Alexandra Cain, Editor, Listed@ASX: What’s the state of tech IPOs globally and what trends are driving listings?

Sam Forman, Managing Director, Investment Banking, Canaccord Genuity Group: While I think there’s the potential to squeeze in a couple of IPOs over the next few weeks, we’re really looking at the pipeline for 2026 and we are fairly bullish about the appetite levels in the market. Globally, interest rates are starting to come down and growth assets are back in favour. We've seen some great issuance in the US market, with IPO volumes up 89% year-on-year in Q3, and this has been led by the tech sector. We expect Australia to follow, and we are hearing the fund managers are being flooded with pre-IPO opportunities.

Michael Skinner, Managing Director and CIO, Blackwattle Investment Partners: We're expecting a lot more listings in 2026. We’ve found the venture capital market, particularly in the US, has been extremely strong, and we expect that to flow through to our market. However, we're cognisant of identifying companies that have good, sustainable business models and we’re cautious on some of the valuations that might come to us upon listing.

Josh Kannourakis, Founding Principal, Co-Head of Emerging Companies and Technology Research, Barrenjoey: The outlook is very favourable for IPOs going into 2026. From a technology perspective, the valuation multiples relative to growth rates are ahead of the companies’ US comparables. Businesses are looking at listed tech businesses, such as Pro Medicus or Technology One, and asking how can they get those multiples. We're not saying everyone can get them, but these questions are filtering down into small caps. The businesses that are now hitting their free cash-flow, break-even point and are able to deliver top-line revenue growth, are the ones primed to come into the small-cap or even the mid-cap index. Currently, there's a scarcity of opportunity for people to invest in, and that scarcity factor is driving valuations higher. Hopefully that will drive more supply of great quality tech companies to the ASX.

Listed@ASX: How do you think the recent economic stability in Australia and globally is influencing the decisions of tech companies to go public?

Michael: At this point, we probably have one of the most stable political environments in the world: inflation is under control, our economy is strong, and so we think it's a great place to do business. If anything, we would implore governments to do more for technology innovation. There needs to be a greater focus on developing great businesses at the grassroots level, whether that be by offering research and development grants, tax concessions or something else.

"If anything, we would implore governments to do more for technology innovation."

Listed@ASX: How do Australian investors perceive tech IPOs?

Josh: The market in Australia is very index driven so companies’ relevance within a particular index impacts the breadth of potential investors and perception. In the mid and small-cap indices, where a lot of the new IPOs will be moving into, there is a scarcity of quality growth companies. When investors are looking for growth, they’re thinking about endurance – the ability of companies to sustain revenue growth rates for an extended period of time.

To understand this, they're looking at potential growth opportunities across geographies and products, so the more of those expansion opportunities a business has, the longer it can maintain that higher level of growth. There are many, very good niche players in Australian markets that demand high valuations, but the ones that will end up ahead of some of the US-related valuations, are those that have multiple product lines, multiple geographic exposure points and very good unit economics. The ability to grow globally is favoured by Australian investors, especially in the mid and small-cap world.

"The narrative from the investor side is that they’re happy to invest ahead of growth as they want access to particular issues."

Sam: Market depth in companies showing growth and quality earnings remains an issue and the market lost some high-quality assets in 2022 when Nearmap and ELMO were sold, and more recently the likes of Altium and Dropsuite. Therefore, investors are seeking new issuers and there is real demand for quality stocks as evidenced in recent IPO bookbuilds being swamped with bids. In secondaries, investors are pushing M&A agendas because they want to put more money behind great stories.

The narrative from the investor side is that they’re happy to invest ahead of growth as they want access to particular issues. There's been some big secondary blocks that have gone through this year that were very competitive and sold at very tight – if any – discount, because investors want access to these high-growth names.

Kate Galpin, Senior Manager, Listings, ASX: I’d like to expand on the idea of scarcity in the market, particularly regarding the tech stocks currently available. If you look at the returns of individual technology stocks, some have seen impressive gains, like Life360 and Codan, up over 100% in 2025. They are clearly benefiting from the upward push in multiples. However, feedback from investors indicates a desire to diversify their options, suggesting there is definitely room for new names in the sector.

