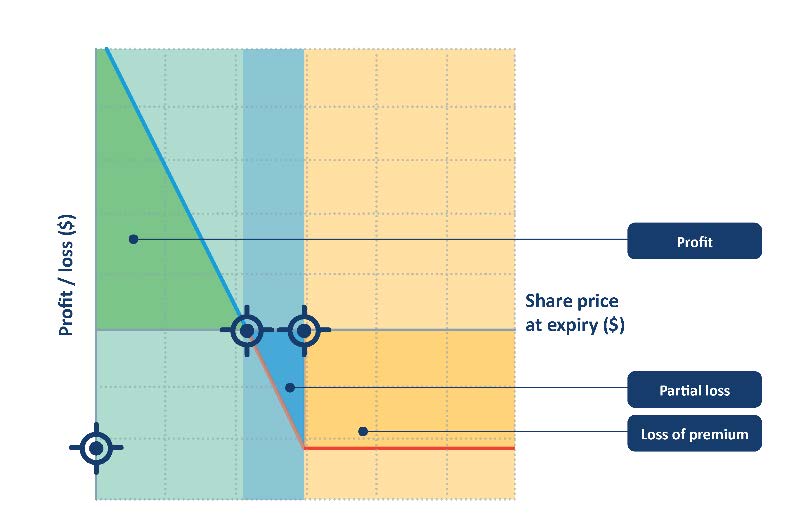

Profits and losses

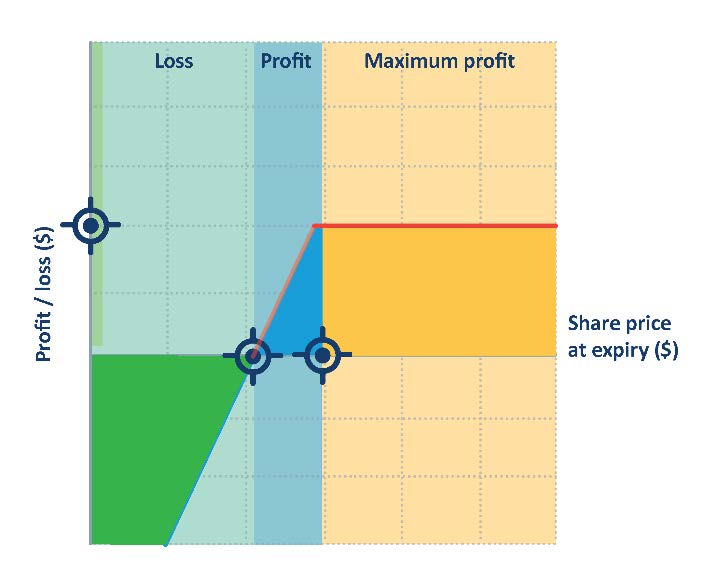

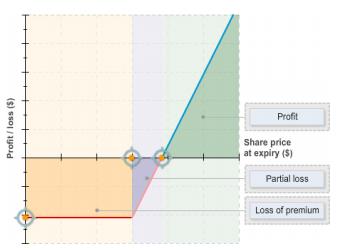

The most you can lose is the premium. You will make this loss if at expiry the index (technically, the OPIC) is at or below the exercise level.

If the index is above the exercise level, the option will have intrinsic value. The higher the index is, the more the option will be worth.

Your profit/loss is intrinsic value less the premium you paid.

The breakeven point at expiry is the exercise level plus the premium paid. At this point, the option is worth what you paid for it.

Above the breakeven, you will make a profit - the higher the index, the greater the profit.

