A growing number of global miners are coming to ASX to access the advantages the Aussie market offers.

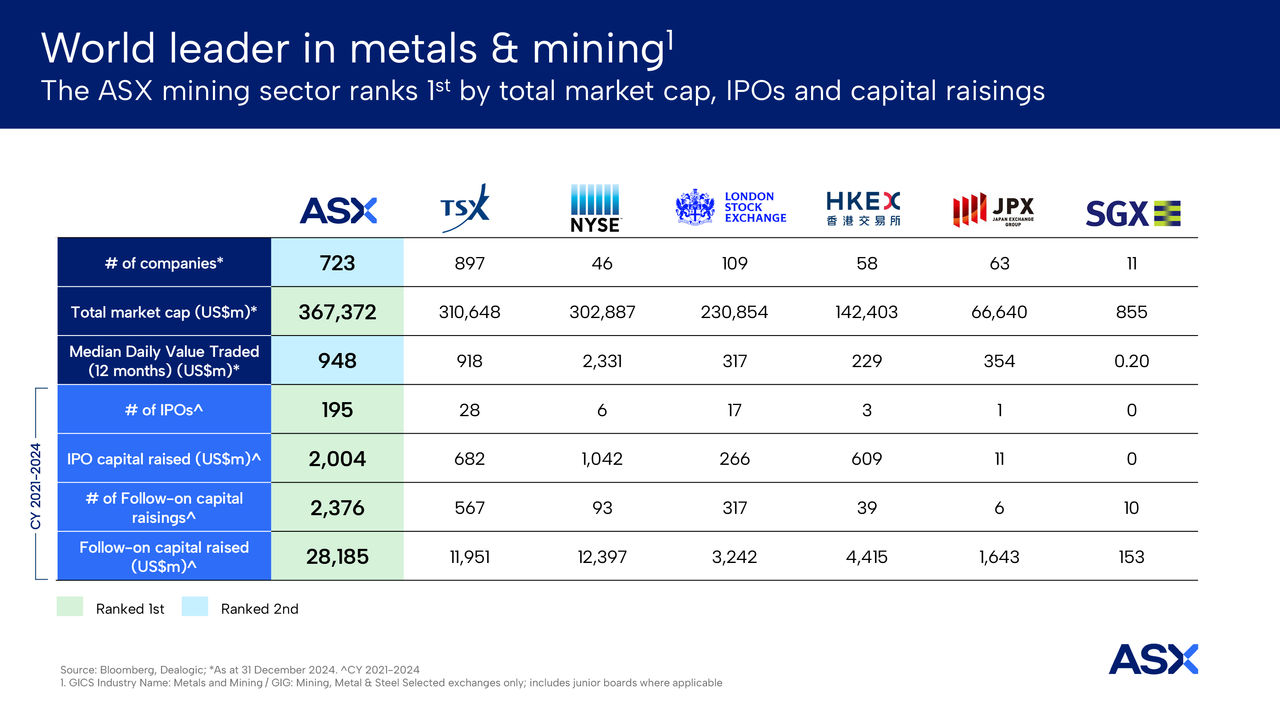

The Australian Securities Exchange (ASX) is the world’s leading bourse for metals and mining companies by many measures, including total market capitalisation, IPO activity and capital raisings (see table below). This is underpinned by the resources sector’s dominance on ASX, accounting for around 47 per cent of all listed companies or more than 860 firms, representing 25 per cent of the exchange’s total market cap.

Further solidifying ASX’s appeal for global miners is its exceptional track record in follow-on capital raisings, for which it consistently outperforms international peers in both volume and value. This shows how easy it is for companies to return to the market for additional funding and the depth and engagement of an investor base that remains highly active in supporting growth and innovation within the sector.

A recent Listed@ASX roundtable explored ASX’s position as the top dual-listing venue for global mining firms seeking to unlock value and expand their reach.

Alexandra Cain, editor, Listed@ASX: Why should global mining companies consider a dual listing on ASX?

