More retail investors are embracing responsible-investing principles, avoiding companies that do social or environmental harm and favouring those that have a positive impact, the 2023 ASX Australian Investor Report has found.

Responsible investing is a process that acknowledges Environmental, Social and Governance (ESG) factors in investment decisions.

“The results on ESG investing are very encouraging,” says Emilie O’Neill, Co-Head of ESG and an equities analyst at Perennial Partners, a fund manager. “The report shows that almost two thirds of retail investors are willing to invest in a sustainable way.”

Many asset managers use ESG filters to invest responsibly. An ESG fund might, for example, avoid a company with poor waste-management practices (Environment).

Another fund might sell their shares in a company that is found to underpay workers in developing nations and treat them as modern slaves (Social).

Some ESG-focused funds have challenged listed companies that have no women on their board, or excessive CEO pay (Governance).

By adopting ESG principles, these funds combine non-financial and financial information to make decisions. They base their investments on fundamentals, such as earnings growth, as well as the company’s impact on a range of stakeholders.

Strong growth in responsible investing

Responsible investing is growing quickly. An estimated $1.54 trillion of assets under management in Australia – about 43% of all professionally managed funds - was invested responsibly in 2021, the latest Responsible Investment Association Australasia (RIAA) Benchmark Report found.

Institutional investors have embraced responsible investing principle for two main reasons. First, their investors don’t want to own harmful companies. Second, responsible investing can potentially reduce risk and enhance portfolio performance over time.

Less is known about retail investors and ESG. For years, the main option for retail investors was to invest in an ethical managed fund that excludes sectors identified as harmful, such as tobacco or weapons manufacture.

Ethical fund choices were limited and higher fees often featured (due to the extra screening of investments). There was also a perception that investing ethically meant sacrificing returns (a false assumption).

Today, retail investors can choose via ASX from a range of Exchange Traded Fund (ETFs), Listed Investment Companies (LICs) and unit trusts (through mFund) that use ESG filters to invest in local and global assets. Some ESG ETFs have low fees.

For investors who prefer to buy and sell shares directly, there is more ESG information than ever to aid investment decisions. Companies in the S&P/ASX 100 Index typically provide detailed sustainability reporting, as market demands for ESG data grow.

Emilie O’Neill, Co-Head of ESG and an equities analyst at Perennial Partners

Large asset owners (such as super funds that own shares on behalf of many individual Australians) and passive investors (for example ETF issuers who issue products over indices such as the S&P/ASX100, 200 and so on) demand that these companies provide transparency on their ESG credentials through reporting (this is referred to as “stewardship”).

Additionally a range of ESG indices now exist that will automatically exclude companies who do not satisfy the ESG criteria imposed by the index. Thus, inclusion in a key sharemarket index can encourage listed companies to increase their ESG reporting.

Key findings from ASX 2023 Australian Investor Report

Released in June, the biennial report is the latest instalment in ASX’s long-running study on investor attitudes, behaviour and decision-making. The first report was in 1986.

This year’s report surveyed 5,519 investors on a range of investment topics. They included current and lapsed investors, and those who have never invested.

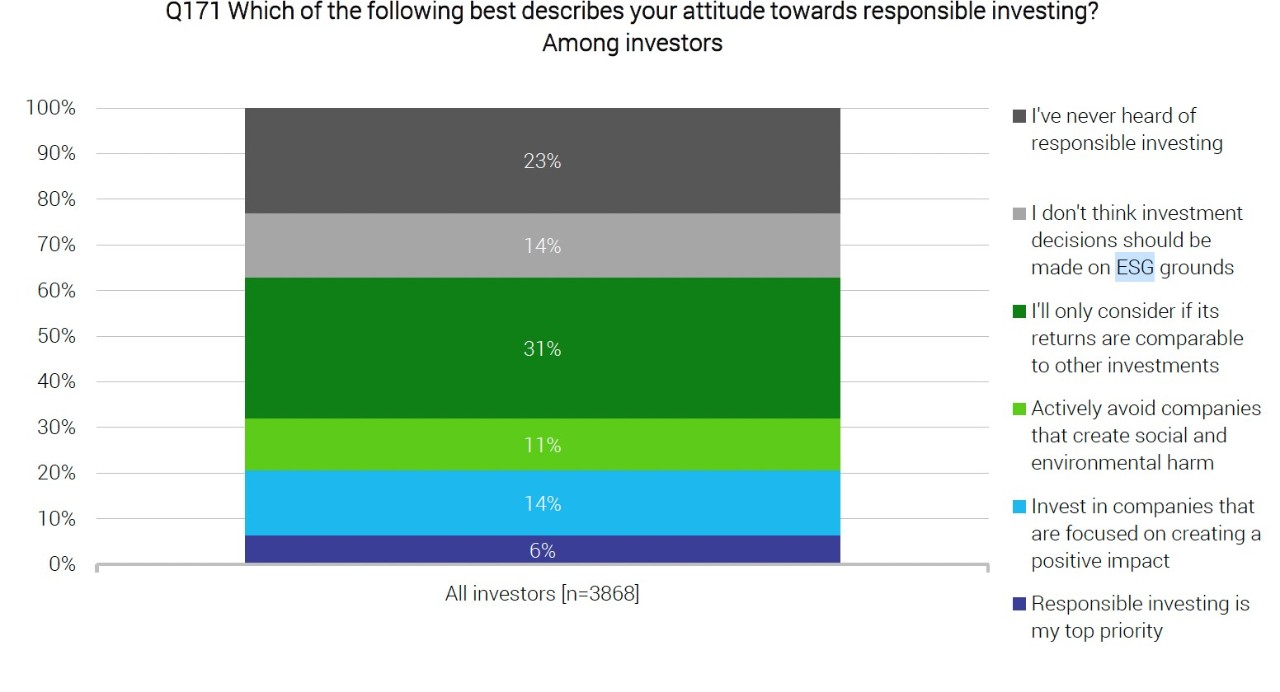

A new focus in the report was the emerging trend of ESG investing among retail investors. Almost a third of current investors said the use responsible investing principles in their approach.

