"While the IPO market was relatively quiet in 2022 and 2023, ASX has seen more than $1 trillion in additional capital quoted on the market over the last 10 years, including from new listings, follow-on offerings, and other capital raised."

The 2023 global IPO market grappled with economic headwinds – in particular uncertainty around inflation and interest rates – with a notable contraction in listings compared to the previous year. There was a 15 per cent downturn in the number of IPOs across the year, which tallied at 1,323 and a 30 per cent decline in total deal value, amounting to US$120 billion, according to Dealogic.

The second half of 2023 saw a re-opening of the IPO market, particularly in the US, where several companies crossed the US$1 billion valuation threshold in their market debuts. High-profile companies such as Instacart, Birkenstock, and Klaviyo made their mark, and the largest IPO of the year – British chip designer Arm – achieved a US$54.5 billion valuation, raising US$5.2 billion. Nevertheless, an October market downturn led many companies to defer their IPOs, awaiting more conducive market conditions.

ASX saw $1.1 billion of IPO capital raised across 45 listings in 2023, versus ASX's five-year average of $5.4 billion raised and 120 listings a year. The total quoted market capitalisation from all new market entrants in 2023 including IPOs, demergers, dual and direct listings was $33.7 billion, up eight per cent on 2022 numbers.

While the IPO market was relatively quiet in 2022 and 2023, ASX has seen more than $1 trillion in additional capital quoted on the market over the last 10 years, including from new listings, follow-on offerings, and other capital raised.

Billion-dollar listings find a home on ASX

Redox Limited (ASX:RDX) was ASX's largest IPO in 2023, raising $402 million and achieving a market cap of $1.3 billion at listing in July. Redox – a family-owned chemical and ingredient distributor– listed to achieve liquidity for the family, which sold down 30 per cent of the company, and raised growth capital for offshore expansion.

The spin-off of Storage King from Abacus Property Group, into Abacus Storage King (ASX:ASK) in August saw $225 million in capital raised at a valuation of $1.8 billion.

In October, Nido Education Limited (ASX:NDO) raised $99 million in IPO capital for a $220 million market capitalisation.

The most significant listing by value was the dual-listing of American mining titan Newmont (ASX:NEM), which followed its Newcrest acquisition. The listing placed $20 billion in CHESS Depositary Interests (CDIs) on ASX, increasing Newmont’s total market capitalisation to approximately $68 billion. This transaction solidified Newmont as the world’s leading gold and copper company, comprising 17 operations across nine countries, building on its commitment to sustainable and responsible mining.

Other dual listings included Nasdaq-listed US-based gaming business Light & Wonder (ASX:LNW) and NZX-listed NZ-based logistics company Freightways (ASX:FRW), with valuations at listing of $8 billion and $1.4 billion respectively.

Following its listing on ASX, Light & Wonder (ASX:LNW) entered the S&P/ASX 200 index, further driving liquidity in the stock and ended the year with a market capitalisation of $10.9 billion.

The year closed with the $11 billion merger and dual listing of Livent and Allkem, forming Arcadium Lithium (ASX:LTM) and establishing it as a top-three global lithium chemicals producer.

While numerous anticipated listings in sectors ranging from consumer discretionary to industrials chose to wait out 2023's uncertainty, there was an increase in M&A deal value in Q4, according to Dealogic. A key transaction was Sigma Healthcare's (ASX:SIG) announced merger with the Chemist Warehouse group, poised to create a $8.8 billion ASX listed heavyweight, pending regulatory approval, with completion eyed for the second half of 2024.

Top 10 new listings in 2023 by market capitalisation

| ASX Code | Listing Date | Company Name | Sector | Sub Industry Name | Capital Raised ($m) | Total Market Capitalisation ($m) |

| NEM | 27 Oct 2023 | Newmont Corporation | Materials | Gold | $0 | $68,573 |

| LTM | 22 Dec 2023 | Arcadium Lithium PLC | Materials | Diversified Metals and mining | $0 | $11,300 |

| LNW | 22 May 2023 | Light & Wonder Inc. | Consumer Discretionary | Casinos and gaming | $0 | $8,531 |

| ASK | 1 Aug 2023 | Abacus Storage King | Real Estate | Self-storage REITs | $225 | $1,853 |

| FRW | 14 Sep 2023 | Freightways Group Limited | Industrials | Air freight and logistics | $0 | $1,424 |

| RDX | 3 Jul 2023 | Redox Limited | Industrials | Trading companies and distributors | $402 | $1,339 |

| BRE | 21 Dec 2023 | Brazilian Rare Earths Limited | Materials | Diversified metals and mining | $50 | $343 |

| NDO | 16 Oct 2023 | Nido Education Limited | Consumer Discretionary | Specialised consumer services | $99 | $220 |

| VHM | 9 Jan 2023 | VHM Limited | Materials | Diversified metals and mining | $30 | $190 |

| ACE | 12 Jan 2023 | Acusensus Limited | Information Technology | Application Software | $20 | $100 |

