Module 4: Implementing multi-legged strategies

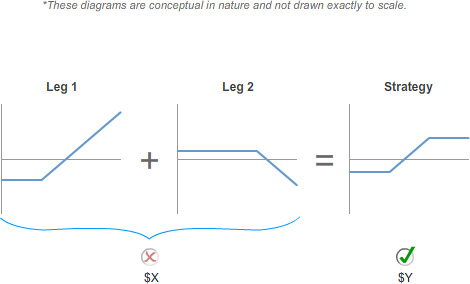

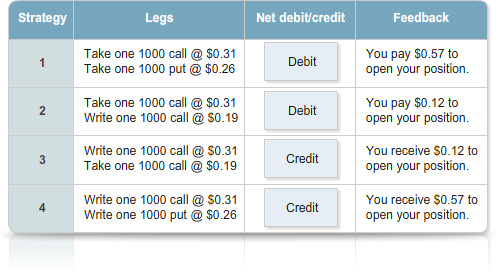

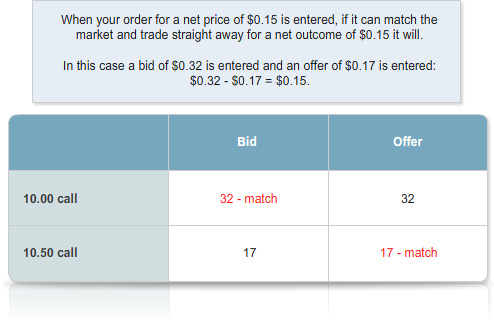

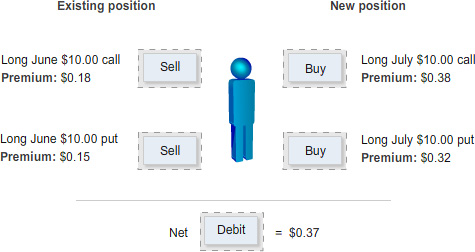

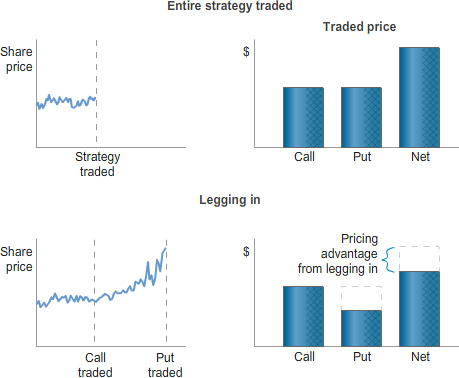

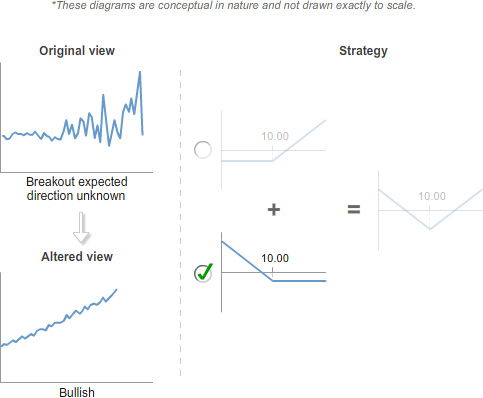

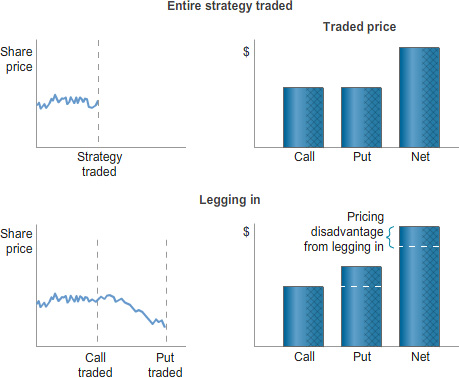

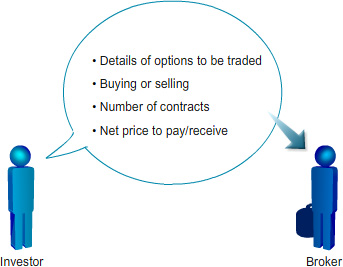

When entering a multi-legged strategy you should think of it as one integrated position, rather than focusing on the component legs. Work out the net amount you want to pay or receive for your strategy. Referring to the current market prices of the component legs can help you to do this. This is the price you specify when placing your order. You do not need to specify the prices for the individual legs.