ASX’s cash equities market, ASX Trade, is the share trading engine of Australia’s share market. Whilst ASX also operates the futures trading platform (ASX 24), the cash equities market turns over an average of $5 billion a day. All-time highs hit circa $20 billion dollars in March 2025 around the index rebalance timetable. This was topped only by $35.9b on 28 January 2022, when BHP consolidated all its stock back onto ASX, collapsing its long held dual entity listed structure from the London Stock Exchange (LSE).

The system supporting this level of activity must be robust and reviewed periodically to ensure it is meeting the needs of the participants in financial markets. Following such a review ASX, in late 2023, announced commencement of work on Service Release 15 - known as SR15 - to update elements of trading in its cash equities market.

The existing process

Since electronic share trading started in 1987, the Australian share market has started the day by opening stocks on a staggered rotation commencing at approximately 10am Australian Eastern time and finishing at approximately 10.09am.

Companies with stock codes starting with A-B open first whilst companies S-Z open in the fifth and final group.

The staggered opening was originally introduced to allow for a more controlled opening of the market, particularly when a large number of orders are expected. This situation is unique to the Australian market compared to other global exchanges.

However, a lot has changed since 1987. Thanks to vast improvements in technology, the need to stagger the opening of stocks to ensure the large number of orders can be handled smoothly is no longer a necessity.

The new process

On 23 June 2025, the Australian market will transition to a single open with all stocks opening at the same time.

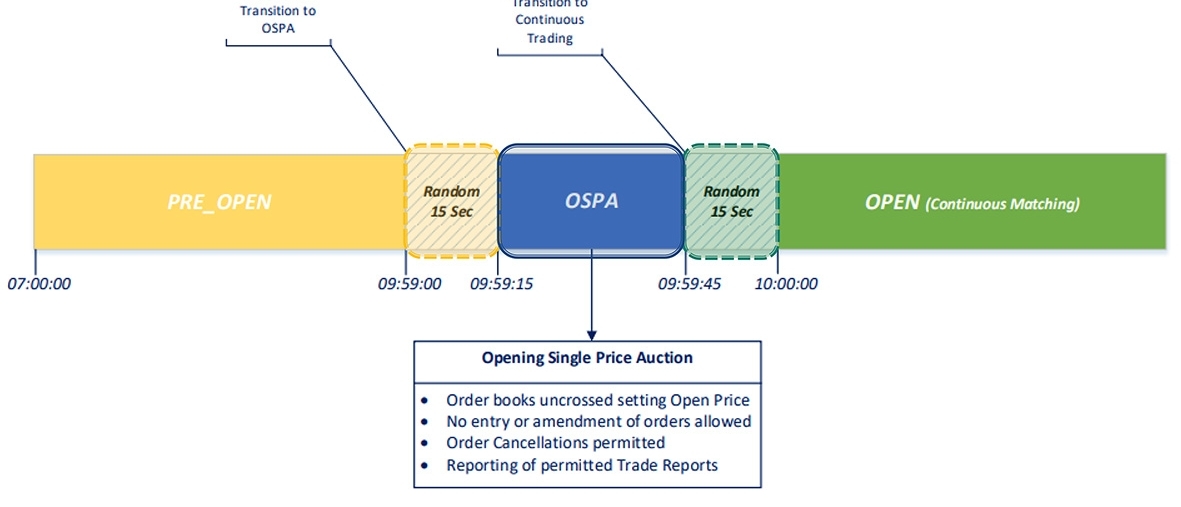

Diagram 1: Opening single price auction for cash markets

Orders will start being accepted by the ASX market from 7am – with no orders matching or trading until 9.59am. During this three-hour window, brokers and their clients will be able to enter buy and sell orders into ASX in preparation for the market opening.

The transition to the opening single price auction, highlighted in the yellow stripes, will occur during a 15 second randomised window, between 9:59 and 9:59:15 (9:59 and 15 seconds).

All overlapping buy and sell orders will match and become trades. After this match, there will be a ‘levelling’ period of 15 to 30 seconds. The levelling period will enable the orderly consumption of the burst of auction trades to be processed by the brokers’ systems.

Between 9:59:45 (9:59 and 45 seconds) and 10:00am, the market will transition to the normal open market operating state.

