- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to {{verificationEmail}}.

Please check your inbox.

An account with your email already exists.

ASX review of sharemarket floats

- Fri 08 March 2019

Large, growing pension pool in Australia one of many attractions.

There are more than 280 international businesses listed on ASX, which by number account for about 12 per cent of all listed entities. They are spread across a number of markets, with New Zealand the largest with 58 entities.

Access to growth capital is the major attraction of ASX for international listings and this article explains how and why this is the case for companies across several different jurisdictions.

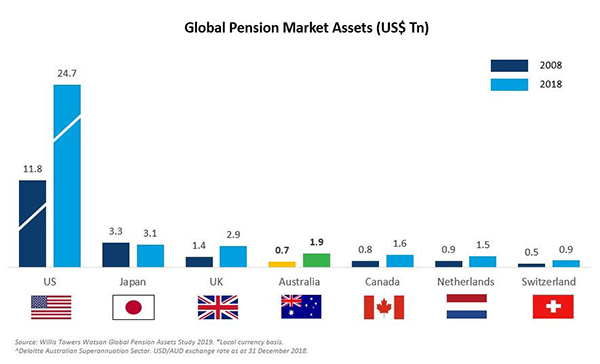

As shown in the graph above, Australia has the fourth largest pension pool globally and also one of the fastest growing. Superannuation assets total A$2.6 trillion and this is predicted to grow to A$9.5 trillion by 2035.

The reason behind the size of the Australian pension pool is the compulsory superannuation system introduced by the Federal Government in 1992. The sheer weight of this pool, where a large percentage is mandated to invest directly in ASX-listed securities, makes the Australian market an attractive venue for international companies looking to access capital for growth.

Why ASX?

In addition to capital, an ASX listing offers a number of other benefits for an international company looking at global public markets. These include a highly active exchange, a main board listing and earlier entry to globally recognised indices.

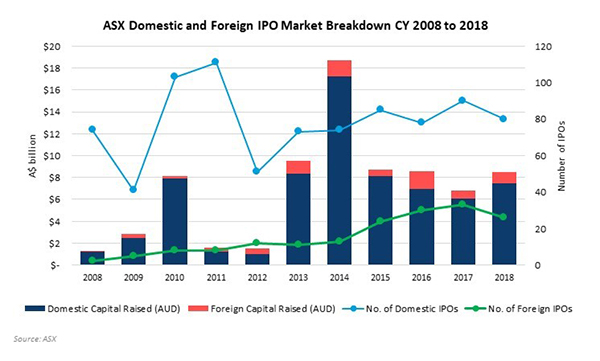

ASX is a very active exchange, typically exceeding 120 initial public offerings (IPOs) a year and trading volumes averaging $5.6 billion on a daily basis.

ASX offers a main board listing, which provides a globally recognised robust regulatory environment and access to the full breadth of investors from retail to global institutions. Access to the main board for earlier-stage growth companies is in contrast to a junior board listing where full access to the investor base can be more limited.

Often, institutional investor mandates stipulate fund managers limit their investment to a globally recognised exchange and not extend to many secondary boards or smaller main boards, examples of which are the AIM market in the UK, TSX-V in Canada, GEM in Hong Kong and Catalist in Singapore.

Index inclusion is another key factor. ASX has two globally recognised S&P indices, the S&P/ASX 300 and S&P/ASX 200. The importance of index inclusion to a listed company is the access this provides to institutional investment, both passive and active.

Institutional mandates are typically mandated to a recognised index and when a company enters an index it will lead to extended investment reach, both domestic and global, as that index weight increases.

The institutional investment in the S&P/ASX 200 index is comprised of about 45 per cent from global asset managers and 55 per cent Australian, meaning companies listed on ASX can have a register of globally recognised investors at an earlier stage than other markets.

Global reach

In the past five years there has been an increase in the number of international companies listing on ASX. It is an attractive listing venue for international companies from a number of different markets but these can be broadly characterised by (i) companies located in a constrained home capital market; (ii) those where size can cause them to be lost in their home market.

Smaller public markets

ASX has attracted listings from New Zealand, Israel, Singapore, Malaysia and Ireland. These countries have smaller public markets, a different investor risk profile to Australia and in some cases more limited listed peer groups for growth companies.

As noted, New Zealand has the largest number of listed companies on ASX, the size differential of investable assets in Australia relative to New Zealand is the main reason, and also the associated access to capital and a wider investor base this provides.

ASX facilitated the dual listing of NZX-listed companies with the introduction the ASX NZ foreign exempt listing category, which enables a company to use its home market filings. A dual listing grants a company access to the liquidity and investors in both markets.

Once an NZX-listed company dual lists on ASX, investors are able to execute trades in the stock on both exchanges, which typically results in an increase in the overall liquidity of the stock.

More recently we have seen companies from New Zealand continue to dual list, but also have a sole IPO on ASX to tap into the investor capital in Australia from the beginning of their listed journey. An example in 2018 was Straker Translations.

Israel and Singapore both have more constrained public markets from an investor risk-reward perspective, where the appetite for risk is different to that of the Australian investor and the scale of the overall market is more confined. This results in capital not being as readily deployed to growth companies.

So, companies need to look beyond their home market to access higher-risk growth capital and a recent example is the Israeli listing of Splitit on ASX in January 2019.

Getting lost in your home market

In contrast, companies from large capital markets such as the United States and continental Europe, such as Germany, also benefit from the Australian market dynamics. The size of the US public markets means that earlier-stage companies, with annual revenues below $100 million or valued at $1 billion market capitalisation or less, struggle to foster investor attention.

The US private markets are the most active globally and high-profile companies such as Uber, Spotify and Airbnb have held off listing until they are well beyond that size. This means there is a whole generation of companies that would prefer to access the public markets, versus private funding, at an earlier stage, but their home exchange cannot support this.

Amazon listed on NASDAQ in 1997 with a market capitalisation of less than $450 million and revenue of $16 million per annum. This would be extremely challenging on the US markets today.

ASX is bridging the gap for companies in these larger markets that would like to use the public markets to raise growth capital and can use ASX as a springboard to reach a size where they would attract attention in their home market.

There are currently 45 US companies listed on ASX. Six new companies listed in 2018. As noted in the 2018 IPO review, over the past two calendar years the largest tech capital raising of an IPO has been a US company: Credible in 2017 and Pivotal Systems in 2018.

The US cohort of companies range across industries but the recent trend has been in the technology sector. The ASX-listed tech sector has more than doubled in the past five years and continues to be our fastest-growing sector in terms of new listings.

Advantages for Australian investors

The focus has been on the advantages for global companies to list on ASX and access their growth capital from the Australian market. But what are the advantages for the Australian investor?

An important element of investing is diversification, and investors seeking diversification opportunities are able to gain exposure to overseas companies with the convenience of investing in an ASX-listed stock.

Investing in global businesses listed on ASX can provide investors with additional means to gain exposure across geographies, broader sectors and more diverse underlying revenue streams.

The broader the “menu” of investment opportunities for investors in Australia, the more diversification opportunities there are.

About the author

Kate Galpin, ASX

Kate Galpin is Business Development Manager, Listings, at ASX.