Capstone Copper operates as a copper mining company in the US, Chile and Mexico. It primarily explores for copper, silver, zinc and other metals.

In February 2024, Capstone Copper dual listed on the ASX from TSX. In April, private equity firm Orion Resources undertook a successful A$593m selldown of CDIs on the ASX, being 8.3% of the company. As at the end of December, Capstone had ~A$1.6b of its market capitalisation quoted on the ASX and in September it qualified to enter the S&P/ASX300 benchmark index.

Listing on ASX provided Capstone Copper with the ability to:

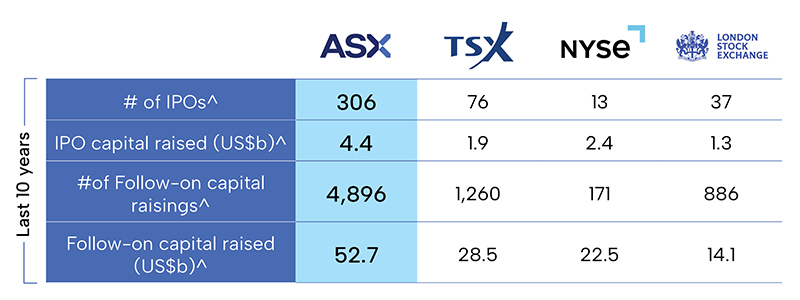

- access a deep pool of Australian based investors, capital and liquidity with a long track record of providing support to resource companies

- assist key shareholder to selldown their position

- enter the recognized S&P/ASX300 index at an earlier stage to drive enhanced liquidity, valuation and analyst coverage.

Index inclusion milestones:

- September 2024 – S&P/ASX 300