In a market awash with financial acronyms and metaphors, few indices get investor pulses racing like the ‘fear index’.

In the United States, market fear is measured by the CBOE Volatility (VIX) Index - one of the world’s most recognised and closely followed measures of volatility.

Back home, volatility is gauged by the S&P/ASX 200 VIX (A-VIX) Index, which is known as Australia’s market sentiment indicator.

Launched in March 2013, the A-VIX is used by investors, traders, financial media, economists and researchers for insights into investor sentiment and expected market volatility for Australian shares.

The VIX and A-VIX indices have similar methodology. The VIX Index in the US measures the implied 30-day volatility of the S&P 500 Index, which is derived from S&P 500 Index Options on the CBOE US Options Exchange.

The A-VIX in Australia measures the implied 30-day volatility of the S&P/ASX 200 Index, derived from the ASX 200 Index Options traded on ASX.

Investors who want more technical information on the A-VIX index and its methodology should read the S&P Global Factsheet on the index.

Although the A-VIX sounds complicated, volatility is simply a measure of the dispersion of stock prices or index values over time. The wider the spread or variance, the higher the volatility, and vice versa.

Measuring volatility requires looking forward. Investors can’t rely on historic volatility because markets price in the future. An ASX-listed company’s valuation, for example, typically factors in expectations of future growth.

In volatility terms, we need to know the trend of future volatility growth, which is where the ASX options market helps. Embedded in options pricing is the market’s expectation of future (implied) volatility.

However, looking at the implied volatility of only one options series on ASX, out of hundreds of options series, is an unreliable indicator of market volatility.

Instead, volatility indices, such as the A-VIX, extract the implied volatility from a series of index options to project the probable volatility for the entire Australian equities market (as measured by the S&P/ASX 200) over the next 30 days.

Interpreting the A-VIX

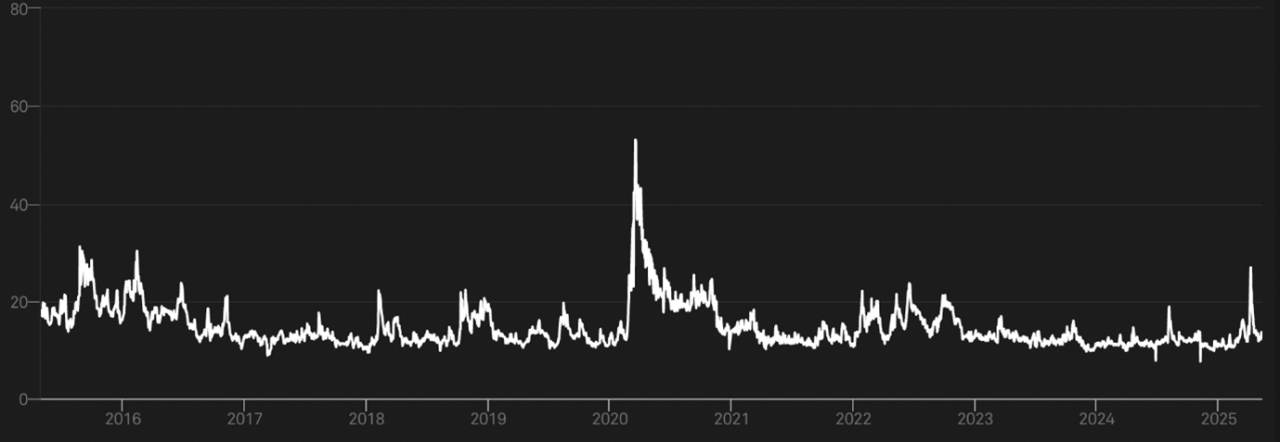

The chart below, from S&P Global, shows the A-VIX index over the past 10 years. Note how the index spiked during early 2020 when the COVID-19 pandemic erupted and after “Liberation Day” in April 2025 when the US imposed new tariffs.

Chart 1: S&P/ASX 200 A-VIX Index

Source: S&P Global

Both events created uncertainty for markets, which was reflected in heightened volatility and investor fear. The same was true of other periods of market turmoil, such as the 2007-09 Global Financial Crisis.

