In December 2024, the Australian Prudential Regulation Authority (APRA) announced that, following extensive industry consultation, it will phase out the use of Additional Tier 1 (AT1) capital instruments (hybrid bonds) by 2032.

According to APRA, by replacing AT1 with forms of capital that are more reliable in a stress situation, Australia’s banks will be even better equipped to respond to a future crisis.

For investors, this should mean an even more resilient banking system and potential opportunities to redeploy returned hybrid capital to other ASX-listed income-focussed investments.

ARPA’s change, however, means the end of the bank hybrid market over the next seven years – and a change to fixed-income investing in Australia and the ASX-listed hybrid market.

Retail investors who have used hybrids for potential yield enhancement and franking credit benefits may need to consider other income securities between now and 2032 as the bank hybrid markets gradually winds down.

NAB Private Wealth estimates that retail investors currently hold 20-30% of all ASX-listed hybrids of the $43.2 billion ASX-listed hybrid market, at 30 April 2025.

In an article, NAB Private Wealth said: “For investors, this transition means losing access to credit instruments that typically yield 2-2.25% above the bank bill swap rate, along with valuable franking credits. This double impact on income returns represents a significant change for those who have relied on bank hybrids as part of their income strategy.”

Geoff Wilson AO, Chairman, Chief Investment Officer and founder of Wilson Asset Management, states that “WAM expects that a lot of capital in bank hybrids will have to move to other income products as bank hybrids expire each year. Nearly $5 billion of bank hybrids expire this year and another $5 billion or so expire next year.”

Understanding hybrids

Hybrid is a generic term used to describe securities that combine elements of debt securities (bonds) with equity securities (shares).

Like a bond, hybrids typically promise to pay a rate of return (fixed or floating) until a certain date. Like a share, hybrids have equity-like risks, including:

- Reduced certainty from the timing and income generated from hybrids

- The potential for hybrids to be converted into equity or early repayment at a time that does not suit the holder

- The hybrid holder ranking behind other creditors in the event of an insolvency.

Hybrids are generally more complex in nature and have potentially higher risks than other forms of investments.

In spite of these risks, hybrids have appealed to income-focused investors over the past decade. Hybrids usually offer a higher yield than traditional bonds, with the higher rate reflecting the higher risk profile of hybrids.

Hybrids can also be used for portfolio diversification and to potentially receive an income stream for a pre-determined period.

The ASX website has information on the features, benefits and risks of hybrids, and is a good place to start for investors who want to learn more about these securities.

ASX hybrid market

At 30 April, 53 ASX-listed hybrids had a combined market capitalisation of $43.2 billion, according to the ASX Hybrids Monthly Update (April 2025).

The ASX Hybrids Monthly Update provides detailed information on all ASX-listed hybrids and is a useful information source for hybrid holders.

The report includes the maturity date, coupon rate, trading volume, yield and price returns for all ASX-listed hybrids. Investors can use the report to see which hybrids are expiring and when.

As the ASX report shows, Australia’s big four banks and other financial institutions account for a significant part of the ASX-listed hybrid market. The Commonwealth Bank of Australia (ASX: CBA), for example, had five ASX-listed hybrids worth a combined $8.2 billion at 30 April 2025, according to the ASX Hybrids Monthly Update (April 2025).

Some investment banks, smaller banks, insurers, wealth management firms and Listed Investment Companies also issue hybrids, but they tend to be much smaller than big-bank hybrids. APRA’s change only affects bank hybrids.

Betashares considers that it is unlikely that banks would issue new hybrids when their existing hybrids mature. Betashares said the big-four banks in particular should still meet their capital requirements, and may issue more Tier 2 capital (but not Tier 1) as hybrid roll-offs occur [1].

