Technology remains one of the most powerful drivers of global markets, shaping economies, industries and portfolios.

The story of disruption is no longer just about breakthrough products or rising company valuations. It is now about the two largest economies taking very different paths to innovation.

In Global X’s opinion, the United States has leaned into a market-led cycle of large investment in technology infrastructure and rapid commercialisation.

In contrast, China has taken a state-directed approach that prioritises efficiency, scale and strategic autonomy.

For investors, the question, in Global X’s opinion, is not whether innovation will continue, but how to potentially capture the opportunities while managing the risks of two contrasting models in the US and China.

This article examines three themes:

- Artificial intelligence and semi-conductors

- Cloud and data centres

- Strategic technologies

Each shows how disruption is unfolding differently across the two countries and what this could mean for investors considering diversified exposure through Exchange Traded Funds (ETFs).

1. Artificial Intelligence and Semiconductors

The US has been the clear leader in artificial intelligence (AI) infrastructure, supported by its dominance in semiconductors and cloud hyperscalers.

Since the release of generative AI tools in 2022, capital expenditure by US technology giants has accelerated, with semiconductor revenue forecasts upgraded by analysts, according to Global X analysis.

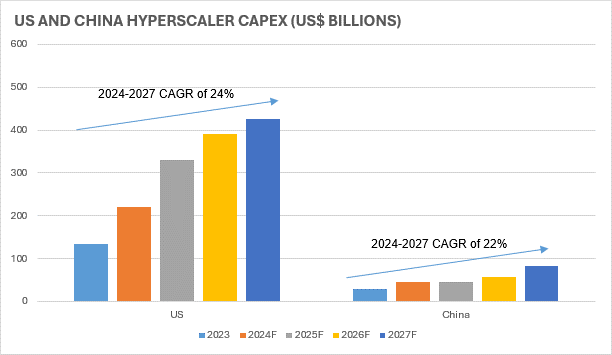

Chip designers and hardware enablers remain central to this cycle, driven by the rapid build-out of data-intensive AI systems. According to Global X, US investment in this area is expected to outpace China in absolute terms, even as both expand at strong growth rates.

This investment in technology has lifted US sharemarkets, but it also raises questions about risks. Valuations of leading US tech companies are already above long-run averages and rely on expectations of sustained earnings growth. Investors appear comfortable for now, although history shows that market sentiment can shift once capital expenditure cycles begin to slow.

China, by contrast, is focused on building a local AI supply chain. Restrictions on access to advanced US chips have accelerated its push for self-sufficiency.

Chinese champions such as Huawei and Cambricon are expanding production, while Chinese memory makers are developing high-bandwidth solutions to support domestic workloads. The emphasis has shifted from competing on raw performance to building cost-effective, scalable systems that can be deployed widely across industries.

For investors, in Global X’s opinion, the contrast is clear. The US offers access to frontier innovation, but with volatility linked to company valuations and technology-adoption cycles; while China presents a more efficiency-driven pathway, supported by state policy and industrial adoption, though risks remain around hardware bottlenecks and the impact of trade restrictions.

US = Amazon, Microsoft, Alphabet, Meta and Oracle. China = Tencent, Alibaba, Baidu, Bytedance, Source: Global X data, Global X ETFs as of 6 Aug 2025

2. Cloud, Data Centres and Digital Infrastructure

AI adoption depends on the infrastructure that supports it. In the United States, investment has already surpassed earlier expectations, with cloud and data centre spending forming the backbone of the AI boom.

Forecasts for 2025 capital expenditure on digital infrastructure have been revised higher, showing how critical this build-out has become to maintaining US leadership in AI development.

The strength of this investment cycle also highlights the risks. Infrastructure spending has historically been cyclical, and any slowdown could weigh on companies that benefit from exposure to digital infrastructure investment.

The shift from infrastructure-led growth to application-led monetisation of online platforms remains another uncertainty for US markets.

China’s approach again looks different. Its cloud providers and internet platforms are deploying AI capabilities at scale, with emphasis on consumer super-apps and industrial uses.

China already hosts the world’s largest 5G network and one of the biggest data centre industries, supported by relatively low energy costs.

Although overall spending on digital infrastructure in China remains below US levels, growth is faster, with AI accounting for an increasing share of Chinese investment, according to Global X analysis.

According to Global X, for investors, cloud and data centres show the dual nature of disruption. In the US, the opportunity is linked to dominance and global leadership in infrastructure.

In China, the potential lies in rapid mass adoption and the ecosystem reach of technology there, although with greater uncertainty around profitability and regulatory oversight.

3. Strategic Technologies: Defence, Quantum and Beyond

While AI and cloud dominate headlines, both the US and China are also directing resources into technologies that could shape the next decade.

In the US, defence and aerospace are central areas of innovation. Military budgets are funding autonomous systems, AI-enabled surveillance, space infrastructure and cybersecurity.

Much of this spending flows into the private sector, creating opportunities for advanced technology suppliers. Defence, however, remains politically sensitive and cyclical, with revenues tied to procurement cycles and shifting priorities.

China’s approach is broader and more state-directed. Through military-civil fusion, innovation is being embedded into both commercial and security applications. Industrial policy is designed not only to support research but also to drive commercial rollout across multiple sectors.

Quantum computing highlights the parallel pursuit of frontier innovation. The US continues to lead in research, often through university and private sector partnerships.

China is investing heavily to close the gap, using state-backed programs to push development. Commercialisation is still distant, yet both see it as a strategic priority that could reshape the balance of technological power.

For investors, China’s policy-led agenda offers scale and breadth, but carries risks tied to execution, subsidies and geopolitics.

In Global X’s opinion, the US model provides access to frontier breakthroughs, though outcomes depend on shifting defence budgets and uncertain timelines for technologies such as quantum.

Balancing Opportunities and Risks

For investors, the divergence between US and Chinese technology represents both challenge and opportunity.

The US remains the centre of frontier innovation, supported by semiconductors, fast-growing infrastructure and online platform leadership.

China is developing a parallel model focused on self-sufficiency, efficiency and scale, with adoption spreading quickly across its consumer and industrial base.

Neither pathway is without risk. The US must sustain high company valuations and demonstrate that infrastructure spending translates into productivity gains.

China must overcome hardware bottlenecks, manage geopolitical pressures and balance the economic trade-offs of rapid deployment of new technologies.

ETFs

Exchange Traded Funds may provide one way to navigate this complexity. They offer access to diversified baskets of global companies exposed to long-term themes such as AI, cloud, semiconductors and defence, while avoiding the need to pick individual winners.

ETFs also give investors flexibility to balance exposures across the US and China, recognising that innovation is likely to continue in both markets, even if through different routes.

Conclusion

The race for technology leadership between the US and China is not a zero-sum contest. Both nations are committing significant resources to AI and related technologies, shaped by their contrasting economic models.

According to Global X, for investors, the opportunity lies in understanding these differences and positioning portfolios to potentially benefit from both.

As with all innovation, patience and balance are essential. These technology themes may take years to unfold, but the impact on portfolios and the global economy is already under way.

DISCLAIMER

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778) and Global X is solely responsible for its issue. This document may not be reproduced, distributed, or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments, or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all or any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. All fees and costs are inclusive of GST and net of any applicable input tax credits and reduced input tax credits, and are shown without any other adjustment in relation to any tax deduction available to Global X. Past performance is not a reliable indicator of future performance.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.