Operational performance of Cash Market Clearing and Settlement Services

| December 2025 Quarter | September 2025 Quarter | June 2025 quarter | |

|---|---|---|---|

| System availability (CHESS) | 100% | 100% | 100% |

| System availability (TAS) | 100% | 100% | 100% |

| Trade registration | |||

| Total trades accepted (ASX) | 161,733,267 | 157,461,081 | 136,195,804 |

| Total trades accepted (Cboe) | 49,597,941 | 48,878,696 | 41,649,024 |

| Total trades accepted (NSX) | 141 | 132 | 181 |

| Total trades accepted (SSX) [1] | 0 | 0 | N/A |

| Daily average trades across all AMOs | 3,302,052 | 3,126,362 | 2,915,492 |

| Highest daily trade registration across all AMOs | 4,147,217 | 4,222,572 | 5,642,893 |

| Highest consecutive 2 days trade registration across all AMOs | 7,834,518 | 7,847,447 | 9,668,072 |

| Clearing | |||

| Daily average traded value (on and off market) | $10.73 billion | $10.31 billion | $10.59 billion |

| Daily average cleared value* | $7.66 billion | $7.39 billion | $7.55 billion |

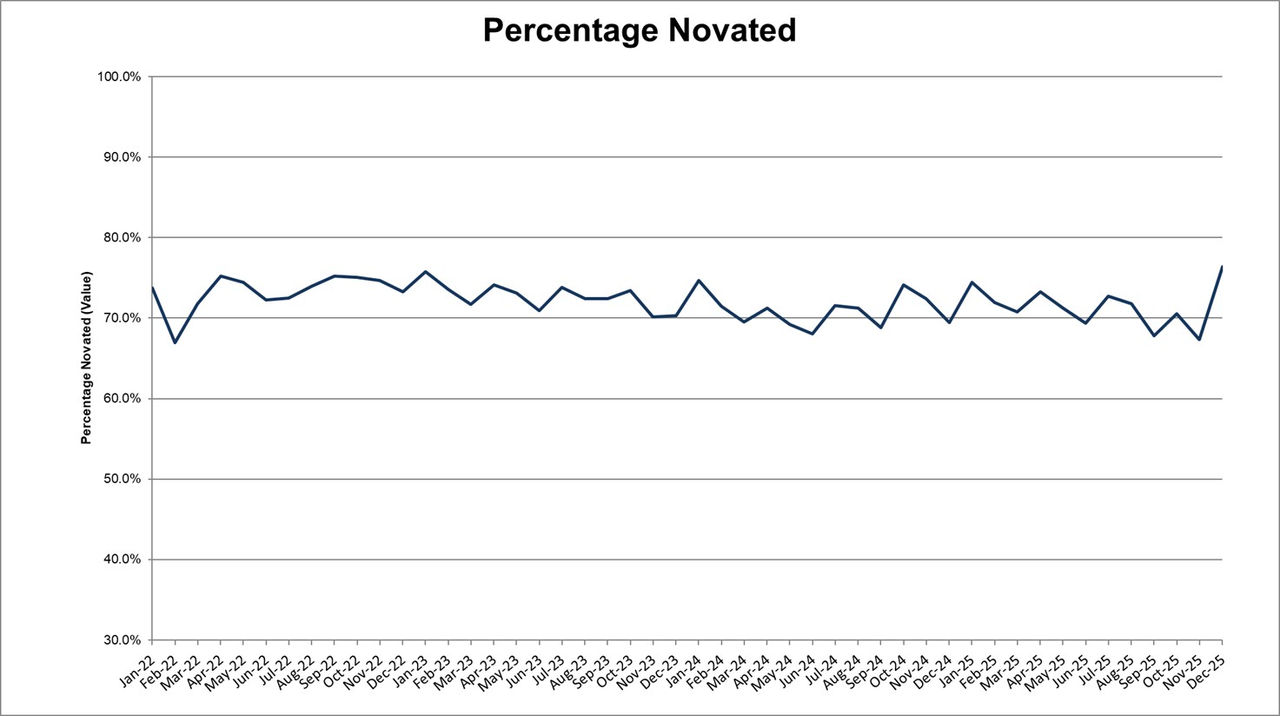

| Percentage novated* | 71.4% | 71.7% | 71.3% |

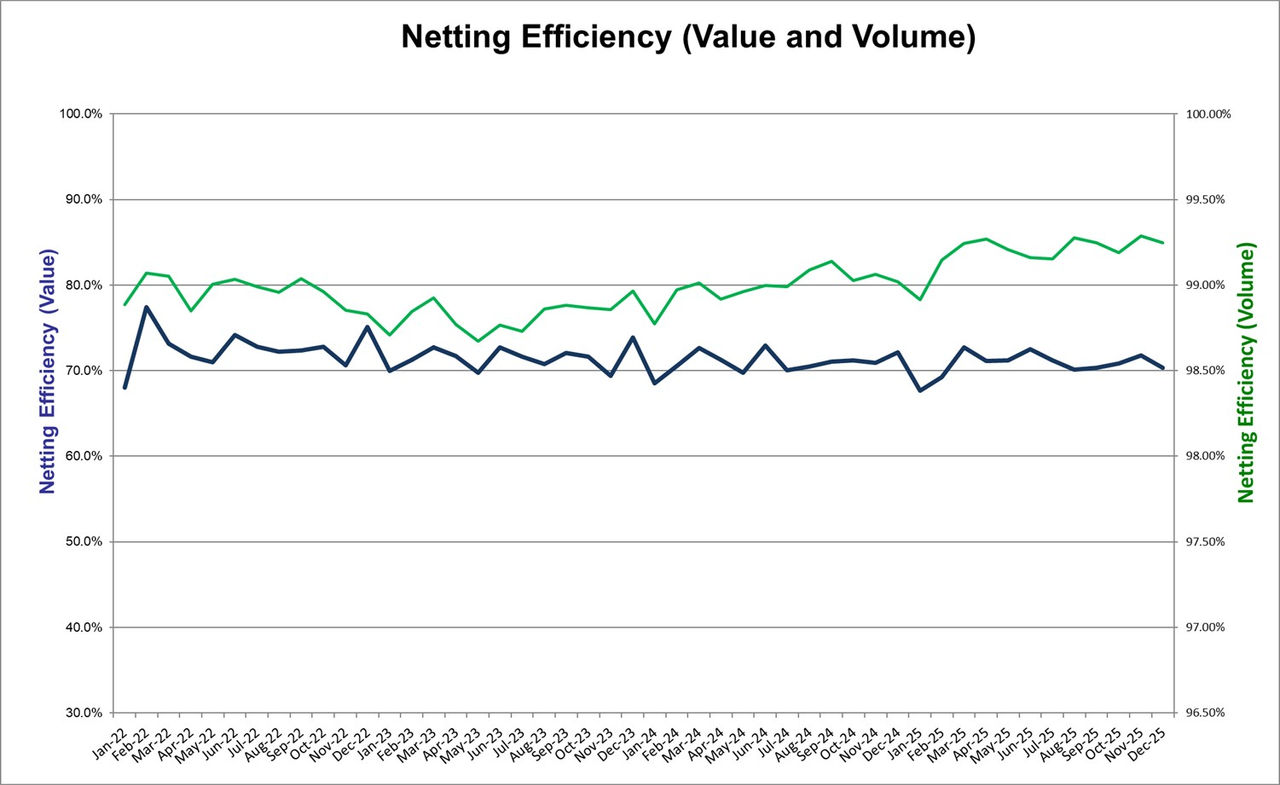

| Netting efficiency (value)* | 70.5% | 70.6% | 71.6% |

| Netting efficiency (volume)* | 99.2% | 99.2% | 99.2% |

| Daily average cleared value post-netting | $3.11 billion | $3.04 billion | $3.00 billion |

| Batch settlement | |||

| Daily average settled value (including non-novated) | $17.37 billion | $16.38 billion | $16.79 billion |

