Australian investors continue to thrive, even against a backdrop of geopolitical turmoil and rising livings costs, according to the latest ASX Australian Investor Study.

Overall, the results show 2023 has seen the highest number of on-exchange investors since 2010. More new investors than ever are entering the share market, many of whom are attracted to the simplicity and low cost of investing in exchange traded funds (ETFs), which makes index inclusion important for larger companies. As an investment instrument, shares remain the most popular investment choice.

The focus on shares and ETFs has implications for listed company communication. As investors become more self-reliant, they will increasingly rely on information sources such as company websites, annual reports and product disclosure statements. Social media and short video content will become especially relevant for younger investors. Ensuring company information is up-to-date and relevant will become increasingly important. As will making it easy for investors to find your company and understand what’s important about it.

There are many opportunities for mid- and small-cap companies to join ASX activities such as CEO Connect, ASX Small and Mid-Cap Conference and the equity research scheme to engage with investors.

Here are the some of the headline results from the research :

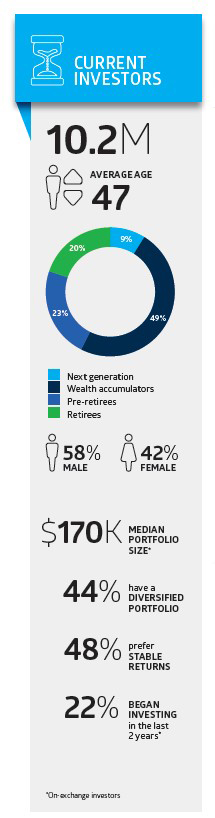

- 51 per cent of Australians (10.2 million people) hold investments in addition to their home and their super fund. This is a rise of 13 per cent (or 1.2 million investors) since the last survey in 2020.

- 58% of investors hold Australian shares and 20% hold ETFs

- 42 per cent of investors are women, while 58 per cent are men.

- 7.7 million investors hold on-exchange investments.

- Of those that hold on-exchange investments, 22% began investing in the last two years.

- Investors can be segmented into the following categories: nine per cent are next gen investors (aged 18 – 24), 49 per cent are wealth accumulators (25 – 49), 23 per cent are pre-retirees (50 – 64) and 20 per cent are retirees (65+).

Investor confidence grows

Investors are adding to their portfolios, despite the rising cost of living and higher interest rates contributing to higher mortgage repayments. According to the study’s results, the median size of an on-exchange investor’s portfolio has risen from $130,000 in 2020 to $170,000 in 2023.Higher salaries contribute to this, with the average annual income for research respondents lifting from $90,000 in 2020 to $96,000 in 2023.

The results also indicate the more experienced the investor, the larger the portfolio. The median portfolio value for investors with ten or more years’ experience investing is $850,000, almost double the $430,000 median portfolio for investors with between five and ten years’ experience.

It’s pleasing to see investors are making investment decisions not on trends, but based on their own investment goals. The results show personal circumstances are one of the most important considerations for investors when deciding how to invest, although they also take into account the potential returns and risks associated with an investment. When it comes to returns, stability is a priority and 67 per cent want stable or guaranteed returns, versus 54 per cent in 2020.

Investors are also demonstrating a growing level of confidence to remain invested through market cycles. Questioned about their likely response to a 20 per cent fall in the market’s value, 40 per cent said they would be concerned, but would wait before taking action. Next generation investors were the group most likely to sell down or transfer to more secure investments in the face of a correction (26 per cent), which would essentially crystalise their losses.

Shifting demographics and changing investment priorities

Overall, maximising capital growth, balancing risk and growth and building an income stream are investors’ main priorities. However, diversification and ESG have become less of a priority compared to the previous survey.

Market demographics have shifted between the two surveys, with younger and female investors now gaining more exposure to shares. In fact, there are more women investing outside their home and super fund than ever before. Half of the 1.2 million new investors since 2020 are female, with the number of female investors now totalling 4.3 million.

A typical female investor is aged 47 and has a median portfolio of $95,990. The median number of trades she has made is nine. But there is still work to be done before women are on a level playing field with men, with the average value of a male’s portfolio equalling $667,000, while the equivalent number for women is $413,000.

Next generation investors are another interesting group. The median portfolio value for investors in this group is $45,500 and the median value of their crypto assets is $2,700. Their average age is 21 and the median number of trades they have made is 22. There is a good opportunity to further educate this group, given 26 per cent don’t know which investments to select.

Looking at some of the other investor groups, considerations vary, depending on age and proximity to retirement. For wealth accumulators, the top considerations when investing in this age group include potential investment returns (43 per cent), the potential risk of an investment (33 per cent) and diversification of their portfolios (17 per cent).

For pre-retirees, top considerations when investing are potential returns (45 per cent), potential risks (40 per cent) and fees and costs associated with investing (29 per cent). Whereas for retirees, top considerations when investing are potential returns (42 per cent), potential risks (35 per cent) and accessing the funds in their portfolio if it’s tied up (24 per cent).

Turning to self-managed super fund (SMSF) investors, people in this category have much higher balances, with a median of $1.04 million. SMSFs are highly exposed to Australian shares, with 73 per cent holding local equities, versus a much smaller 23 per cent holding international shares. SMSF investors report high levels of diversification, with 58 per cent saying they have a diversified portfolio, compared with 44 percent of all investors.

In terms of portfolio size, SMSF investors are only rivalled by high-value investors (HVIs), who are defined as the top 10 per cent of investors by wealth and trading volume. HVIs have a median portfolio of $1.45 million. SMSFs and HVIs are not mutually exclusive.

HVIs are more likely to directly hold shares (75 per cent) versus non-HVIs (58 per cent) and another 55 per cent hold ETFs. More than twice as many HVIs (33 per cent) hold crypto assets versus non-HVIs (15 per cent).

ESG gathers pace

A growing number of investors, especially those in the next generation category, are investing with environmental, social and governance (ESG) performance of an asset in mind. But they are finding it hard to identify trustworthy information sources.

While 31 per cent of investors are now ESG conscious, 52 per cent of next gen investors who are open to ESG themes have actually bought or sold an investment based on its ESG credentials in the last 12 months. But 16 per cent of all investors say it is difficult to find out the ESG standing of a company.

Looking ahead

Overall, the 2023 ASX Investor Survey shows the local equities market and the people who invest in it are becoming increasingly sophisticated. This indicates a promising future in the market for all the different groups who have exposure to it.