Michael Slifirski, Director Investor Relations, APAC region, Capstone Copper (ASX:CSC, TSX:CS): In Australia, there are plenty of specialist mining funds and resources-friendly fund managers who can be converted to shareholders pretty quickly because they understand the commodity and the context of the opportunity being presented. It’s a pretty easy sell to an educated market, supported by brokers with mining analysts and specialist sales teams. They act as the loudhailer for the company, broadcasting the message more effectively than an IR team operating remotely.

In Australia, these sales teams are skilled at engaging specialist portfolio managers and already speak the language of resource companies versus perhaps more generalist or introductory conversations with some North American investors. Another important aspect in Australia is the established infrastructure for investor engagement, including analysts and broker conferences, plus high-quality journalists. Brokers are exceedingly supportive, keen to host management roadshows and investors are generally willing to take those meetings. So, Australia is an easy market to operate in.

Luke Salter, Division Director, Macquarie Capital: Australia offers a unique, incremental investor pool. There’s a specialist understanding of mining, both among specialists and generalists. A lot of capital is captive to the ASX; these miners can’t access it unless they list here. Tied to that, particularly in certain commodities, you see premium valuation outcomes on the ASX.

"Another important aspect in Australia is the established infrastructure for investor engagement, including analysts and broker conferences, plus high-quality journalists."

Christian Calabrese, Managing Director, Canaccord Genuity: What's unique about Australia is the superannuation industry deploying a significant portion of their funds under management (FUM) into ASX-listed equities which includes local mining companies. There’s also a large number of specialist mining investors in Australia who have a deep understanding of the global metals and mining sector. We have a very captive retail & high net worth investor audience as well.

Scott Gibson, Partner, Thomson Geer: ASX makes it quite easy for foreign mining entities to obtain a dual listing. There's a lot of consistency between the disclosure regimes and mining codes of ASX and other key exchanges. From a compliance and cost point of view, it's not a huge burden on foreign companies to access ASX.

Listed@ASX: Michael, why did Capstone decide to list on ASX?

Michael: A really important part is the demand pull, rather than the supply push. The underlying equity should fill a void in the market where investors might not be able to get the local equity exposure to the commodity or thematic they want. Secondly, any offering should be differentiated. So for a resources company, it should be longer mine life, better growth, a management team that's well recognised because of what they've done in the past, diversity of production sources and valuation. The more ticks you can get in those boxes, the higher the demand is likely to be.

"Companies considering a dual listing also have to be prepared and able to support that listing through regular management road shows. You can't just set and forget."

Companies considering a dual listing also have to be prepared and able to support that listing through regular management road shows. You can't just set and forget. Management should be prepared to visit this market multiple times a year. Analyst briefings should be at convenient times for both markets. So rather than having separate briefings for separate groups or briefings set at outrageous times early in the morning, it should be a time that works for both markets. Also identify somebody who can be the local presence who can provide continuity of information about the company in the investors’ timeframe, not with a 24-hour delay and time zone challenges. This should be somebody who understands the story, understands the sector, is known and respected by analysts and investor, and who understands what local expectations are.

Listed@ASX: What should companies consider if they are thinking of dual listing on ASX?

Christian: What's important from a corporate and investor perspective is really understanding the potential ASX liquidity profile of the issuer. Ideally, there would be sufficient liquidity post listing to attract institutional and high net worth investors to the company. To that end, there's ways to optimise an ASX-listing structure to create a pathway into relevant index inclusion, which would further attract institutional investor demand for the stock.

Scott: There has to be a plan about how you're going to attract Australian investors, and whether that's pre-existing shareholders or a decent capital raising as part of the listing.

Luke: There's really three pathways. There's a compliance listing utilising a foreign exempt listing, for which you need AUD2 billion market capitalisation on a recognised exchange to qualify (otherwise a standard ASX listing process applies). That’s a huge attraction to offshore listed companies. There's raising money at IPO, but that has challenges, because you have an elongated timetable to raise money as an already listed company, and there’s the M&A route to acquire an ASX listed company and maintain that listing like Newmont (ASX:NEM, NYSE:NRM, TSX:NGT) and Alcoa (ASX:AAI, NYSE:AA) did when they acquired Newcrest and Alumina. So thinking about the pathway is important.

"There has to be a plan about how you're going to attract Australian investors, and whether that's pre-existing shareholders or a decent capital raising as part of the listing."

