Brokerage

Brokerage (commission) is typically charged as a percentage of premium traded, with a specified minimum. The contract value (exercise value) does not affect the brokerage charged.

Rates vary widely.

Advisory brokers typically charge between 1 and 2% of premium, with a minimum of around $100.

Execution-only brokers tend to offer lower rates as there is no advice given with their service. Rates for orders placed on the internet are typically around 0.4 - 0.6% of premium, with a minimum of $35.00 - $55.00. Charges for placing orders by phone are usually higher.

If you are a 'high volume' trader, your broker may offer discounted brokerage rates.

Before committing to a broker, ask for information on their rates.

Margins

Brokers may require you to pay a margin over and above the ASX Clear margin requirements. You can read this brochure to learn more about margins (PDF 137 KB).

Opening an account

Once you decide on a broker, there are a few steps to take before you can trade:

- You will need to sign an Options Client Agreement with your broker - even if you already use them to trade shares.

- Your broker will give you access to the ASX booklet Understanding Options Trading (PDF 724KB) which you must read before signing the client agreement.

- If you intend to lodge shares as cover for written positions, you will need to sign a Collateral Agreement giving permission to lodge the shares as collateral with ASX Clear.

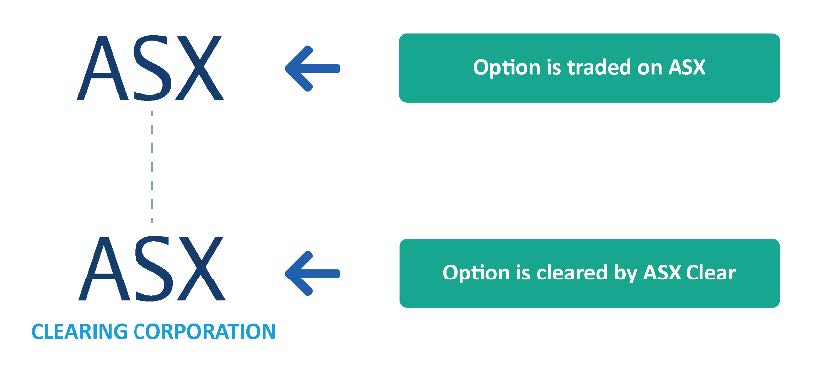

If your Trading Participant is not a Clearing Participant, you will need to sign a separate client agreement with the broker you use to clear your trades. The broker you trade through will normally organise the paperwork for you.

If you trade options through a number of different brokers you will need separate client agreements with each of them.

Your broker will also get you to complete a document as part of their process of assessing whether options are an appropriate investment for you.

You may be asked for details of your:

- investing experience

- financial position

- tolerance for risk

- knowledge of options

- financial objectives in trading options.

Take time to consider these questions carefully. It is in your interests to give a complete and accurate picture of your financial situation, objectives and understanding. Your broker is entitled to rely on the information you provide.

Depending on the information you provide, your broker may restrict the strategies you are able to implement.

Ongoing reporting from your broker

Once you start trading, you will receive certain reports from your broker, either by email or by post.

Any time you trade, you will receive a confirmation, containing details such as:

- trade date

- option series traded

- price you traded at

- brokerage and ASX Clear fees.

You will receive a monthly statement if you:

- traded an option in that month, or

- had an open position at the end of the month.

The monthly statement shows details of:

- any transactions during the month (including trades, exercise and assignment)

- opening and closing account balance, and

- collateral held.