“No one ever went broke from taking a profit” is an old investment saying, even though it does not consider the capital gains tax (CGT) obligations that selling may create.

For some investors, using options to hedge (protect) some of their exposure through to the 12-month timeframe before disposal, may be a consideration.

Understanding hedging

If investors are concerned with the future performance of a stock, they can hedge their exposure by buying a security with inversely correlated returns. This means if the value of the stock goes down, all other things being equal, their ‘hedge’ should go up.

Investors can potentially achieve this by using futures or warrants with the objective of directly offsetting a loss on a stock.

Alternatively, investors can buy a Put option to lock in a future price for the sale of the stock. Buying a Put has the added benefit of being at the buyer’s discretion, so if the stock remains above the agreed price, the Put will expire worthless with the stock holding remaining unimpacted.

An alternative approach

Each of these strategies, however, has its own pitfall. Futures or warrants will typically provide a like-for-like hedge entirely offsetting any upside (in the stock), so while you’re hedged to the downside, you’re also not going to see any upside should the stock unexpectedly rally.

With a bought Put, you keep the upside, but the cost of buying the Put can be significant over time, and depends on how volatile the stock is. This makes the strategy potentially cost-prohibitive in practice.

What if there was a way to use options to obtain the protection of a bought Put without the cost?

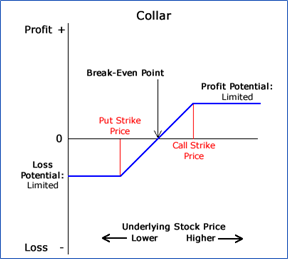

As with any option position, there’s always a trade-off. In this case, the trade-off comes from funding the purchase of the Put by selling an out-of-the money Call option - effectively foregoing any upside beyond the strike price.

Source: AUSEIX

Hypothetical example

- Let’s consider below hypothetical example as at 6 June 2025: Current share price: $179.90

- The investor holds 1,000 shares initially bought in November 2024 @$150.00.

Options Trades

- Buy 10 18th December 2025 Put Strike: $168.00 American (100 shares per contract) @ $5.31.

- Sell 10 18th December 2025 Call Strike $190.01 European (100 Shares per contract) @$5.61

In this example, the investor has purchased a Put for $5.31, offsetting any share price fall beyond $168.00.

The purchase of the Put is funded by selling a Call for $5.61, where the investor agrees to deliver the stock if called upon at the strike price of $190.01.

By writing the Call, the investor limits their potential gain in the shares as they will not receive any benefit beyond the $190.01.

The above example allows the investor to hedge any fall of greater than 6.6% ([168-179.90]/179.90 = -6.6%), at zero cost*.

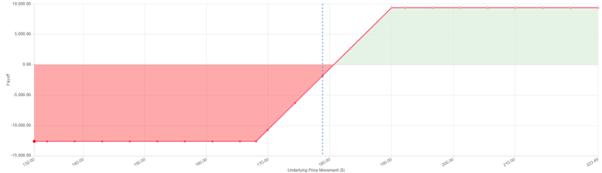

However, the investor will give away any further upside beyond 5.6% ([190.01-179.9]/179.9=5.6%), yielding the below pay-off diagram with three possible outcomes when the options expire on 18th December.

Source: AUSIEX

Three Possible Outcomes

1. The shares are< $168.00

Should the price of the shares close below $168.00 per share on 18th December, the sold $190.01 Call would expire worthless, while the bought $168.00 Put would expire in the money and be exercised, allowing the investor to sell their shares at $168.00.

2. The shares are between $168.00-$190.01

Should the price of the shares close between $168.00-$190.01 per share on 18th December, both the $168.00 Put and $190.01 Call will expire worthless with the investor retaining their shares.

3. The shares are > $190.01

Should the price of the shares close above $190.01 per share on 18th December, the sold $190.01 Call would expire in the money with the investor assigned and required to deliver their shares at the strike price of $190.01.

The bought $168.00 Put in this scenario would expire worthless. In each case, the investor has been able to minimise their exposure to the downside while holding the shares through to 12 months, to be entitled to the 12 month CGT discount (where applicable).

Risks and other considerations

1. Downside hedge versus forgone upside

As outlined above, when employing options strategies over a portfolio, it’s essential for an investor to understand the risk and trade-offs involved and ensure they are comfortable with them.

When employing a “costless” protective collar for example, it’s important to consider how much of the shares value you are looking to hedge, versus what you would be willing to deliver the stock for if it performs strongly.

If you are looking to keep outlay to a minimum (all else held constant), the higher the strike price for your Puts (the more conservative your approach) the more expensive they will be to purchase.

This means your Calls will need to have a lower strike to offset the more costly Put hedge. The lower your Call strike price the more upside you potentially forgo should the stock outperform.

2. Franking

To be entitled to franking credits, the holding period rule requires investors to continuously hold shares ‘at risk’ for at least 45 days (90 days for certain preference shares) not counting the day of acquisition or disposal.

For a position to be considered ‘at risk’, you must hold 30% or more of the financial risk. i.e. the delta of the strategy you employ cannot be less than -0.7.

For more information on the tax treatment, you should always engage your accountant or qualified financial adviser.

3. Writing European versus American

It’s worthwhile considering whether to use American or European style options when employing a Collar, particularly on your sold Call.

American options can be exercised at any time up until expiry while European options can only be exercised at expiry.

As it‘s the buyer who has the right to exercise an American style option early, as the seller of the Call (when employing a Collar), we need to consider the likelihood of the counterparty exercising the Call before expiry.

This will completely change the strategy and payoff diagram, akin to that of a bought Put and may impact 12 month ownership period required for any CGT discount. The example above uses a Sold European Call in order to mitigate this risk.

Conclusion

Options, often misunderstood, are simply a tool that when implemented effectively, can allow investors to better trade in line with their views.

In this example, a “costless” collar strategy can be deployed when the investor doesn’t wish to sell the stock immediately, but is nervous about potential downside risks. They want to hedge some of this risk in exchange for giving away some of the upside should the stock price improve during the life of the option.

----------------------

* Please note, the above examples exclude transactions costs, such as brokerage and clearing fees.

DISCLAIMER

This information contains general advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider its appropriateness, having regard to your objectives, financial situation and needs. Investors should read the relevant disclosure document and seek professional advice before making any decision based on this information. This information has been prepared by

Australian Investment Exchange Limited (“AUSIEX”) ABN 71 076 515 930 AFSL 241400 is a wholly owned subsidiary of Nomura Research Institute, Ltd. (“NRI”). AUSIEX is a Market Participant of ASX Limited and Cboe Australia Pty Ltd, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited. Share Trading is a service provided by AUSIEX.

AUSIEX believes the information contained in this article is reliable, however its accuracy, reliability or completeness is not guaranteed and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the Competition and Consumer Act 2010 and the Corporations Act, AUSIEX disclaim all liability to any person relying on the information contained in this article in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. Persons relying on this information should obtain professional advice relevant to their particular circumstances, needs and investment objectives.

Any opinions or forecasts reflect the judgment and assumptions of AUSIEX and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this article are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this article is prohibited without obtaining prior written permission from AUSIEX.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.