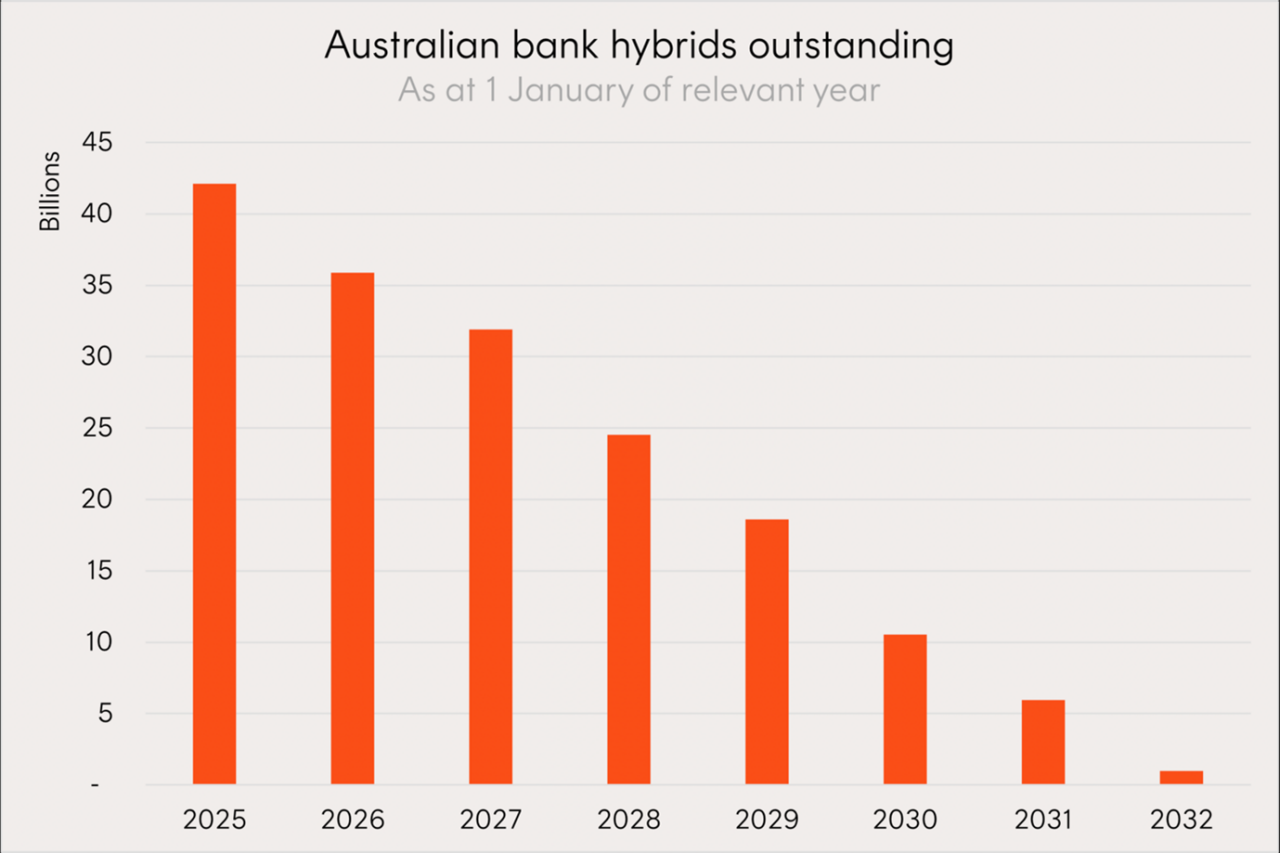

As a result, Betashares estimated nearly $42 billion of capital from bank hybrids will be returned to investors between now and 2032.

The chart below, from Betashares, shows the expected phase down in the bank hybrid market over the next eight years.

Source: Betashares. As of March 2025

If banks choose to issue more Tier 2 Capital to replace expiring hybrids, the structure of their capital base will shift towards instruments that rank higher in the capital structure.

While Tier 2 Capital typically offers lower yields than AT1 hybrids and typically does not carry franking credits, this debt may be seen as lower risk by some investors due to its seniority in a wind-up scenario.

This change could potentially attract different types of fixed-income investors who prefer more traditional debt instruments available on ASX.

Conclusion

Investors who currently hold bank hybrids should consider seeking advice from an independent, licensed financial adviser on the potential impact of the phasing out of the bank hybrid market by 2032.

As mentioned earlier, hybrids are more complex by nature and the gradual reduction in the size of ASX-listed bank hybrids over the next seven years could potentially affect the liquidity and pricing of some expiring hybrids.

For hybrid holders, the key is understanding which bank hybrids expire each year; having a strategy in place to monitor those hybrids; and identifying other potential investments if hybrid capital returned needs to be reinvested.

Some hybrid holders may choose to exit before expiry. Others might exit upon maturity and some investors might hold bank hybrids for several more years (depending on expiry), to potentially achieve enhanced yield along the way.

-------------------------

[1] Betashares Insights: 5 options for investors as the bank hybrid era winds down - 19 March 2025

DISCLAIMER

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.