As Sam mentioned, secondary offerings have taken advantage of the investor demand and companies like Xero, Goodman and NextDC have been able to capitalise on opportunities for significant capital raises for acquisitions or expansion. There is certainly potential for new capital to flow into emerging names as well, so it’s all about seizing the right opportunities at the right time.

Sam: And when it comes to opportunities in the market, I think the sectors likely to see the most IPO activity will reflect the adage that generally money follows money. For example, during COVID, a number of ecommerce businesses did really well with their IPOs. At the moment, Defence is in favour. Listed businesses that have any defence element are performing strongly but whether that will continue into 2026 I’m not sure. The AI infrastructure play continues to attract dollars.

Listed@ASX: What’s changing at ASX to facilitate the tech IPO pipeline?

Kate: ASX Listings worked closely with the broad equity capital markets ecosystem and ASIC to help facilitate ASIC’s announcement of the fast-track IPO trial, which accelerates the IPO process for eligible companies seeking to list on ASX. Any innovation that decreases friction between a company leaving its private status and listing is welcome. We’ve had a couple of examples so far, the first being GemLife, and the market has been supportive of the reduction in the ‘on-risk’ period and of truncating the process.

Listed@ASX: What are the key factors that tech companies should consider when preparing for an IPO?

"ASX listings worked closely with the broad equity capital markets ecosystem and ASIC to help facilitate ASIC’s announcement of the fast-track IPO trial."

Josh: Expectations management is a lot more difficult when you're a fast-growing company, and there's a very delicate balance between trying to peg yourself to a high future revenue or growth number and getting that associated high valuation upfront, versus actually putting a number in the market that you're confident you can achieve and beat. Investors want companies that have set expectations at a reasonable level that can be exceeded. Companies need to know that this is a journey, and the journey requires you to continue to compound trust with the market, to get those premium multiples, and you don't get it on day one. So under-promising and over-delivering is generally the message.

Sam: Fundamentally, it's about confidence in the value of long-term cash flows. It's about being able to articulate the size of the opportunity in terms of TAM, how this translates to the revenue opportunity in the future, and then the potential margins that can be achieved on this. At the moment, it feels like growth is the key factor, so investors are willing to look at growth rather than profitability (and there is lots of work on using efficiency scores – the rule of X – to drive valuation), but it's about maintaining that balance and then telling a good story.

Michael: You can present accounts and valuations in creative ways and if something's priced at 40 times earnings or 60 times earnings, we're wise enough to know, that we don’t know which one is correct. We always go back to: what is the business model? What is the size of the market opportunity? What makes the company special? What's the point of difference that we can understand, versus the market? So in technology, particularly when valuations are so disparate, we go back to business fundamentals more than other sectors.

Listed@ASX: How does listing on the ASX compare to listing on international markets?

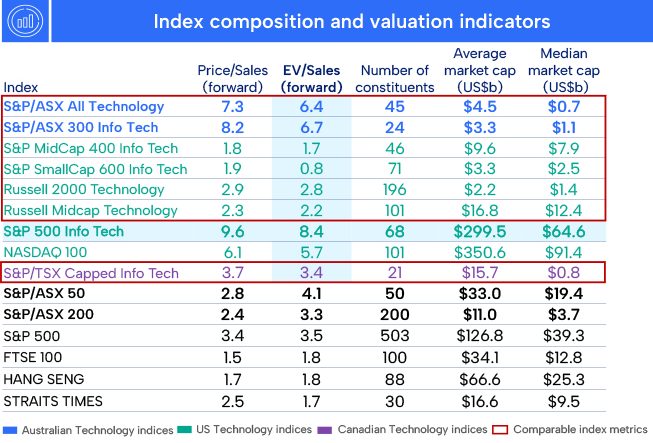

Sam: When looking at ASX versus other exchanges, Australian tech companies can get multiples of the support that you’d get from a company with a similar market cap in the US – the ASX provides high levels of demand fed by the superannuation system, high levels of liquidity, strong broker and research coverage and lower thresholds for index inclusion. In fact, when comparing the valuations for businesses with similar fundamentals in the rule of X, we see ASX valuing companies at around 30% higher than Nasdaq.

