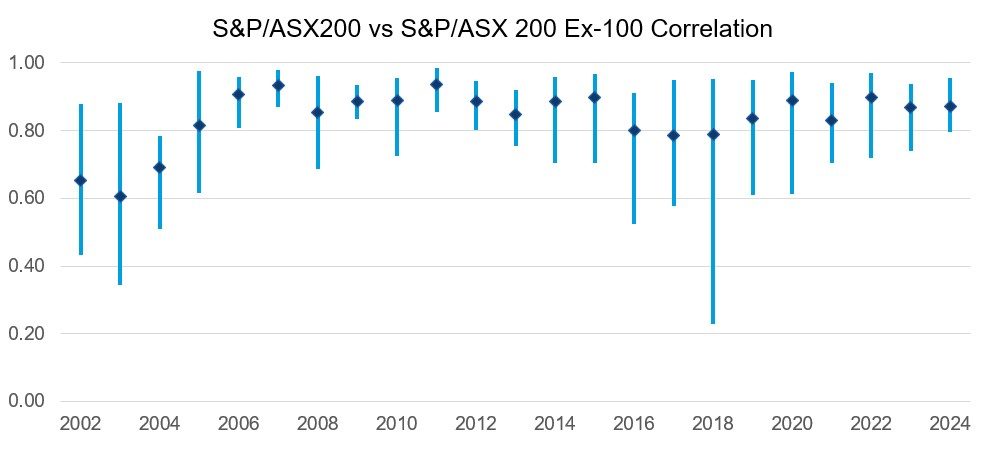

Source: ASX & Dr Russell Rhoads; wings represent monthly high & lows, bullet represents average correlation for each calendar year

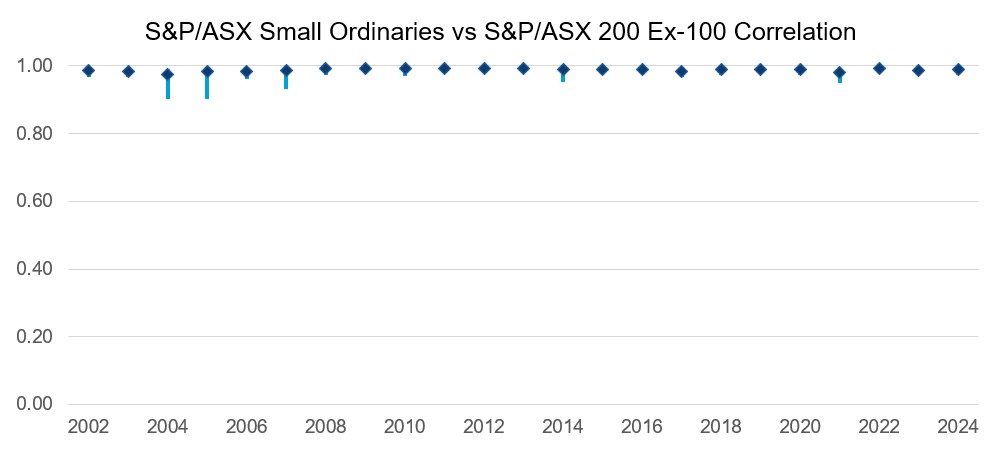

By contrast, the correlation between the S&P/ASX 200 Ex-100 and the Small Ordinaries (which covers small-cap stocks in the S&P/ASX 300 outside the S&P/ASX 100) is much stronger than with the broader S&P/ASX 200. The lowest monthly reading in this series, recorded in 2004, was still just above +0.90 - underscoring the consistently close relationship between the two indices. This is shown in the chart below:

Source: ASX & Dr Russell Rhoads; wings represent monthly high & lows, bullet represents average correlation for each calendar year

The takeaway is, the S&P/ASX 200 Ex-100 Futures contract provides the liquidity you’d expect from S&P/ASX 200 stocks, while delivering performance that reflects the small to mid-cap segment of the Australian equity market.

When the SPI 200 isn’t the right hedge

As noted above and detailed in Russell Rhoads’ research paper, Australia’s mid-cap equities segment has shown that it can be too distinct to hedge with a one-size-fits-all approach. Mid-cap portfolios are often hedged with SPI 200, however when those benchmarks diverge, the cost of an imprecise hedge can be material. Managers may assume that using SPI 200 is 'close enough,' yet market conditions can lead to unexpected tracking differences and real losses.

