Many investors would be familiar with the ‘Magnificent Seven mega-cap tech stocks’, such as Amazon and Apple, and for good reason.

Since ChatGPT debuted in November 2022, the Magnificent Seven technology giants have driven over half of the S&P 500’s more than 70% surge [1], with artificial intelligence (AI) emerging as a central force shaping market trends.

From its potential to enable long-term productivity gains, to becoming a geopolitical bargaining chip among the world’s economic powerhouses, the market’s fervour for AI has risen this year.

However, in Betashares’ view, the investment opportunity set for AI is now broader than the Magnificent Seven. Many other tech firms could be affected as AI technologies proliferate, and data-centre capacity grows.

That said, the original seven are not going away. Collectively, they account for almost 35% of the S&P 500 [2] and, in Betashares’ view, remain critical to the build-out of AI infrastructure. This includes the physical data centres that house components from accelerator chips, memory chips and networking devices, to power, cooling and security systems.

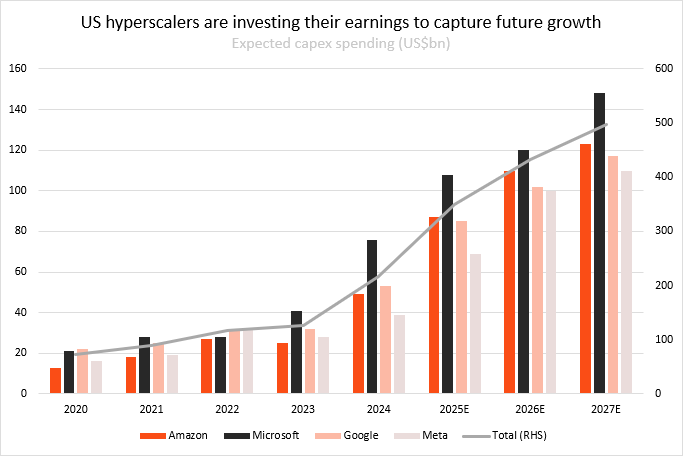

This year alone, these companies are expected to spend more than US$340 billion in capital expenditure [3] , (see chart below) - a scale that’s already influencing US economic growth and supporting the broader semiconductor supply chain.

Source: Company data, Goldman Sachs Global Investment Research. As at 1 August 2025. Historical and projected capital investments for US cloud and hyperscale providers (post 2Q25).

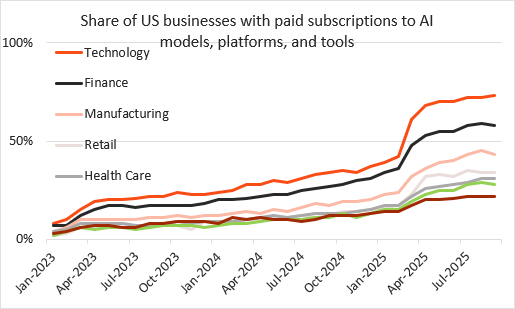

The next chart shows the growth in company expenditure for AI tools, across industry.

Source: Ramp AI Index, business spend data from Ramp. Data as at September 2025.

All roads lead to Asia

The immense amount of data centre spending from the likes of Amazon, Microsoft, Google and Meta is, in Betashares’ view, providing tailwinds for companies across the semiconductor supply chain, particularly in Asia.

A large part of this spend involves purchasing leading-edge accelerator chips designed by the likes of Nvidia and AMD but manufactured by a company called Taiwan Semiconductor Manufacturing (TSMC).

This model of outsourcing chip manufacturing to a specialised ‘foundry’ has allowed TSMC to become one of the world’s most valuable semiconductor companies, by market capitalisation [4].

The company recently reported a 30% increase in third-quarter sales and generates more than half its net revenue (51%) from high-performance computing (HPC), an area that has become increasingly profitable for TSMC’s bottom line [5].

Beyond manufacturing, memory is another critical component found within an accelerator chip that helps AI applications process huge amounts of data in a seamless way.