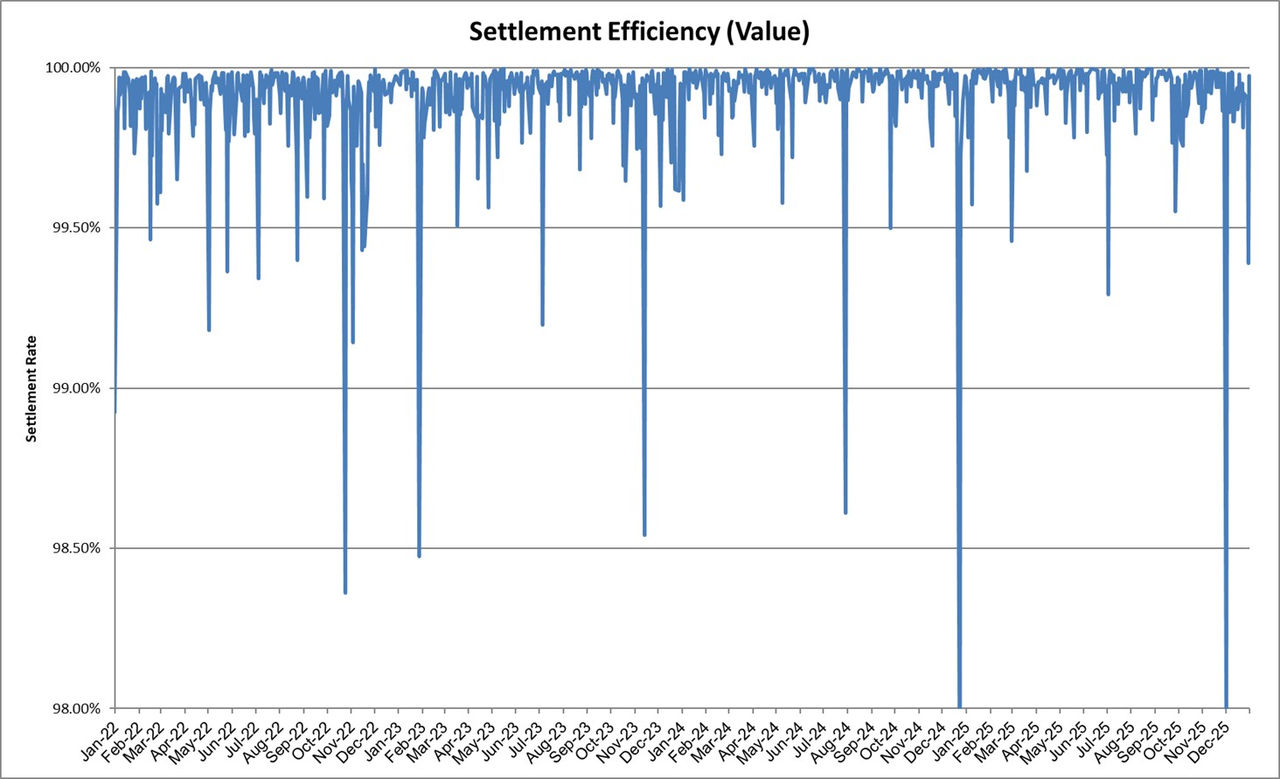

| Settlement efficiency (value) | 99.89% | 99.93% | 99.95% |

| Average daily CHESS fail rate (% rescheduled to the next settlement date) | 0.256% [2] | 0.137% | 0.118% |

| Average value based fail rate (% rescheduled to the next settlement date) | 0.111% | 0.064% | 0.044% |

As of March 2022 quarter, Traded Volume includes transactions (for all AMOs) with settlement status “I” (e.g. crossings, informational)

[1] Sydney Stock Exchange (SSX) joined TAS on 4 August 2025

[2] The higher fail rate was driven by a participant who experienced network outage on 1 December 2025, which prevented them from connecting to CHESS and resulted in a large volume of securities failing to be delivered to market.

* Data for the 20 December 2024 is not included in the calculations due to the cancellation of Batch Settlement and reschedule of all obligations.

As of March 2022 quarter, traded volume includes transactions (for all AMOs) with settlement status “I” (e.g. crossings, informational)