Topic 3: The initial margin

What is the initial margin?

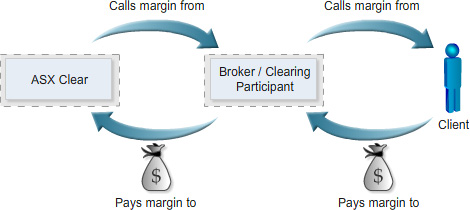

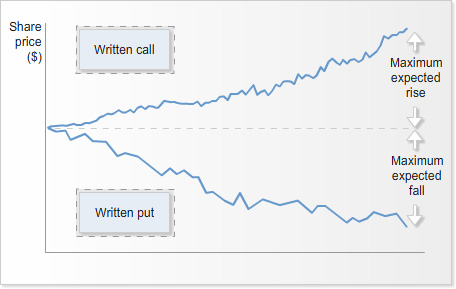

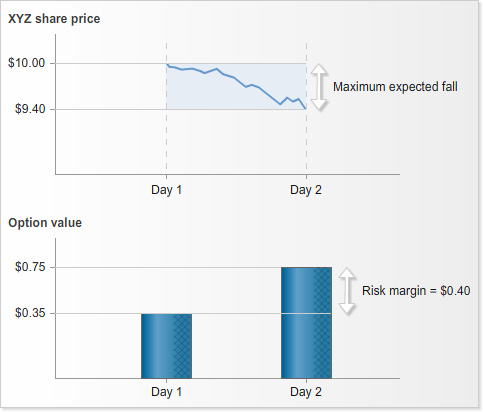

The initial margin covers the potential change in the price of the option contract assuming the assessed maximum probable inter-day movement in the price of the underlying security.

To calculate the initial margin, CME SPAN 4.0 uses the published price scan range (also referred to as the margin interval).

The price scan range is determined through various observations of the price (or underlying price) over a period of time.

How is the initial margin calculated?

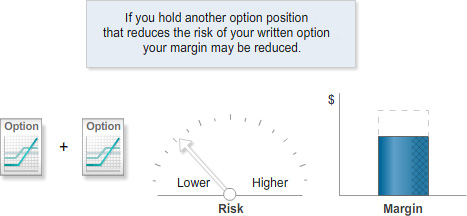

SPAN can be considered as a risk based portfolio approach for calculating initial margin requirements.

SPAN uses risk arrays, which is a set of numeric values that specify if a particular contract will gain or lose value under different conditions (risk scenarios).

The value for every risk scenario symbolises the gain or loss for that contract for a certain combination of volatility change, price change, and decrease in time to expiry.

How is the SPAN requirement calculated? (cont)