Whether it’s uncertainty about how sharemarkets work, concern about not having enough money, or fear of losing it all - investment inertia is real. And it may be holding many people back from building wealth over the long term. Most of these roadblocks could be easier to overcome than people think.

Over the years, I’ve seen thousands of people take their first steps into investing. And I’ve also seen what holds many of them back. Some concerns come up again and again, from feeling unsure about what to buy, to worrying about market timing, volatility or tax.

Here are some of the most common reasons I’ve seen why people delay investing - and what has helped them build the confidence to get started.

1. “Investing is too complicated”

This is one of the most common concerns. Markets can seem overwhelming, full of jargon and charts, and many people assume they need a finance degree to understand how it all works.

But at its core, investing is about owning a share in a business or group of businesses. When those businesses grow and make profits, investors could potentially benefit. Over time, reinvesting those profits can compound and help grow wealth.

The basics haven’t changed in decades: start with your investment goals, diversify your investments, keep your costs low, and hold for the long term. You don’t need to know everything about the market to get started. In fact, trying to follow the news every day or predict short-term moves often does more harm than good. A simple strategy, stuck to consistently, tends to beat complexity.

2. “I don’t have enough money to invest”

A common myth is that investing is only for people with lots of money. That might have been true 20 years ago when brokerage fees were high and minimum trade sizes were large, but it’s no longer the case.

These days, you don’t need to be wealthy to get started. One of the biggest advantages younger investors have isn’t money - it’s time. The earlier you start, the more time you give compounding to work in your favour. Once you’ve built up a rainy-day fund (Stockspot suggests three to six months of living expenses) even small, regular investments may grow into something meaningful.

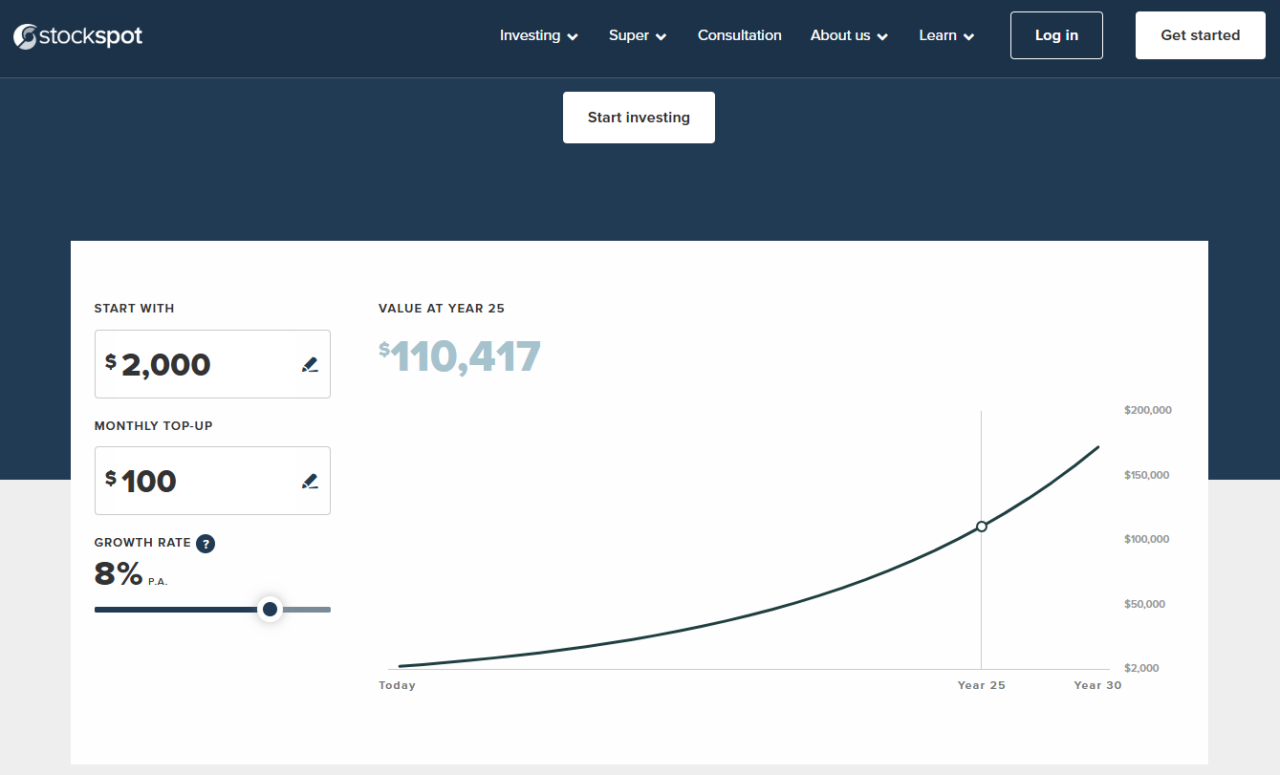

Even modest contributions can add up as shown by Stockspot’s investment calculator which factors in compound growth. For example, an investor starting with $2,000 and investing just $100 a month could grow to more than $110,000 in 25 years, assuming an 8% annual return [1], as the calculation below shows. That’s compounding doing the heavy lifting - where your returns start earning their own returns.

