Observed outcomes since the 3-Year Bond Futures Tick Change

1. Strengthened top of book liquidity

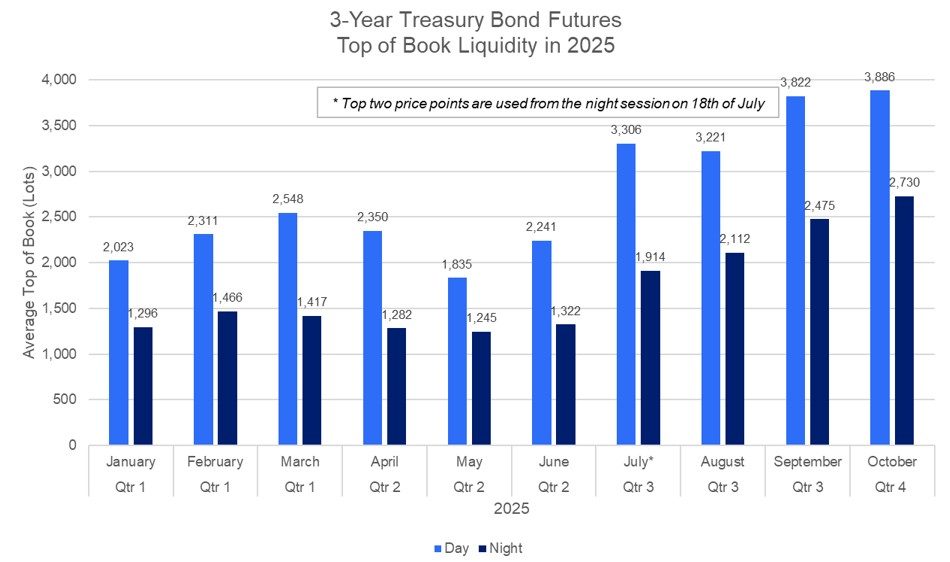

Since reinstating the 0.5bp tick size effective trade date 21 July 2025, the 3-Year Treasury Bond Futures contract has exhibited a steady uplift in top of book liquidity. Importantly, because the narrower tick distributes liquidity across a greater number of price points, post-change depth is assessed on a like-for-like basis by aggregating the top 2 levels (a 1bp equivalent band) from the night session when the change was first introduced.

Based on 2025 year-to-date observations, liquidity within this 1bp equivalent range has increased notably across both day and night trading sessions. Given the timing of the implementation, analysis of post-change behaviour is conducted from August onward, the first full month under the 0.5bp tick. In the day session, average liquidity was 2,200 lots in January to June and rose to 3,600 lots between August and October, resulting in a 64% uplift. Night session liquidity followed a similar pattern, strongly increasing by 85% over the same comparison period, with average top of book liquidity rising from 1,300 lots to 2,400 lots post-implementation. In comparison, the 10-Year Treasury Bond Futures contract, with no microstructure change applied, showed an uplift of approximately 45% in top of book liquidity over the same analysis period (January to June vs August to October), across both day and night sessions.

