The pipeline of new listings looks promising into the second half of the year, including companies in the industrials, mining and consumer discretionary sectors. After an extremely busy 2021 it has been relatively quiet over the past couple of years, similar to 2011-12, but the IPO market is cyclical, and activity will return. We are expecting increasing activity in the second half of this year, continuing into 2025.

Headwinds caused by uncertainty around inflation and increasing interest rates played a role in reducing the number of new listings globally last year, and ASX was no exception with some highly anticipated IPOs deferred.

As Perennial Partners’ portfolio manager, Karen Chan, recently noted in a blog post:

“We have reached a cyclical low point in IPO activity and this is being compounded by increased takeover activity, resulting from a number of key factors: attractive valuations especially at the smaller end of town, increased confidence from boards and management to commit to dealmaking with interest rates increasingly looking to have peaked, and the low Australian dollar is making targets attractive for foreign bidders.”

Karen goes on to note the “IPO window is cracking open again”, with Reddit’s and Astera Labs’ recent US listings well received and a more active IPO market expected in the second half of 2024.

Notwithstanding that it's been a quiet period, an analysis of capital activity on ASX shows that there has been an increase in net capitalisation every year from 2017 to 2023.

These are the key takeaways from ASX’s analysis

- There has been A$750 billion of new capital quoted on ASX over the past seven years, including new listings, secondary capital raisings and other capital raisings.

- Over the same period, there has been A$441 billion in net new capital quoted, after factoring in de-listings of A$309 billion.

- In each and every year, there has been net capital added on to ASX, even though some years saw a net decrease in the number of listed companies.

- That trend has continued in calendar year 2024 and for the five months to the end of May there’s been a net new capital of A$7 billion added.

Takeovers accounted for approximately 94 per cent of the delisted value over the past seven years. However it’s worth noting takeovers have also recycled capital back onto ASX, either by an ASX company being the acquirer, for example BHP acquiring Oz Minerals (A$9 billion) or overseas examples resulting in dual listings back onto ASX; such as Newmont’s (ASX:NEM) takeover of Newcrest and Arcadium (ASX:LTM), the new entity created from the combination of ASX listed Allkem and NYSE listed Livent.

A deep and active market

ASX remains one of the world’s most active exchanges by volume of new listings.

In 2023, ASX did 45 new listings, putting us ahead of the London Stock Exchange, New York Stock Exchange and Singapore Exchange. The current listings pipeline suggests there will be increasing ASX IPO activity as we move through 2024.

The April listing of Tasmea (ASX:TEA), an industrial play in the maintenance and engineering space, raised A$59 million reportedly oversubscribed and performed well in the immediate aftermarket.

In addition, there have been a number of dual listings from international markets. Light & Wonder (ASX:LNW), a Nasdaq listed gaming and technology business dual listed on ASX last year with a market cap of US$5.5 billion. There was no capital raise, but domestic investor sector expertise and demand saw LNW gain S&P/ASX 200 index inclusion by October 2023. Due to demand LNW has re-rated to a valuation of US$8.9 billion at time of writing.

TMX listed mining business, Capstone Copper (ASX:CSC) dual listed on ASX in February. ASX is the global leader in metals & mining listings and offers deep sector specialisation and investor sophistication. Capstone Copper has had a similar valuation rerating to LNW.

Both of these companies are large and their home markets offer investor expertise in their respective industries – Nasdaq for gaming and TSX for mining. The positive reception here demonstrates the true attractiveness, strength, expertise and depth of our market.

NYSE listed Metal Acquisition Limited (ASX:MAC) operating in the copper space also dual listed in February to tap into the investor expertise and support on ASX.

Guzman y Gomez (ASX:GYG) is the latest ASX IPO, and began trading on 20 June with a A$2.2 billion market capitalisation after raising A$335 million. Trading well in the immediate aftermarket, the share price was up 36% at the close of day one resulting in a market capitalisation of A$3 billion. It was a significant IPO for the market, the largest since the highs of 2021, and demonstrates a return of conditions where investors are willing and confident to value and support new listings.