Christian: A pathway that has been recently explored is seeding an offshore listed entity with Australian shareholders prior to an anticipated ASX-listing. This alternative creates an ability for Australian shareholders to eventually transfer their shares to the ASX register (post ASX listing) which naturally increases the ASX float and can enhances trading liquidity.

Sasha Conoplia, Senior Manager, Listings, ASX: another strategy to generate liquidity for the ASX listing is to follow the Capstone Copper playbook. On our recent trip to Toronto and Vancouver to meet with TSX listed metals and mining companies about the ASX dual listing opportunity, the Capstone ASX playbook was very well known and caught a lot of interest from Canadian companies. Capstone listed on ASX and then later a strategic shareholder, in this case Orion, sold down an AUD593m stake of the ASX listed line via a block trade, to seed the ASX liquidity and trading. This helped Capstone qualify for the S&P/ASX300 index and attract further institutional investors. Subsequently we have seen the market capitalisation of shares traded on the ASX line grow from AUD600m to around AUD1.6bn and in March 2025 we saw Capstone enter the flagship S&P/ASX200 index, opening the door to attract even more Australian and global investors.

Scott: That’s the most common scenario we're seeing, particularly in small cap mining, where funding is particularly difficult in North America. Lots of the entities are looking at assets and need money straight away. They can't wait the three or four months to get the listing up and running, so there's a trend of seeding the entity with Australian shareholders with a promise to pursue an ASX listing. Innovative instruments are emerging because people are investing on the basis there will be an ASX listing and they want some downside protection in the event you don't get there.

We're seeing some interesting instruments like liquidity warrants, where the equity effectively reprices if there's no liquidity event in a defined period post a capital raising.

Listed@ASX: How does ASX differ from other global exchanges in terms of benefits for mining companies?

Kate Galpin, Senior Manager, Listings, ASX: Within metals and mining, ASX listed companies raised $13.5 billion in follow-on capital last year, underscoring the segment’s significance relative to the broader market. Regarding dual listings, key distinctions versus other global exchanges include Australia’s sophisticated investor base - and for dual listings as a result of local M&A - the observed growth in Australian shareholder participation post-listing, as domestic investors value exposure to the expanded entity.

Also, the $4.2 trillion Australian superannuation system is the fifth largest in the world and allocates around 25 per cent to 30 per cent of its funds to domestic, ASX-listed equities. This is one of the highest, if not the highest, allocations to domestic equity markets globally. By contrast, the Canadian pension system allocates around six per cent to its domestic market and the UK is around three per cent. This is a real and ongoing tailwind for ASX given the Australian superannuation system is expected to grow to around $11 trillion in the next 15 years and institutional investors are looking for new ways to deploy capital and seek diversification into the right companies.

Sasha: The real standout is that the metals and mining market in Australia is open for business. The real difference is the ability for companies to come back, not just once, but sometimes twice a year or more, to raise capital quickly through the best settings globally. So if we look at the number of follow-on capital raisings on the ASX over the four years to 31 December 2024, it was 2,376 capital raisings on ASX raising USD28.2bn equivalent versus 567 transactions on TSX/TSX-V raising USD12.0bn, 93 on NYSE raising USD12.4bn and 317 on the LSE/AIM raising USD3.2bn. ASX is a real standout. ASX gives companies the ability to follow through on their own story. But you need to come back for the right reasons, at the right price.

Luke: Success breeds success. There are so many great examples it gives companies the confidence to move ahead, which I think is really important, particularly for larger companies.

Listed@ASX: What else is involved in a successful dual listing?

Michael: Getting the support of local Australian market participants is really important because without local market analyst coverage, fund managers feel somewhat naked, because they might not have the depth of relationships with offshore analysts. There are lots of good analysts and brokers, but fund managers have their chosen one or two analysts, whose views they respect, whose models they understand, whose opinions they know how to put into context. So getting that follow through analyst coverage is critical.

Listed@ASX: What about the size of the raise?

Christian: Sizing should be a function of a relevant ‘use of funds’ so investors are comfortable that the additional capital raised is applied appropriately. There's an overlay we consider to ensure a successful listing in terms of optimising the issuer liquidity profile and potentially creating a pathway to an index inclusion.