Kate: To build on that point regarding the comparison between the ASX and international markets, particularly the US exchanges, it’s important to note that size plays a significant role. In the venture capital and founder communities, there is a strong focus on Nasdaq, but this is where size becomes critical. For instance, to be included in the S&P 500, a company needs to have a market capitalisation of over US$22 billion, which is materially different from the requirements for the S&P/ASX 300 & 200 which are currently below US$1 billion. If a company falls within those parameters, the ASX is often the best option.

Additionally, index inclusion significantly impacts valuations. Investors tend to seek stocks that are part of these indices. We’re seeing tech valuations on our indices, particularly for companies valued between $1 billion and $5 billion, aligning closely with larger companies in the S&P 500. However, if a company is not included in the S&P 500 and instead falls into the mid-cap index, the valuation can drop dramatically. This is a crucial factor we discuss with businesses, emphasising the importance of size when making these considerations.

Valuation metrics compare favourably to other major exchanges

Source: Bloomberg, 30 September 2025

The equity centricity of the superannuation system is also an important differentiating factor. Australia’s pension system has the highest allocation to equities of all pension funds globally, and the total allocation to ASX-listed securities is 25%. To put this into perspective domestic equity allocations in both Canada and the UK are less than 5%. This capital is important in supporting listed businesses.

Listed@ASX: What should tech companies do to make themselves attractive to public markets?

Michael: First, I think ASX is an amazing place to list. It's one of the best markets in the world. However, companies need to understand why they’re listing. For me, there's three core reasons: access to capital, access to liquidity or the brand – or a combination of those three. I think you have to look at your business and ask whether it should list. Listing isn’t necessarily appropriate for all businesses. When it comes to technology, we’d want to see a clear competitive advantage that can deliver decades-long revenue growth and free cash flow at some point. There are some great examples – Xero, Pro Medicus, Wisetech – which have had double-digit growth for many years.

Listed@ASX: What advice would you give to tech founders considering an IPO in the near future?

"Companies need to understand why they’re listing. For me, there's three core reasons: access to capital, access to liquidity or the brand – or a combination of those three."

Sam: I guess it's the same with any transaction, preparation is key. Maintaining optionality is important, and so if there is disruption or volatility, the business can decide to delay until a later date or indeed accelerate things if the market is supportive. If trouble is lurking, it’s important not to leave decisions to the last minute, because that's when you lose your bargaining and positioning power. With regard to general preparation, you need to get some stability into your last two quarters and have your accounts and strategy prepared for scrutiny. Investor education is important, and you need to start that six to nine months out – with non-deal roadshows and early socialisation. Finally, you shouldn't view an IPO purely as an exit event for yourself and your shareholders, it is an opportunity to access deep pools of ongoing capital and continue on the business’ growth story.

Michael: It’s a good idea to run your company like you are a listed entity today, before you actually list. That may involve employing executives onboard who have experience on the ASX or a similar index. It’s very different being a public company versus private, and you need to embed those skill sets months, if not years, before you consider an IPO.

Kate: I agree it makes sense to act as a listed company before you list. This greatly assists in helping a company understand its metrics and how to prepare internally for the new levels of reporting. There’s also that key point of whether a company is mature enough and its revenues sustainable enough to list. So, acting as much as you can like a publicly listed company before you actually go public – so that everything and everyone is prepared – is really good practice.

Josh: Remember it's a journey, so being prepared for the journey and demonstrating execution ahead of time is always very helpful. Investors want to see a track record and clearly articulated strategy before the IPO, so having the governance frameworks in place early is important, as is having dedicated management and strong communication. At the end of the day, it's about demonstrating to investors what you're heading towards – your north star – and having the right partners, whether that is brokers or investors, who are supportive of that vision long-term.

Related links

Disclaimer

Independent advice from an Australian financial services licensee is needed before making financial decisions. This is not intended to be financial product advice. To the extent permitted by law, ASX Limited ABN 98 008 624 691 and its related bodies corporate excludes all liability for any loss or damage arising in any way including by way of negligence.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2025.