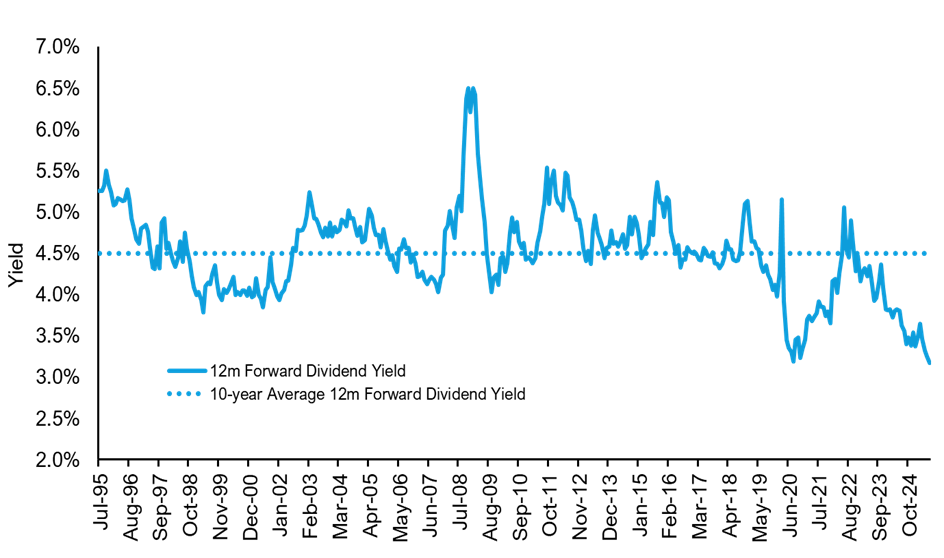

If forward expectations are anything to go by, dividend yields in the year ahead are expected to hit a 30-year low based on the consensus view of markets, as shown by the chart below.

While this low dividend yield could seem alarming to investors, Ausbil believes there may be reasons for a more constructive outlook for equity income investors.

Forward dividend yield for the S&P/ASX 300 is at a 30-year low

Source: Bloomberg, Ausbil as at 31 July 2025.

This reporting season, in Ausbil's view, FY25 saw dividends still at weak levels relative to history but doing better than the market expected.

FY25 dividends exceeded consensus expectations three times as often as they disappointed, found Ausbil analysis.

Highlights included special dividends from a number of consumer-facing companies, including JB Hi-Fi (ASX:JBH), Super Retail Group (ASX:SUL), ARB Corporation (ASX:ARB), Nine Entertainment Co (ASX:NEC), Qantas (ASX:QAN) and Helia Group (ASX:HLI).

Although dividend expectations for the year ahead were upgraded at around the same frequency as they were downgraded, according to consensus analyst forecasts, this was better than the outcome for revenue and earnings, which both had a downgrade bias.

Earnings growth for FY26 was downgraded by 1% by consensus (to under 5%), but in Ausbil’s view, an improving macro environment could support better earnings growth than expected by the consensus view.

Low expectations reflect dividend risks

The market currently has low expectations for dividends, based on consensus forecasts, because of limited prospects for dividend growth from banks and resources, which pay the majority of the dividends in the Australian market.

However, in Ausbil’s opinion, consensus expectations are underestimating potential dividend outcomes. Ausbil sees two major things at play that they believe can see dividends exceed market expectations in the year ahead.

First, Ausbil believes the market is underestimating the potential for the economy to rebound in Australia and the US following the US tariff shock of April 2025. Consequently, Ausbil thinks the consensus view underestimates earnings growth, and dividends as a function of that, in Australia.

Second, businesses have been hedging their balance sheets against the unknowns of interest rates, inflation and tariffs, and so have announced lower dividends on average than past years. The good news for investors is that Ausbil believes that the low in dividends is nearing a turning point, albeit a slow one.

The consensus view has been bearish on the US, global and Australian economies, contrary to Ausbil’s view that economic growth will improve.

