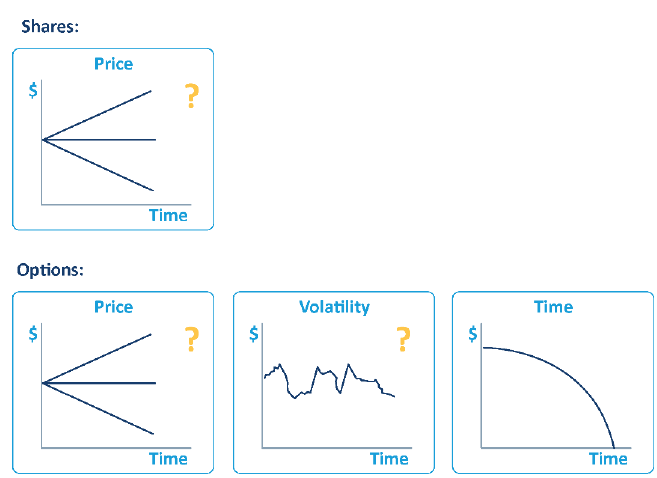

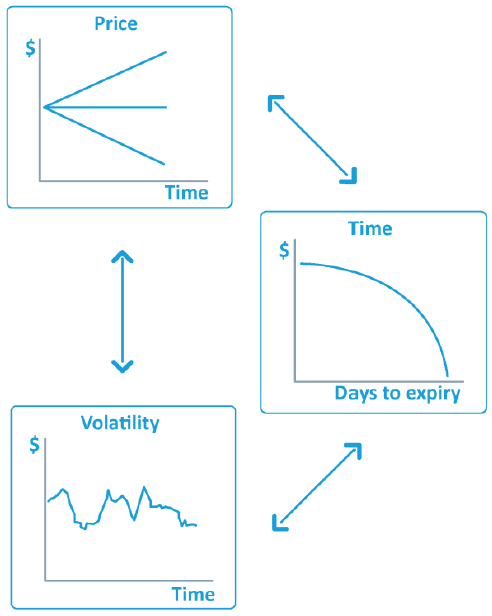

When trading options, you need to take into account:

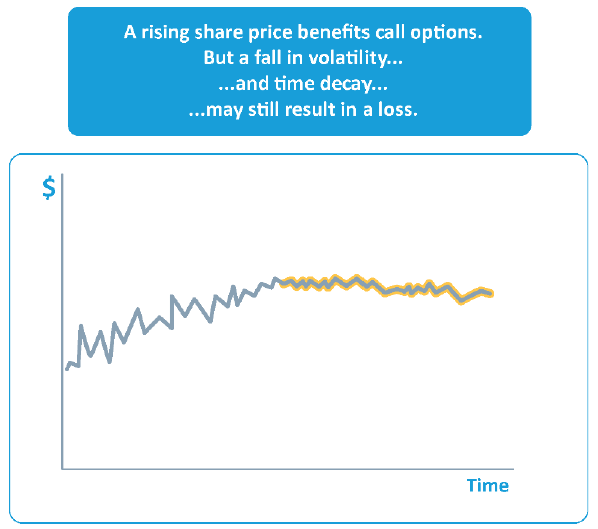

- price (the direction the share price will move in)

- volatility (the extent of price fluctuations), and

- time (when will it happen?).

