For Australian investors, 2025 was shaping up to be another good year for global markets, with every major asset class returning positive absolute returns through to the end of October.

But November was marked by heightened volatility, showing how quickly strong trends can reverse as sentiment turns cautious and valuation concerns resurface.

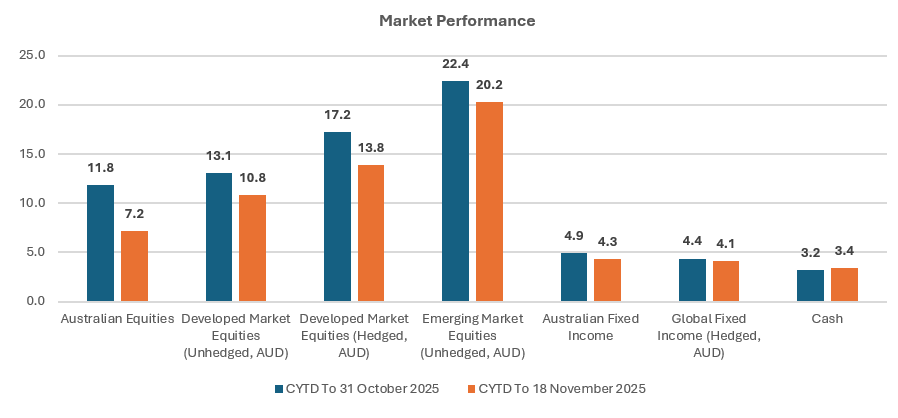

The chart below compares market performance across the major asset classes.

Benchmark returns at 31 October 2025

Source: Morningstar

Australian Equities = Morningstar Australia GR Index, Developed Market Equities (Unhedged, AUD) = Morningstar Developed Markets NR Index AUD, Developed Market Equities (Hedged, AUD) = Morningstar Developed Markets NR Index Hedged AUD, Emerging Markets (Unhedged, AUD) = Morningstar EM NR Index AUD, Australian Fixed Income = Morningstar Australia Core Bond Index AUD, Global Fixed Income = Morningstar Global Core Bond Index Hedged AUD, Cash = Morningstar AUD 1M Cash GR Index.

Australian equities, as measured by the Morningstar Australia Index, returned 11.8% to Friday 31 October, a solid outcome, although still behind global equities in hedged Australian dollar terms.

The appreciation of the Australian dollar (AUD) against developed-market currencies partially offset these returns, leading global equities in unhedged AUD terms to be slightly lower.

However, emerging markets have been the standout performer, with the Morningstar Emerging Markets Index rising 22.4% over the same period in unhedged AUD terms.

Fixed income

In Morningstar’s view, bond returns, while lower than equities, were good relative to their volatility, potentially providing stability for defensive investors.

As the chart above shows, fixed-income returns exceeded cash and the Australian September annual inflation rate of 3.2%, reinforcing their role for investors with a lower tolerance for risk and shorter time horizon.

The Reserve Bank of Australia delivered three interest-rate cuts in 2025. However, a recent increase in inflation has dampened expectations of further interest rate easing, possibly making an additional rate cut this year unlikely and leaving the 2026 outlook increasingly uncertain.

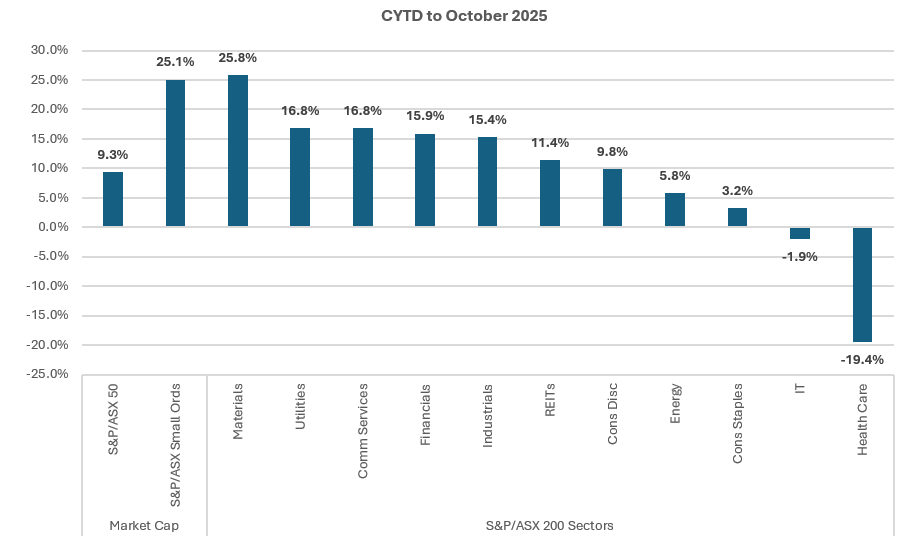

Benchmark returns at 31 October 2025

Source: Morningstar, S&P

From a market capitalisation (market cap) perspective, Australian large-cap stocks (S&P/ASX 50 Index) produced high single-digit returns to 31 October 2025, as the chart above shows.

Although this was a solid return in any year, it pales in comparison to the larger gains being made further down the market cap spectrum, with Australian small-cap stocks returning over 25% (S&P/ASX Small Ordinaries Index), through the same period (the second bar in the chart above).