The SPI 200 may not always move in step with mid-cap exposures, particularly during sector rotations, size or momentum factor driven rallies or when company-specific moves drive dispersion. A hypothetical example of this using historical market data is detailed in the research paper which illustrates this challenge: a fund manager or asset owner tied to a mid-cap benchmark in 2014 would have lost about 5% in value on their long equities portfolio (this was the performance of the S&P/ASX 200 Ex-100 over that time: -5.05%). If they attempted to hedge their exposure by shorting SPI 200 Futures – they would have lost an additional 1.1% (as the ASX200 increased by that amount over this period). The result is a double performance drag that could have been significantly reduced by using the S&P/ASX 200 ex-100 Futures contract.

Practical execution: How to trade the ASX/S&P 200 ex-100 Futures contract

Trading of the S&P/ASX 200 ex-100 Futures contract is conducted on-market via ASX’s electronic trading platform, ASX24®. The product is also available off-market via block trade (20 contracts is the current minimum threshold for block trades) and exchange-for-physical facilities. Calendar and inter-market spread trading functionality is supported, allowing for flexible execution strategies.

The ASX/S&P 200 ex-100 Futures contract is not typically traded on-screen in the same way as the SPI 200 contract, but that does not mean liquidity is unavailable. Rather, liquidity is available through established “over the phone” markets (via appointment) or by quote requests.

Here is how institutional managers would typically access and execute ASX/S&P 200 ex-100 Futures trades:

1. Engage directly with liquidity providers

ASX has five confirmed investments banks prepared to make ‘over the phone’ or request for quote markets on request. Please see next steps below to access the linked liquidity provider summary or reach out to ASX if you have any questions. All liquidity providers are active in the underlying equities and can quote executable markets by appointment. These market participants understand the index constituents and are typically well-placed to provide two-way markets.

2. Negotiate price, then execute the order

There are two ways to execute these equity futures contracts depending on the size of the trade:

If under block size (i.e. less than 20 contracts) - the liquidity provider will quote a two-way market on screen which the fund manager can execute against.

If over block size (=>20 contracts) - once pricing is agreed, the trade is submitted as a block transaction. These blocks are traded on ASX24 and centrally cleared through ASX Clear (Futures), supporting operational efficiency and risk management.

3. Monitor performance with valid and reliable daily settlement prices

Reliable settlement prices are crucial for effective risk management when using futures contracts. To this end ASX has a number of processes in place including incorporating on screen prices for trades and orders as well as considering the daily movement (or value) of the underlying index to help ensure valuation is in line with market views.

When ASX/S&P 200 ex-100 Futures work best

The S&P/ASX 200 ex-100 Futures contract is designed to meet the needs of institutions managing concentrated or benchmark-aware mid-cap exposures.

Common scenarios include:

- Eliminating tracking error to the ASX 200: This may particularly apply to active managers tracking the All Ordinaries or other mid cap benchmarks.

- Exploiting spread trading opportunities between market cap segments: As noted in Russell Rhoads’ research paper, mid-cap equities often behave differently from large caps in changing macro environments. ASX/S&P 200 ex-100 Futures help ensure hedges track with portfolio movements.

- Index rebalancing and quarter-end flows: Mid-cap stocks frequently see liquidity spikes during rebalance windows. The S&P/ASX 200 ex-100 Futures contract may allow risk to be managed in parallel.

Why ASX/S&P 200 ex-100 Futures improve risk management

ASX/S&P 200 ex-100 Futures allow small-mid cap managers to target the part of the market they are actually exposed to. This can improve hedge precision, reduce unintended exposures, and strengthen overall portfolio risk management.

With central clearing via ASX Clear (Futures), negotiated liquidity (linked to the underlying security constituents) via ASX24, and confidence in robust settlement prices; the contract is purpose-built to support managers who value accuracy and efficiency.

Next steps

Whether you are looking to enhance your overlay strategy or reduce slippage and tracking error, ASX/S&P 200 ex-100 Futures provide a targeted solution worth considering.

If you are a fund manager, execution desk, or sell-side trading partner:

- Download the Dr. Russell Rhoads’ research paper for case studies and detailed historical insight.

- Contact ASX to access the summary list of liquidity providers or to discuss how block execution works.

- Assess whether ASX/S&P 200 ex-100 Futures could deliver better hedge performance for your portfolio and strategy.

For more information, contact

Email: options@asx.com.au

Other Insights

To receive regular insights via email, please subscribe to the ASX Equity Derivatives monthly newsletter.

Equity options trading observations and insights

ASX have partnered with Dr Russell Rhoads to create a series of articles which provide observations and insights for options trading.

Disclaimer

Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. Although ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”) has made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2025.