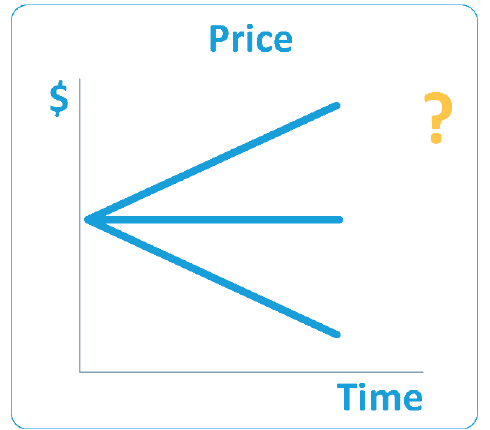

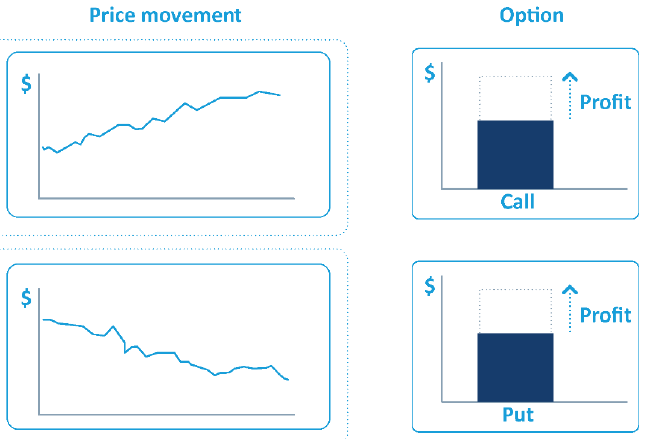

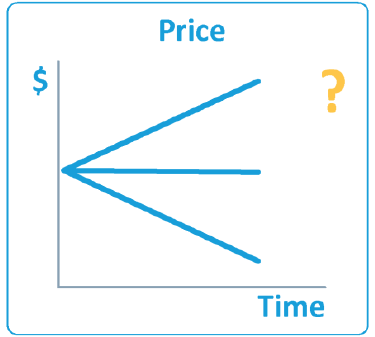

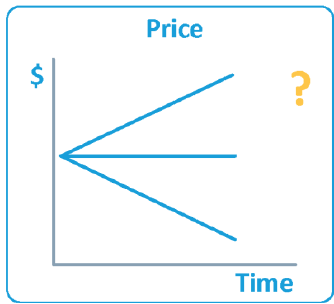

Share price movements are the most important influence on option prices. Do you think the share price will:

- rise

- fall, or

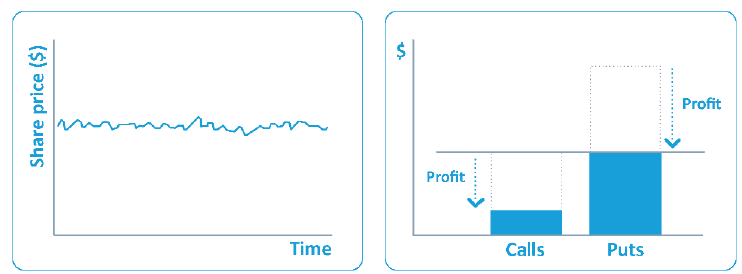

- remain steady?