About another third said they would only consider ESG principles if returns were comparable to other investments (see Chart 1, below).

The final third of respondents did not use ESG principles when investing. That was mostly because some investors surveyed had never heard of responsible investing (23%). Only 14% of respondents said investments should not be made on ESG grounds.

Chart 1: Attitude toward responsible investing

Source: 2023 Investment Trends. 2023 ASX Australian Investor Report

These are important findings. Taken together, the results suggest there is a large group of retail investors poised to embrace responsible investing principles. And that ESG investing will become the norm for most retail investors this decade.

For Perennial Partners’ Emilie O’Neill, the key finding was the large proportion (31%) of respondents who would invest responsibly if returns were comparable. “There is a growing body of research that shows you don’t have to sacrifice investment returns to invest sustainably,” she says. “In Perennial’s experience, ESG investing can aid performance over time.”

Responsible investment products (multi-asset category) outperformed the overall market over all time periods (1, 3, 5, 7 and 10 years), according to RIAA’s latest report.

O’Neill says the finding that Next Gen (aged 18 to 24) and Accumulators (25 to 49) are slightly more interested in avoiding harmful companies compared to pre-Retirees (50-64) and Retirees (65 or more) is consistent with responsible-investing trends.

So, too, are gender differences towards ESG investing. More men (19%) said investment decisions should not be made on ESG grounds compared to women (10%). However, there was little gender difference in overall adoption rates of ESG.

“The outlook for ESG investing this decade is positive as more women invest in shares, and as younger people inherit money through inter-generational wealth transfers,” says O’Neill. “Younger people, in particular, don’t want their money invested in companies that hurt the environment or communities, or engage in unethical practices.”

ESG and risk reduction

As an ESG analyst, O’Neill is passionate about investing in ways that help rather than harm the planet. But she says ESG investing is about more than doing good. “ESG is an essential part of risk reduction in portfolio construction and maintenance. These days, it’s very risky owning a portfolio full of companies with high ESG risks. You don’t want to be left with companies that could have stranded assets or volatile share prices”, she says.

Stranded assets are not considered sustainable over the long term (for example coal-fired power stations, which may be legislated out of existence in a specified time period), so become “uninvestable”.

For all its benefits, ESG investing can be complex. “At Perennial, we spend a huge amount of time assessing and comparing sustainability performance across companies,” says O’Neill. “We also meet with boards through our stewardship focus to discuss ESG matters, and advocate for ESG improvements, where needed.”

O’Neill says the easiest way to implement responsible-investing principles is by investing through a dedicated sustainability fund. “If you prefer to invest directly in shares, the company’s sustainably report is a good a place to start for ESG information.”

O’Neill hopes the term “ESG analyst” becomes redundant this decade. “I’d like to think ESG investing will be of every analyst’s role, not a specialist job. You can’t make a thorough investment decision on a company without considering its ESG risks.”

Giri Tenneti, Senior Manager of Listed Company Services at ASX

ESG education

Giri Tenneti, Senior Manager of Listed Company Services at ASX, says Australia’s investment industry needs to raise awareness of ESG among retail investors.

“ESG trends are heading in the right direction, but almost one in four investors (23%) are still unaware of responsible investing, based on the ASX 2023 Australian Investor Report,” says Tenneti.

“As an industry, we need to ask: Why is that still the case and what can be done to raise awareness among retail investors of the features, benefits and risks of ESG investing? There needs to be more ESG tools and resources for retail investors.”

Education is key, says Tenneti. “ESG investing is fundamentally about reducing the amount of risk you have to take to achieve a return. A big education piece is needed on the value of ESG as a risk-management tool within retail portfolios.”

Greater focus on ESG investing among retail investors is timely, says Tenneti. “As the world decarbonises, the risks of owning companies that harm the planet are rising. So, too, are the risks of owning companies that produce negative outcomes for society or have poor governance. No investor should ignore these long-term ESG trends.”

Tenneti says ESG investing is not just something for investors in the market’s largest companies. Through the ASX Equity Research Scheme, ASX CEO Connect and ASX Small and Mid-Cap conference, Tenneti liaises with a wide range of ASX-listed companies.

“I see more small and mid-cap companies talking about ESG issues in their investor presentations and providing ESG data to the market,” she says. “ESG trends often start with the market’s largest companies and work their way down. Retail investors should expect to hear about ESG issues from a much wider range of companies in coming years, and have more ESG data to inform their investment decisions.”

Tenneti says ASX continues to provide ESG choices for retail investors. “There’s been strong growth in ESG funds listed on ASX, across asset classes. ASX also continues to be a platform for listed companies and other market participants to inform and educate retail investors about the long-term benefits of responsible investing.”

The report found people who invest in listed assets (on-exchange investors) were far more aware of responsible investing trends than those who invest in unlisted assets (off-exchange investors). Only 16% of on-exchange investors had never heard of responsible investing, compared to 36% for off-exchange investors.

DISCLAIMER

Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. Although ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”) has made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.