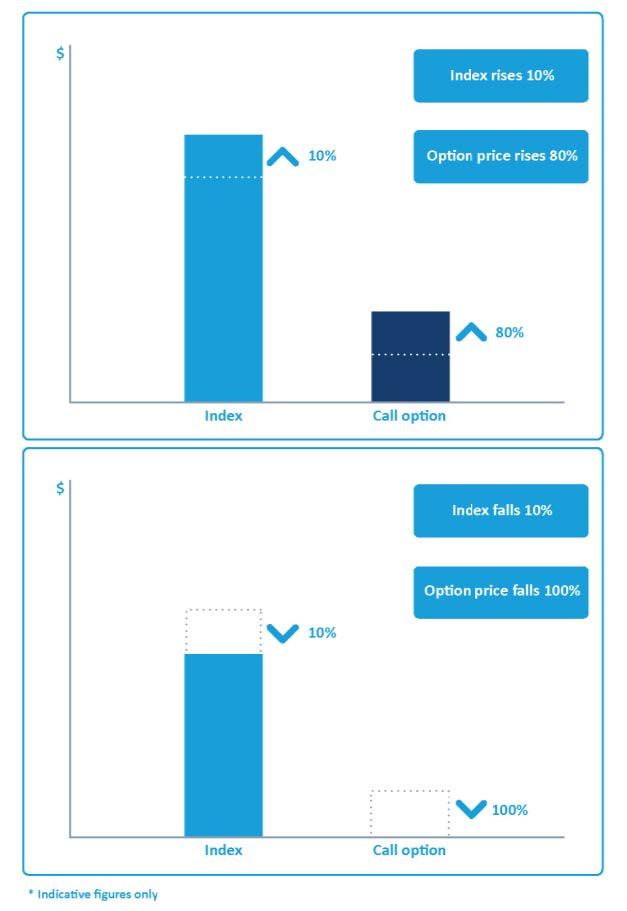

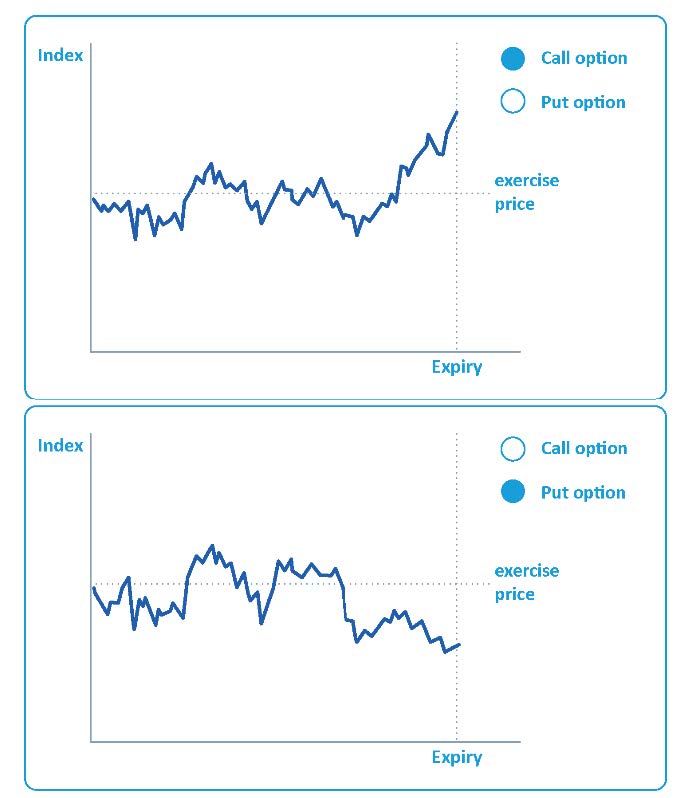

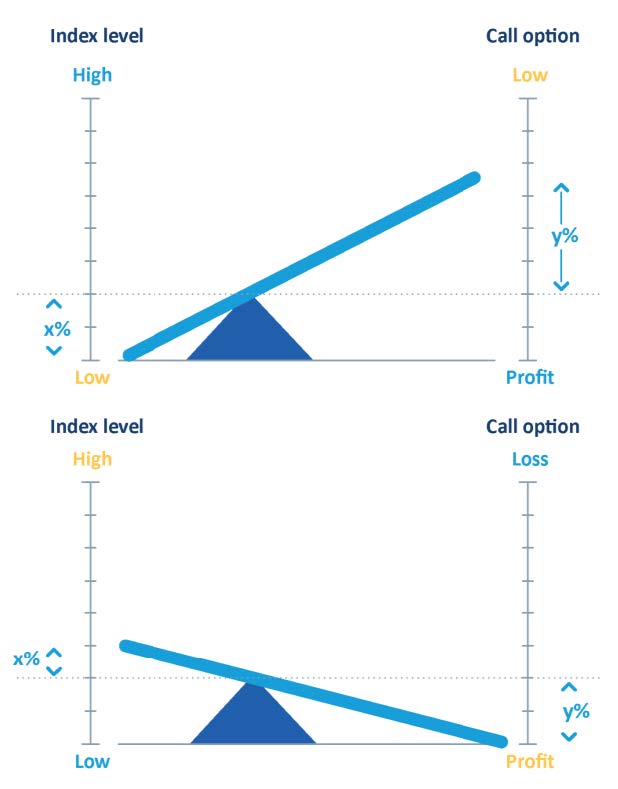

Outcome 1 - index rises

March 8,400 XJO @115 points

At expiry, the index has risen to 8,600 points. The 8,400 call is worth 200 points (intrinsic value).

The 2.3% increase in the index has resulted in a 74% increase in the value of the call.

Your profit is 85 points = $850.

The index has moved favourably and leverage has increased your returns.

At expiry, you can either exercise the call or sell it - the profit you realise should be the same.

(If you decide to take profits before expiry, you can do so by selling the option.)

Outcome 2 - index falls

March 8,400 XJO @115 points

Leverage works both ways. If the index falls, the call option will suffer magnified losses in percentage terms.

A fall in the index of 200 points represents a decline of 2.3%.

Your 8,400 call will be out of the money and expire worthless. Your loss is 100%.

It's important to be clear that leverage refers to changes in percentage terms.

In terms of points, the change in the index can be expected to be more than the change in the option's value.

Risks