The A-VIX peaked at 55 during the early stages of the COVID-19 pandemic [1]. Expressed in percentage terms, an A-VIX reading of 55% implied the market expected the annualised standard deviation of returns for the S&P/ASX 200 to be 55% over the next 30 days, such was the uncertainty and volatility initially associated with COVID-19.

Following Liberation Day in the US in April 2025, the A-VIX peaked at 27, again reflecting market expectations of high volatility in the ASX 200 index over the next 30 days [2].

As a rough rule of thumb:

- An A-VIX reading between zero and 15 indicates low expected market volatility and is considered bullish.

- A reading of 15 to 20 is considered normal and suggests a slightly bullish bias for market sentiment.

- A reading from 20-30 is considered high and indicative of market sentiment turning negative.

- Any reading above 30 suggests the market is extremely uncertain about the next 30 days, as was seen during COVID-19 and the Global Financial Crisis.

Like any investment rule of thumb, there can be times when an indicator does not perform as expected. The A-VIX is no guarantee of future market volatility – it is a gauge of market expectations of volatility, which can sometimes be wrong. The risks of using the A-VIX are considered later in this article.

Using the A-VIX

Some investors use the A-VIX as a trading or investment signal. For example, if the A-VIX has an extended period of low volatility, a trader might conclude that the market has become too complacent or that investor sentiment is too bullish – and decide to take some profits on their holdings.

Another investor in this hypothetical example might decide that an extended period of high A-VIX readings could suggest market sentiment has become too bearish – and that is a good time to buy.

Conversely, a long-term investor might use the A-VIX as a signal on when to ‘hedge’ or protect their portfolio through index options.

For example, if the A-VIX is at the low end of its range, the investor might believe volatility could rise as the market turns more bearish. So, they consider using index put options to protect the value of their portfolio against a potential market downturn.

When the A-VIX is high, the investor might conclude that market volatility will fall as the market becomes less bearish in the future. They may decide to sell index put options to benefit from potential gains or sideways movement in the S&P/ASX 200 Index.

A-VIX readings can inform other types of options trading. When the A-VIX is high, option premiums for puts and calls tend to be higher. Options become more expensive when the market expects larger price swings and greater uncertainty.

By selling covered calls, traders might potentially benefit from higher premiums when expected market volatility is high. The main risks of covered call strategies include limited upside potential and downside risk if the underlying asset falls.

The ASX Options Knowledge Hub has information on the features, benefits and risks of options, which can be complex. Investors should seek independent advice from a professional adviser before using options.

Risks with A-VIX

The main risk with the A-VIX relates to interpretation. As a measure of expected market volatility, the A-VIX can be a useful sentiment indicator. It is not, however, a direct signal of when to buy and sell, or which way the market will move.

Moreover, a high A-VIX reading does not necessarily mean expected volatility will fall and that the market will rise in the future. Rather, it means the market expects large price moves (up or down) over the next 30 days.

The same is true of a low A-VIX reading. It does not automatically mean that volatility will rise and be accompanied by future market falls. As the earlier chart showed, the market can have long periods where the A-VIX trades in its normal range (15-20).

Also, the A-VIX measures near-term volatility (over 30 days). For long-term investors who think in terms of years, a 30-day sentiment gauge may provide less value – or increase the risk of over-reacting to short-term market noise.

A-VIX readings can also change dramatically in short periods based on unexpected news or geopolitical events.

The key is to view A-VIX readings as one of several data points that inform investment and trading decisions – rather than use them in isolation.

Conclusion

Returns and risk are fundamental to investing. Some investors consider future investment returns, but pay far less attention to future market risk. In doing so, they could miss the full “investment picture”.

By providing information on market expectations of future volatility for Australian shares, the A-VIX is an important gauge of market risk. The index, however, is not just about fear – used well, it can also be a source of a market opportunity.

-------------------

[1] Source Yahoo Finance. Based on monthly high of 55.81 for S&P/ASX 200 A-VIX Index during March 2020.

[2] Ibid. Based on monthly high 27 for S&P/ASX 200 A-VIX Index during April 2025.

DISCLAIMER

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.