF and the Lakehouse Small Companies Fund (‘the Funds’). Equity Trustees is a subsidiary of EQT Holdings Limited ABN 22 607 797 615, a publicly listed company on the Australian Securities Exchange (ASX: EQT). The Investment Manager for the Funds is Lakehouse Capital Pty Ltd (‘Lakehouse’) ABN 30 614 957 603 | AFSL 526842. This publication has been prepared by Lakehouse to provide you with general information only. In preparing this publication, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Lakehouse, Equity Trustees nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accept any liability to any person who relies on it.

Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statements before making a decision about whether to invest in these products. The Target Market Determination for both funds is available at – www.lakehousecapital.com.au. It describes who each financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the products can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for the financial product may need to be reviewed. Lakehouse, its directors, clients, employees, and affiliates, may, and likely do, hold units or securities in entities that are discussed in this article.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.