Impact of lower rates

On monetary policy, Ausbil expects more rate cuts from global central banks this year, including the US and Australia, further adding support for our outlook for improving economic growth, which may also increase the relative attractiveness of dividend income strategies to other sources of income like term deposits and annuities. Ausbil remains positioned accordingly and has been judiciously ignoring the noise for the data.

This brings us back to the growth outlook for dividends in FY26 and where equity investors could potentially find income.

The market’s lower outlook for dividends is a challenge for dividend investors looking for extra income, but it is potentially an opportunity for active dividend income strategies that seek to maximise yield through dividend harvesting and optimised franking credits, especially as we may have to look beyond the traditional dividend payers in banks and resources for dividends that are growing.

Conclusion

Earnings and dividends have declined for a number of years, but Ausbil believes that they could start to climb again in 2026.

For FY26, Ausbil anticipates that health care, financial services, consumer discretionary and some select industrials sectors may provide better dividends.

Ausbil expects resource dividends to fall over the year ahead, however it anticipates them to be higher than the current market consensus forecast.

DISCLAIMER

This material is issued by Ausbil Investment Management Limited ABN 26 076 316 473, AFSL 229722 (Ausbil) as at 12 September 2025 and is subject to change. The material is not intended to provide you with financial product advice. It does not take into consideration the investment objectives, financial situation or needs of any person. For this reason, you should, before acting on this material, obtain professional advice from a licensed financial adviser and read the relevant Product Disclosure Statement which is available at www.ausbil.com.au and the target market determination which is available at www. ausbil.com.au/invest-with- us/design-and-distribution-obligations. This material contains general information only and is intended for viewing only by investment professionals and their representatives. It must not be distributed to retail clients in Australia (as that term is defined in the Corporations Act 2001 (Cth)) or to the general public. This document may not be reproduced in any form or distributed to any person without the prior written consent of Ausbil. Past performance is not a reliable indicator of future performance. Any reference to past performance is for illustrative purposes only and should not be relied upon on. Ausbil, its officers, directors and affiliates do not guarantee the performance of, a particular rate of return for, the repayment of capital of, the payment of distribution or income of, or any particular taxation consequences for investing with or in any Ausbil product or strategy. The performance of any strategy or product depends on the performance of the underlying investment which may rise or fall and can result in both capital gains and loss. Any references to particular securities or sectors are for illustrative purposes only. It is not a recommendation in relation to any named securities or sectors. The material may contain forward looking statements which are not based solely on historical facts but are based on our view or expectations about future events and results. Where we use words such as but are not limited to ‘anticipate’, ‘expect’, ‘project’, ‘estimate’, ‘likely’, ‘intend’, ‘could’, ‘target’, ‘plan’, we are making a forecast or denote a forward- looking statement. These statements are held at the date of the material and are subject to change. Forecast results may differ materially from results or returns ultimately achieved. The views expressed are the personal opinion of the author, subject to change (without notice) and do not necessarily reflect the views of Ausbil. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market. The actual results may differ materially from those expressed or implied in the material. Ausbil gives no representation or warranty (express or implied) as to the completeness or reliability of any forward-looking statements. Such forward looking statements should not be considered as advice or a recommendation and has such should not be relied upon. To the extent permitted by law, no liability is accepted by Ausbil, its officers or directors or any affiliates of Ausbil for any loss or damage as a result of any reliance on this information. While efforts have been made to ensure the information is correct, no warranty of accuracy or reliability is given, and no responsibility is accepted for errors or omissions. Any opinions expressed are those of Ausbil as of the date noted on the material and are subject to change without notice. Figures, charts, opinions, and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data and make no promise of future investment returns. This material may include data and information (including research, quotes, commentary) from a third party. While we believe that the data and information to be reliable at the time of the material, we make no representations or warranties as to its accuracy or completeness. All trademarks, logos and brand names are the property of their respective owners. The use of the trademarks, logos and brands does not imply endorsement.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.