Luke: An ASX listing creates a competing pool of capital that can work very favourably for companies or secondary sellers of shares, because you can work with the two groups to get the best outcome. Otherwise, sometimes you do see some digestion in the market, as capital might be recycled, and some weakness post deal.

Christian: For mining developers, which need to raise equity capital to fund development activities, having that unique and differentiated pool of capital can be beneficial. It helps allay investors’ fears that the company can’t access appropriate levels of capital to progress their corporate initiatives.

Sasha: with a focus on S&P/ASX index inclusion, if companies are large enough they should think about how to raise capital or discuss a strategic sell down to target entry into the S&P/ASX300 which currently starts around USD350m market cap equivalent for entry. That’s the market capitalisation quoted on the ASX listing, not the global market cap of the company.

Listed@ASX: What are CDIs and how are they involved in a dual-listing?

Kate: Listing on ASX through a CHESS Depository Interest, or CDI, enables foreign shares to trade electronically on ASX while remaining listed on their home exchange. These financial instruments facilitate electronic trading of foreign-listed shares on ASX. Similar in function to an American Depositary Receipt (ADR), a CDI represents an ownership interest in the underlying shares of a foreign company, granting holders the same rights, such as dividends and voting, as direct shareholders.

Sasha: Unlike ADRs, CDIs don’t need a sponsored broker arrangement. Rather, they are a mechanism run by ASX to streamline cross-market trading in an efficient way so investors can move their shares across the listing venues easily.

Listed@ASX: What's the most significant step a global mining company should take when considering dual listing on ASX to ensure long term success?

Scott: There are a few quirks in the dual listing system, and every time we do one, there's something new we observe that doesn't fit perfectly across the two markets. It might be a second class of share, or a golden share you often see in North America. Or you might have investors that have a long-standing top-up right to maintain their percentage shareholding. We have even had auditors saying the accounts of foreign companies have been prepared for local purposes only and not for use in an Australian listing. These quirks need to be addressed right up front, because if they’re not fixed, then there's a potential wrinkle down the track. Once you know the path, the process is very streamlined; ASX grants waivers to make the two exchanges fit together, but there's a couple of little hooks that can catch people out.

For example., ASX grants waivers around the issue of shares to directors and as long as you comply with the local exchange’s escrow provisions, no escrow applies at time of listing on ASX. That's important because if you had to apply ASX's escrow rules, most dual listing would not be possible as you can’t put the toothpaste back in the tube.

Listed@ASX: What should foreign issuers planning to list on ASX think about?

Michael: It's a very quick, seamless way of accessing this market, but it takes grunt work and long-term commitment. There's a huge amount of effort behind it and ongoing maintenance is required as well as commitment of management time and resourcing to make sure it’s successful.

Scott: That's so true for small-cap land with minimal people and resources. We always have a conversation very early around staffing. A dual listing is not just ticking a box. We recommend engaging a transaction coordinator who is familiar with ASX and the IPO process, who can do a lot of the heavy lifting. The IPO process is quite different to what happens in Europe and North America, so using people with the correct experience is critical.

Christian: The ASX investor audience is open for global metals and mining companies. I would encourage foreign issuers contemplating an ASX listing to come to Australia, meet with investors and gauge feedback firsthand before making any decisions around a dual-listing.

Luke: Companies should be aware of ASX’s depth and that a first mover advantage does exist, so move quickly on the opportunity, which is a real and sustainable one.

The ASX continues to be the leading destination for global mining companies to seek a dual listing. The combination of a highly educated market and specialist fund managers, a large superannuation base and the ASX providing an easy pathway for foreign mining entities to get a dual listing and raise follow on capital makes it particularly attractive.

If the process is planned and managed well and a physical local presence is provided to work with local investors, the listing can be setup for long-term success.

For further information and to explore opportunities, please contact the ASX Listing team.

Related links

Disclaimer

Independent advice from an Australian financial services licensee is needed before making financial decisions. This is not intended to be financial product advice. To the extent permitted by law, ASX Limited ABN 98 008 624 691 and its related bodies corporate excludes all liability for any loss or damage arising in any way including by way of negligence.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2025.