Source: ASX data

Source: ASX data

2. Improved order book depth

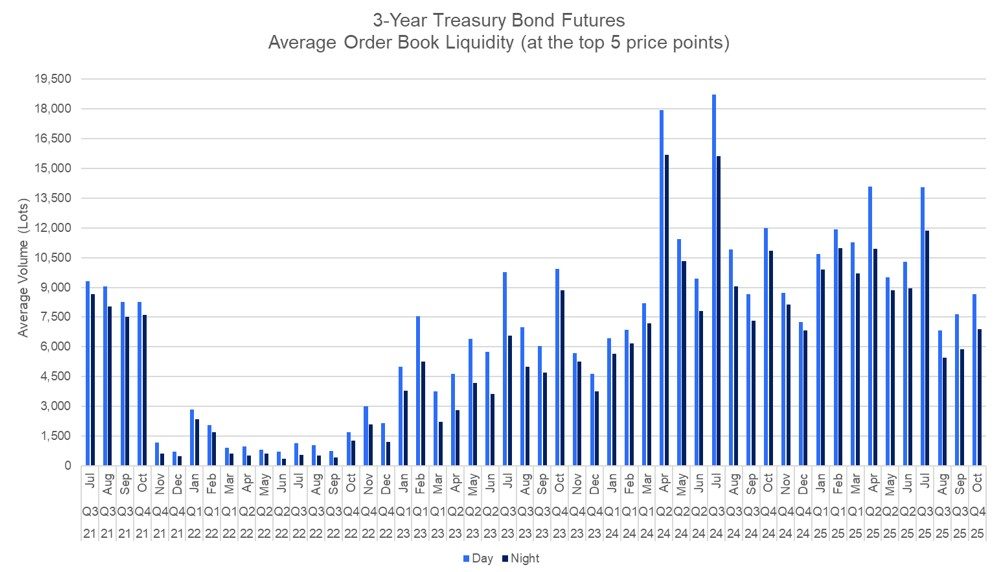

Following the tick size adjustment, order book depth at the top five price levels now represents a 2.5bp price range compared to the previous 5bp (under a 1bp tick increment) where order book depth has remained resilient and robust, despite the change. A comparison of the August to October periods in 2021 and 2025 – both operating under a 0.5bp tick size, has highlighted that day session order book depth at the top 5 price levels has remained broadly unchanged, holding at an average of 8,000 lots daily across the three months in both years. Night session depth shows only a modest decline, falling from approximately a monthly average of 7,700 lots to 6,100 lots during the same analysis period. This provides a useful benchmark for market conditions that remove the volatility associated with the RBA’s quantitative easing measures that came into effect November 2021.

Source: ASX data

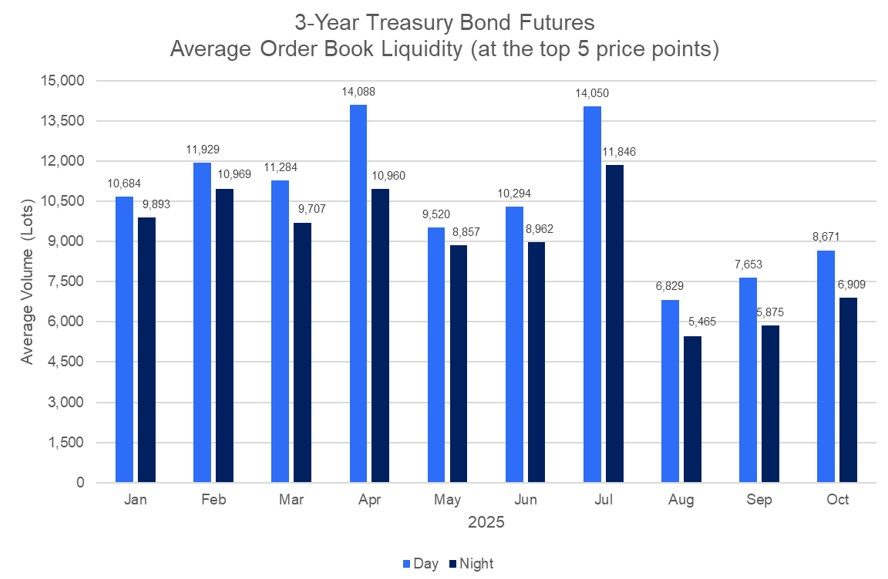

Additionally, from a year-to-date perspective, order book depth has continued to be comparatively strong. Prior to the tick size change, day session order book depth at the top five price points ranged between an average of 9,500 to 14,100 lots between January and June, with night session averages between 8,900 to 11,000 lots. Whilst the price range has halved after the tick size change, order book depth has remained relatively resilient at an average range of 6,800 to 8,700 lots during the day trading sessions. This is a positive outcome as the market has adapted to the updated tick increment and continues to be sufficiently liquid at multiple price points.

Source: ASX Data

Conclusion

In conclusion, setting the tick increment for the 3-Year Treasury Bond Futures contract has led to measurable improvements in liquidity and overall market quality. The sustained resilience of order book depth and the marked increase in top book volume highlight the effectiveness of this targeted adjustment. As market conditions continue to evolve, ongoing monitoring and engagement with participants will remain essential to maintaining effective contract settings and supporting a robust, efficient market.

Other insights

To receive regular insights via email, please subscribe to the ASX Rates Highlights quarterly newsletter.

Disclaimer

Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. Although ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”) has made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2025.