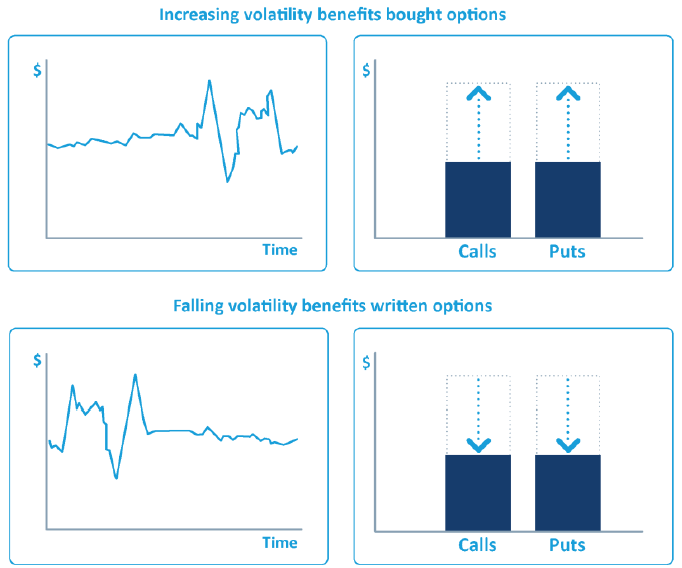

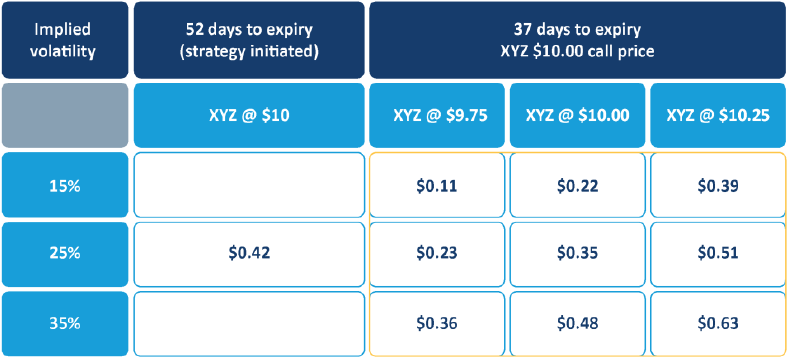

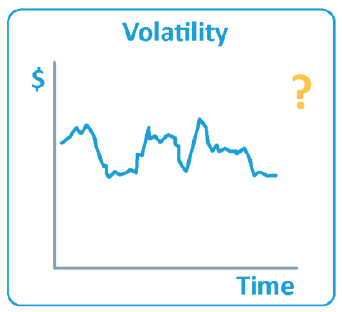

Changes in volatility can have a significant impact on the success of your option strategy. Do you think volatility is likely to increase or decrease?

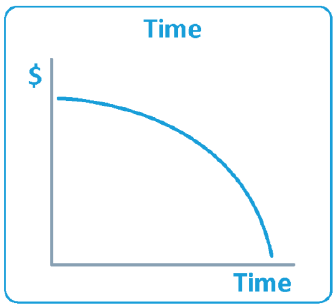

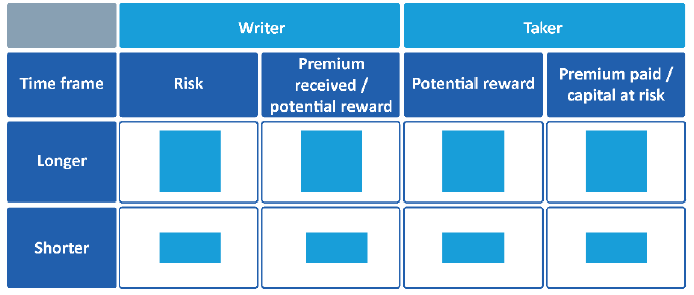

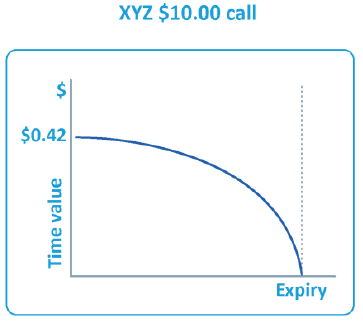

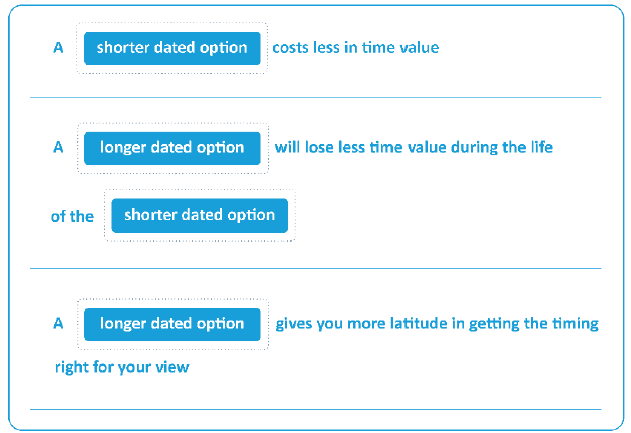

Your timeframe is important. The timeframe of your expected share price movement will guide your choice of expiry month.

Time decay works against you when you buy an option, and in your favour when you write an option.

You should now have an understanding of the factors to take into account when deciding on an option strategy.

It's important also to have a sound knowledge of the strategies available.

Option strategies can be constructed to reflect any market or volatility outlook. Strategies range from a bought or written call or put, to positions comprising multiple option and stock 'legs'.

Before considering complex strategies, you should become familiar with the basic strategies. Four common strategies are covered in other ASX online options modules.