Source: ASX Internal, S&P Capital IQ as of 31 December 2023

ASX: A resilient platform for capital raising amid global downturn

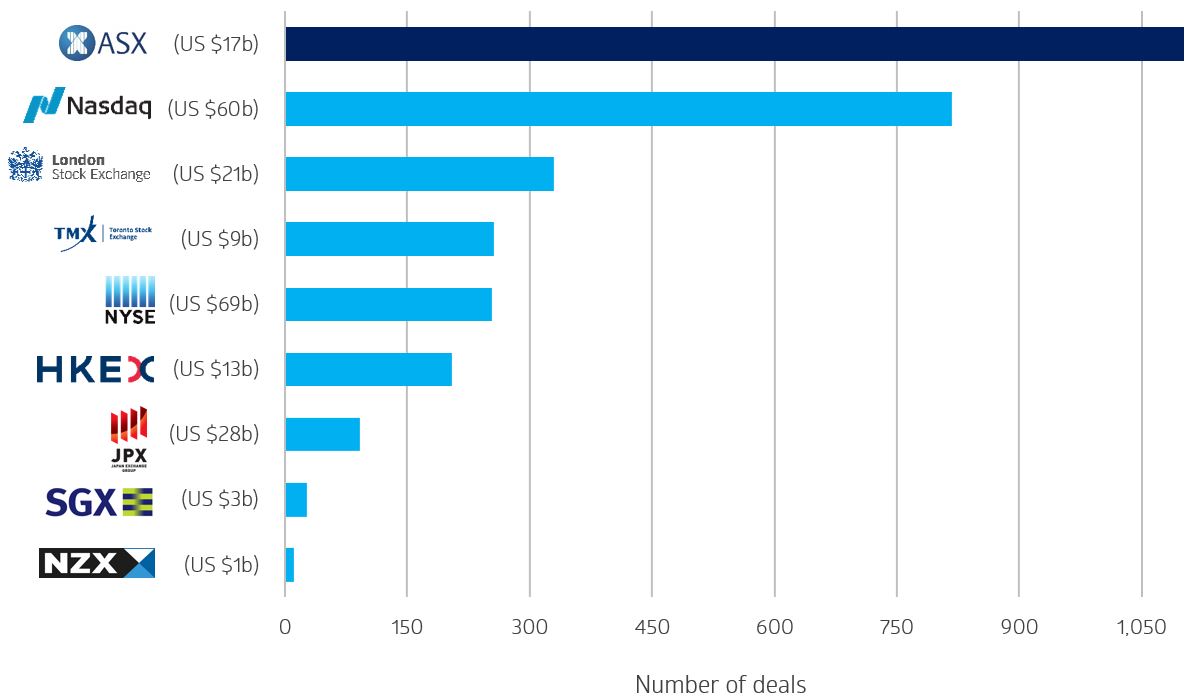

In a year that saw global venture capital funding plummet to its lowest since 2018 with a 38 per cent decline according to Crunchbase, ASX stood out for its resilience, reporting only a 14 per cent dip in secondary capital raised at $34.5 billion. ASX has maintained its leading position amongst exchanges globally in terms of number of follow-on offerings for the sixth year in a row with 1,150-plus transactions in 2023, according to Dealogic.

Notable follow-on transactions included Orora's (ASX:ORA) $1.3 billion raising for the Saverglass acquisition and APA Group's (ASX:APA) $875 million to acquire assets in Pilbara. Infratil (ASX:IFT) and Treasury Wine Estate (ASX:TWE) raised $851 million and $825 million respectively, in follow-on offerings for strategic acquisitions, while Star Entertainment Group (ASX:SGR) bolstered its balance sheet with a substantial $800 million raising.

These instances of substantial follow-on offerings on ASX reflect the market's strategic importance for companies seeking to fund significant transactions in short time periods, particularly in a globally challenging funding climate.

Volume of follow-on offerings by exchange CY23

Source: Dealogic, selected exchanges. Includes main and second boards where applicable. Includes placements, right issues, SPPs (excludes DRPs, employee share and options issues). Dollar value represents capital raised.

ASX market performance review

In secondary markets, ASX experienced a notable rally in the latter part of last year, fuelled by speculation the US Federal Reserve might initiate a reduction in interest rates. The market experienced robust growth, with the S&P/ASX 200 delivering solid price returns of 7.84 per cent (just 0.50 per cent below its all-time record high of 7628.9 in 2021).

When adding back the 4.57 per cent dividend return of the S&P/ASX200, the total return in 2023 was 12.42 per cent. Neuren Pharmaceuticals Limited (ASX:NEU) was the best performing S&P/ASX200 stock, up 214% in 2023.

Source: S&P Capital IQ

Tech companies experienced a strong year, driven in part by a rise in demand for digital services and innovations. This growth was spurred by widespread digital transformation, particularly in artificial intelligence across different sectors. Further contributing factors included an improvement in market sentiment and risk tolerance following a challenging 2022, along with expectations of stabilising interest rates heading into 2024.

Overall, the 2023 results highlight a year where technology and consumer discretionary sectors significantly outperformed the market, while utilities, consumer staples and energy lagged, and financials and healthcare showed more conservative growth.

Outlook for 2024

ASX has a strong track record of enabling listings and capital raisings, even in a challenging global macroeconomic environment. It continues to be an attractive destination for both domestic and foreign companies seeking to access Australia's substantial and growing superannuation fund pool, which now boasts an impressive $3.5 trillion in investable assets, according to the Australian Prudential Regulation Authority. This growth in assets will continue to support demand for IPOs as market conditions become more favourable. Notwithstanding continuing macroeconomic and geopolitical risks, the current listings pipeline points to an increase in ASX IPO activity in 2024.

More information

Discover the benefits of listing on the ASX by visiting Why List on ASX? or email listed@asx.com.au for more information.

Related Links