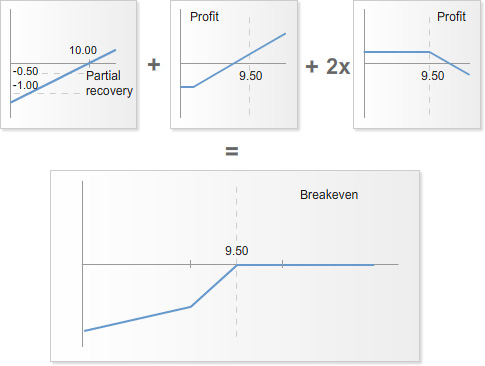

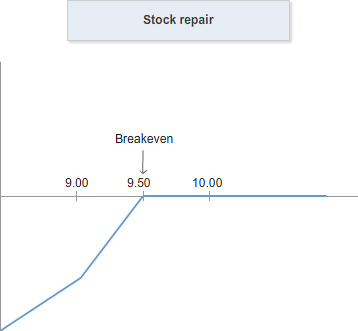

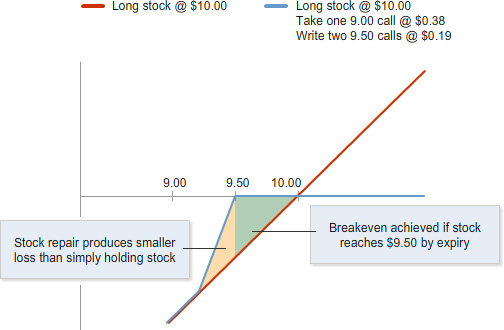

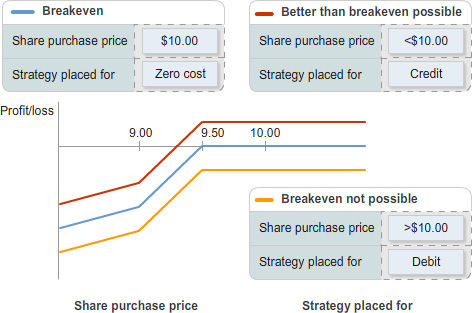

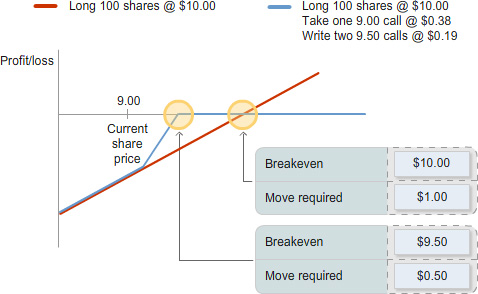

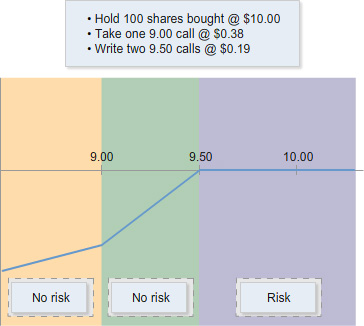

The stock repair typically is held to expiry, rather than being closed out early. Breakeven is usually only possible at expiry, when time value has fallen to zero.

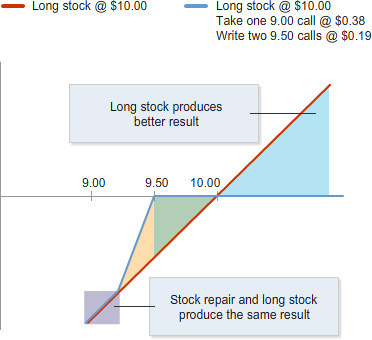

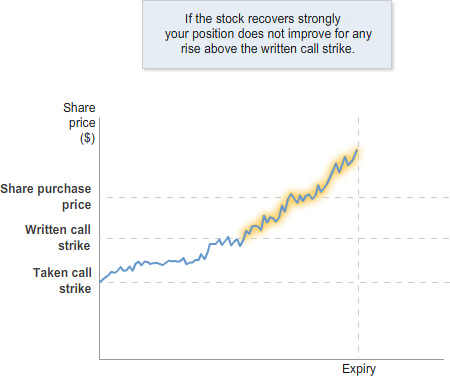

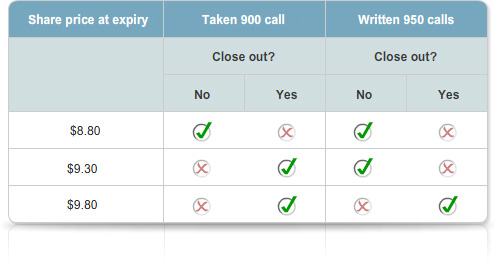

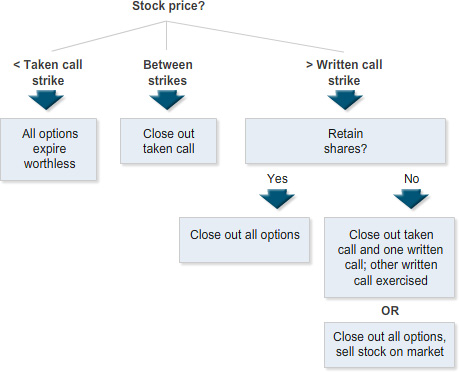

However, if the stock price rises well above the written call strike ahead of expiry, you might change your view on the stock and believe the price may rise further. If so, you can consider closing out the written calls to remove the cap on your upside.

If you decide not to close out your written calls, you should be aware of the risk of early exercise.

This risk of exercise is greatest if the stock goes ex-dividend during the life of your strategy. If the written calls are deep in the money, you may want to consider closing them out before the ex-dividend date to remove the risk of exercise.