Global leader in follow on capital raisings

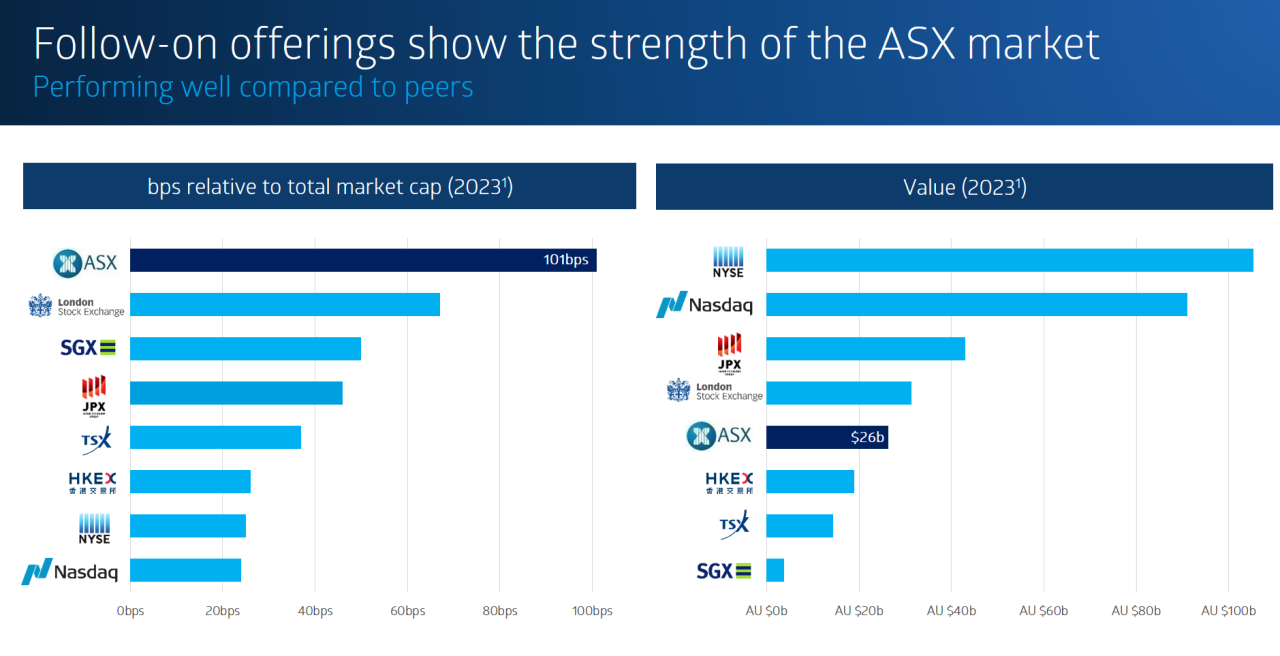

ASX performs extremely well in follow-on offerings and is admired globally for its efficient regime.

Source: Dealogic

In 2023, ASX listed companies raised A$26 billion, more than both Hong Kong and Toronto Stock Exchange (TSX), both of which are larger markets and close to London Stock Exchange, again a larger market.

Relative to the Australian listed market cap of A$2.6 trillion, we rank materially above other exchanges. At a rate of 101 bps, follow on offerings on ASX are about 4 times the rate of Nasdaq and 3 times that of TSX.

Three key factors explain this; firstly, ASX’s efficient rule frameworks that enables a streamlined secondary capital raising process; secondly, continuing investor demand driven by the growing pool of capital here in Australia; and finally, the attractive investment opportunities offered on ASX.

So, if you’re a growing company that wants access to capital to continue that growth – you should consider listing on ASX.

Data centre operator NextDC is a clear example of this, having raised close to A$2 billion in the past 12 months. NextDC listed on ASX in December 2010 with an A$80 million market cap and today is worth almost A$11 billion - it’s a great ASX listed tech success.

An attractive proposition

Aside from the vibrancy of our capital markets, there are many reasons to list a company on ASX. This starts with Australia’s robust economy and well-regulated financial markets.

Approximately 2,000 companies across multiple sectors and geographies are listed on ASX. A single main board offers access to the full spectrum of investors from retail to global institutions.

Internationally, ASX has an expanding technology sector with valuation multiples in this sector for comparable sized companies matching or exceeding other major exchanges, and offering earlier entry into globally recognised indices. ASX has a strong track record of enabling listings and capital raisings in growth stage companies. Importantly, ongoing listing costs are less than half those in the US, and a dedicated support program helps both early-stage and mature listed companies to connect with investors.

Access to the world’s fifth largest pension market

Access to capital continues to drive global interest in ASX. An ASX listing opens the door to the world’s fifth largest pool of pension assets. Currently close to A$4 trillion, it has been forecast to grow to over A$11 trillion by 2043, making it one of the fastest-growing pension pools in the world. It is number one globally for allocation to listed equities.

As a top 10 global exchange for capital raising, ASX has raised an average of A$6.6 billion in IPO capital each year from 2018-23.

Small and mid-cap ASX listed companies have broad access to investment capital, and listing on ASX provides access to public-market investor capital at an earlier stage than other major international exchanges.

Early access to globally-recognised indices

Being part of globally-recognised S&P indices can have a significant impact on a company’s visibility. Access to a wider pool of investors can increase demand, boosting a stock's price and liquidity.

Listing on ASX can introduce benefits at a relatively early stage, optimising opportunities for early- to mid-stage growth companies. At the last rebalance of 2023, the market capitalisation of the smallest entrant was A$192 million for the S&P/ASX All Tech, AU$580 million for the S&P/ASX 300, and A$1.1 billion for the S&P/ASX 200, which compares very favourably to A$9.3 billion for the FTSE 100, A$23.2 billion for the S&P 500 and A$48 billion for Hang Seng.

Together, these factors are very attractive to both Australian and global investors, with 46 per cent of institutional investment in the S&P/ASX 200 index coming from offshore. ASX expects market conditions to continue to improve and offers growing companies access to capital in a dynamic and growing market, at volumes above the relative size of our market.

Related links

Disclaimer

Independent advice from an Australian financial services licensee is needed before making financial decisions. This is not intended to be financial product advice. To the extent permitted by law, ASX Limited ABN 98 008 624 691 and its related bodies corporate excludes all liability for any loss or damage arising in any way including by way of negligence.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2024.