It’s also why more parents I speak to are investing on behalf of their kids. Putting aside a small amount each month may quietly build a nest egg to help with university, a car or a first home. In Stockspot’s opinion, it’s one of the smartest financial gifts you can give.

Source: Stockspot investment calculator

3. “I don’t know what to invest in”

Another major hurdle is not knowing what to buy. With thousands of shares and Exchange Traded Funds (ETFs) to choose from, the fear of picking the wrong one can cause people to give up before they begin.

Rather than trying to pick winners, one approach that has become increasingly popular is investing through diversified index funds or ETFs. These funds are intended to spread your money across many companies, industries and countries, making it easier to avoid costly mistakes from lack of experience or emotion-driven decisions.

Like all investments, ETFs have risks. If a market index fell sharply, an ETF that tracks that index would be expected to fall by a similar amount. Investing in Exchange Traded Products on the ASX website outlines the features, benefits and risks of ETFs.

In Stockspot’s opinion, not only is using ETFs a simpler strategy than buying shares directly, but the results also speak for themselves. Research from S&P’s SPIVA Scorecard consistently shows that low-cost indexing (using ETFs) works over time, without needing to choose individual companies or time the market.

This type of diversification helps reduce risk, as you’re not relying on the fortunes of just one or two businesses. Over time, the collective growth of a broad market index has historically delivered reliable returns for patient investors [2].

4. “Markets feel risky right now”

This is a very real concern - especially with recent market volatility. What’s important to know is that market dips are not unusual. In fact, history shows that a 10% to 20% decline happens nearly every year. Despite this, Australian shares have delivered average returns of 10.9% per year since 1926 [3]- that’s a strong long-term track record that has rewarded those who stay the course.

Trying to time the perfect exit and re-entry is near impossible. Instead, long-term investing success tends to come from staying invested and riding out the rough patches. Having a clear investment plan and sticking to it during periods of volatility could potentially make all the difference.

5. “I’m worried about tax and paperwork”

Tax can be another common concern, especially for those investing in ETFs. While ETFs are known for being cost-effective and tax-efficient, there are a few details that can trip up first-time investors.

For instance, ETFs can distribute capital gains even if you haven’t sold anything. Australian share ETFs may also pass on franking credits, which need to be included in your return to benefit from them. And many Australian ETFs are structured as Attribution Managed Investment Trusts (AMITs), which can lead to annual cost base adjustments that affect future capital gains.

These moving parts can seem complex, but they’re not a reason to avoid investing. Most investing platforms now consolidate all of this into a single tax statement at the end of the financial year. That report typically includes everything combined: income, franking credits, capital gains, cost base adjustments, and any reinvested distributions - making it far easier to complete your return.

Tax may seem daunting at first, but with the right tools, the process has become much simpler and more accessible for everyday investors.

[Investors should consider seeking independent advice from their accountant or financial adviser on taxation matters that relate to their investments.]

The bottom line

Getting started with investing doesn’t have to be difficult, expensive or risky. The hardest part is often overcoming the initial hesitation. Once you take that first step - even with a small amount, the rest tends to fall into place.

In Stockspot’s opinion, successful investing is less about finding the perfect time or the perfect investment, and more about building good habits. Stay diversified, invest regularly, keep costs low, and don’t let short-term noise distract you from long-term goals.

In a world of increasing financial complexity, a simple, consistent investment strategy can be one of the most effective paths to building wealth.

-----------------------

[1] Assumes an 8% p.a. average annual return over 25 years. This is a hypothetical example and does not account for fees, taxes or market fluctuations.

[2] Source: ASX Long-Term Investing Report.

[3] Source: ASX Long-Term Investing Report.

DISCLAIMER

Stockspot Pty Ltd ABN 87 163 214 319 is a licensed Australian Financial Services provider (AFSL 536082) regulated by ASIC. Any advice contained in this article is general advice only and has been prepared without considering your objectives, financial situation or needs. Before making any investment decision we recommend that you consider whether it is appropriate for your situation and seek appropriate taxation and legal advice. Investing into financial products involves risk. Past performance of financial products are no assurance of future performance. Please read our Financial Services Guide on stockspot.com.au before deciding whether to obtain financial services from us.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.