From a sector perspective, most were positive over the year, with the exception of Information Technology and Health Care.

The performance of the Materials and Financials sector contributed significantly to the returns of the overall market due to their positive absolute returns and combined weight in the index.

The performance of large-cap stocks and health care was significantly impacted by one particular stock, CSL Limited (ASX:CSL), the third-largest stock (5.96%) in the Morningstar Australia Index at the beginning of the year, which dropped to seventh spot (3.45%) at end-October.

Three key market themes

To understand these divergences, it’s essential to examine the three themes that defined market behaviour this year: defence, gold, and the impact of tariffs on global healthcare companies.

Theme 1: Defence

Within defence, several Australian small-cap stocks benefited from the increase in global defence spending.

Austal (ASX:ASB), a ship builder, and Electro Optic Systems (ASX:EOS) were two of several ASX-listed defence stocks that rallied this year.

Theme 2: Gold

Gold emerged as a standout performer this year, rising from USD$2,641 an ounce to USD$4,067 by Tuesday 18 November, a 54% gain.

Growing concerns around inflation, potential weakness in the US dollar and investors seeking safe-haven assets pushed the price to all-time highs in October.

Gold has since retraced and has been trading sideways around USD$4,000. For the Australian stock market, which has a meaningful weight towards the materials sector, this saw significant price increases for large- and small-cap gold miners.

Large-cap miners such as Newmont Corporation (ASX:NEM) and Evolution Mining (ASX:EVN) rose more than doubled, while small-cap names such as Kingsgate Consolidated (ASX:KCN) and Pantoro Gold (ASX:PNR) tripled in value by mid-November.

So, while the surge in gold prices contributed positively to the overall market return, it benefited small-cap stock miners to a greater extent.

Theme 3: Health care

Lastly, the S&P/ASX 200 Health Care sector was down 19% over the year to October (see first chart above). and was a major detractor from the large-cap stock index.

As mentioned earlier, one of the largest companies in the index, CSL, was not immune to the market volatility triggered by new US tariffs on select pharmaceutical and biotech products, which heightened concerns about potential cost pressures across the global health care sector.

Conclusion

In Morningstar’s opinion, valuations across global equity markets remain elevated, signalling that future returns might potentially be more moderate than the strong returns seen over the last three years.

Morningstar’s Australian equity return forecast, for example, trades at a premium to long-term valuations, while dividend yields sit well below historical averages and below government bond yields. These indicators point to heightened market expectations for earnings growth, which might prove harder to achieve in this environment, leaving investors exposed to potential valuation risk.

In Morningstar’s view, fixed-income markets appear more fairly valued. Australian government bond yields have steepened modestly, and current levels might offer reasonable compensation for risk, particularly for defensive investors seeking stability.

With equity markets possibly trading at elevated levels, positioning portfolios for the best balance of risk and return is critical. Diversification remains fundamental.

However, with the Artificial Intelligence theme now permeating many asset classes outside of the US IT sector, investors should be cautious when relying simply on historical relationships of currencies or asset classes for diversification. A more nuanced approach may be required to navigate concentration risk.

Equally important is having a well-defined process that focuses on fundamentals rather than headlines, ensuring decisions are consistent and disciplined.

Paramount to this is an adequate time horizon to realise objectives. Markets can move sharply in the short term, but achieving long-term objectives requires patience and consistency. By combining diversification, valuation awareness, and a structured approach, investors may be able to better navigate market uncertainty through any environment.

From ASX

ASX Content On-Demand provides links to ASX podcasts and webcasts that cover a range of investment topics, featuring market experts.

DISCLAIMER

This article has been prepared by Morningstar Investment Management Australia Limited (ABN 54 071 808 501, AFS Licence No. 228986)

The information is general in nature and does not consider the financial situation of any individual. For more information, refer to our Financial Services Guide at morningstarinvestments.com.au/fsg. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.

About Morningstar Investment Management Australia Limited and Morningstar, Inc.

Morningstar Investment Management Australia Limited is a subsidiary of Morningstar, Inc., a leading provider of independent investment insights in North America, Europe, Australia, Asia, and Africa. Morningstar, Inc.’s investment advisory subsidiaries provide discretionary investment management and advisory services. Guided by our investment principles, Morningstar, Inc.’s investment advisory subsidiaries are committed to focusing on their mission to design portfolios that help investors reach their financial goals. Morningstar, Inc.’s global investment management team works as one to apply a disciplined investment process to its strategies and portfolios, bringing together core capabilities in asset allocation, investment selection, and portfolio construction. This robust process integrates proprietary research and leading investment techniques. As of Sept. 30, 2025, Morningstar, Inc.’s investment advisory subsidiaries were responsible for approximately US$369 billion* in assets under management and advisement across North America, Europe, Australia and Asia.

*Includes assets under management and advisement for Morningstar Investment Management LLC, Morningstar Investment Services LLC, Morningstar Investment Management Europe Ltd., Morningstar Investment Management Australia Ltd., Ibbotson Associates Japan, Inc., and Morningstar Investment Management South Africa (Pty) Ltd, all of which are subsidiaries of Morningstar, Inc. Advisory services listed are provided by one or more of these entities, which are authorised in the appropriate jurisdiction to provide such services.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.