The key takeaway is that there are businesses across the supply chain, particularly in Asia, that are potentially leveraged to the billions of dollars being spent on critical AI infrastructure build-out.

Harnessing AI in cybersecurity and robotics

Beyond Asian technology companies, AI is reshaping the cybersecurity industry, particularly as geopolitical tensions continue to simmer and national self-sufficiency needs rise.

While AI has the potential to unlock major productivity benefits, it is also being exploited by adversaries that often target critical network systems and infrastructure.

Against this backdrop, governments, businesses and individuals are all becoming more proactive in protecting their data. Global cybersecurity spending is expected to see sustained growth of double-digit rates reaching US$377 billion by 2028, according to International Data Corporation.

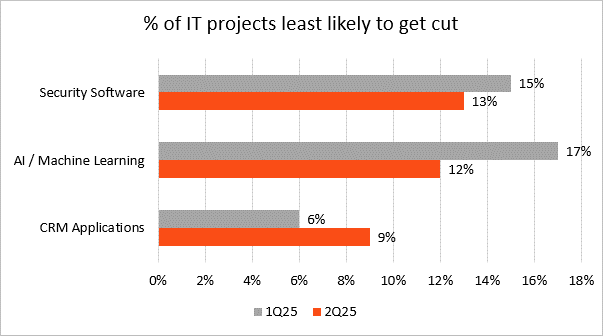

This large amount is potentially more defensible in nature, with Chief Information Officers surveyed by Morgan Stanley viewing cybersecurity as the category least likely to get cut in an economic downturn [6].

Source: Morgan Stanley 2Q25 CIO Survey. Percentage of total responses.

This spending backdrop has driven new product offerings from offshore cybersecurity firms, including Palo Alto Networks and CrowdStrike, which are developing AI agents that work alongside humans to automate complex security tasks like malware analysis and cyberattack interception.

Robotics is another adjacent industry that AI is rapidly changing. For some time, the development of robots struggled to kick off due to high manufacturing costs, a lack of demand, and nascent software development tailored for robotics.

However, as AI technologies have advanced rapidly and supply chains become vertically integrated, robotics has, in Betashares’ opinion, become a key theme in 2025.

While still in its infancy, Betashares sees robotics becoming a bigger and more recognised investment exposure over time as developed market economies seek automation as a critical solution to counter structural macro issues including labour shortages and falling population growth rates.

Conclusion

Investing in AI has become much broader than the Magnificent Seven companies. While they continue to lead the market in scale and innovation, there is a growing cohort of companies and sectors, including cybersecurity and robotics, that are already potentially benefitting from the diffusion and advancement of AI technologies.

Of course, there are investment risks. AI has driven equity markets to record high valuations, and concerns around the sustainability of data-centre spending remain front of mind for investors.

However, in Betashares’ view, AI could be a potential long-term investment opportunity, spearheaded by some of the most innovative and cash flow-generative companies in the world.

From ASX

The S&P/ASX All Technology Index features Australia’s leading and emerging technology companies, in AI and other technologies.

---------------------

[1] Bloomberg. As at 28 September 2025.

[2] S&P 500 Fact Sheet (USD). Source: S&P Global.

[3] Company data, Goldman Sachs Global Investment Research. As at 1 August 2025. Historical and projected capital investments for US cloud and hyperscale providers (post 2Q25).

[4] At 20 October 2025. TSMC’s market capitalisation was US$1.53 trillion at 20 October 2025. Source: Yahoo Finance.

[5] https://pr.tsmc.com/english/news/3264

[6] Morgan Stanley 2Q25 CIO Survey, Percentage of total responses.

DISCLAIMER

Betashares Capital Limited (ABN 78 139 566 868 AFSL 341181) is the issuer of this article. This article contains general information only and does not take into account any person’s objectives, financial situation or needs. Investors should consider the appropriateness of the information taking into account such factors and seek financial advice.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.