New Post Close trading session

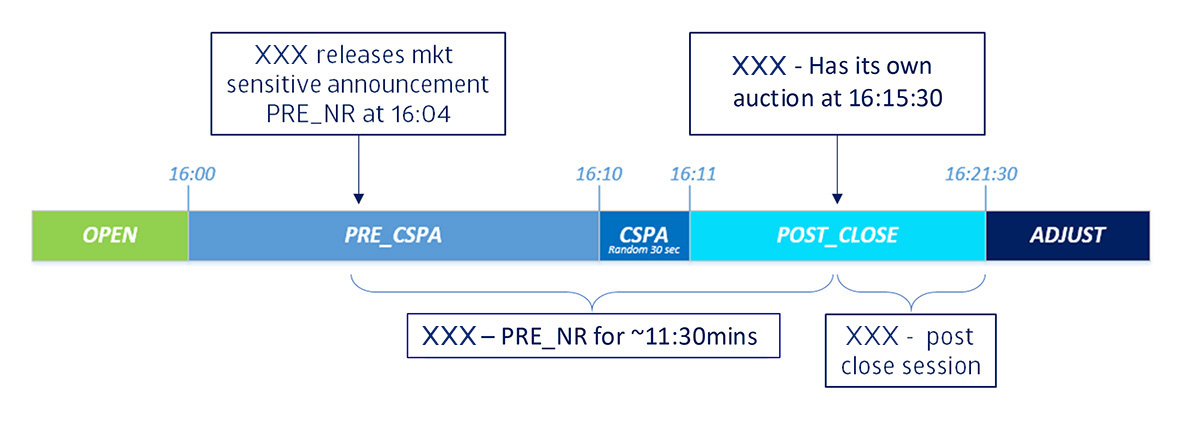

Presently market open state finishes at 4:00pm, with a Closing Single Price Auction (the closing price for the day for any given stock) taking place between 4.10 and 4.11pm. This is an important feature of trading as many market-related instruments use the closing price on any given day – for example it may be used to set the price for the equity component of an asset sale to a listed entity or for the price in a dividend reinvestment plan.

The Post Close trading session is a new continuous trading period, at the end of the day, allowing additional liquidity to be traded at the Closing Single Price Auction.

Transactions in the closing auction currently represent over 20% of the entire day’s liquidity. The new post-close trading session will help brokers and clients source any liquidity they may have missed in the close.

Post Close Trading and Price Sensitive Announcements

These new changes address an issue that has arisen in the past when a listed company releases a price-sensitive announcement between 4pm and the auction time.

In the current format, when a listed company releases a price sensitive announcement, the security transitions to the “pre-notice received” session state, also known as Pre-NR, for a period of around 11 and a half minutes. This results in that particular security not having a closing auction for the day.

In the new format, the Post Close Session State provides an opportunity to have a closing auction during the post close trading session.

A worked example of the new post-close session state

Pre 23 June 2025: Hypothetical company XXX releases a price sensitive announcement at 16:04 prior to 23 June 2025. This would result in a pre-notice received session, causing it to miss the closing auction.

XXX would transition out of Pre-NR at 16:11 into an ADJUST session state and miss the window for participating in the closing auction.

Post 23 June 2025: XXX releases a price sensitive announcement at 16:04. At 16:15:30, XXX will move from Pre-NR, into Post Close, generating its own closing auction during the transition.

This means shareholders will now have the opportunity to draw on the significant liquidity the closing auction provides.

What does this mean for listed companies?

"Importantly, the changes are designed to enhance the efficiency, integrity and capacity of the ASX cash equities market and will assist liquidity in your company’s securities."

Listed companies should be aware of these changes in case they generate queries about trading in their stock by investors, directors or other company stakeholders. Importantly, the changes are designed to enhance the efficiency, integrity and capacity of the ASX cash equities market and will assist liquidity in your company’s securities.

Both the closing and opening changes come into effect on 23 June 2025. Full details of the changes can be found here. For any questions related to these changes, please email equities@asx.com.au. You can also view these videos below, which explain the changes in more detail.

Related links

Disclaimer

Independent advice from an Australian financial services licensee is needed before making financial decisions. This is not intended to be financial product advice. To the extent permitted by law, ASX Limited ABN 98 008 624 691 and its related bodies corporate excludes all liability for any loss or damage arising in any way including by way of negligence.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2025.