Module 7: Strategies for price break-outs

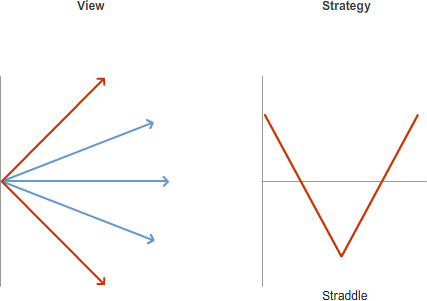

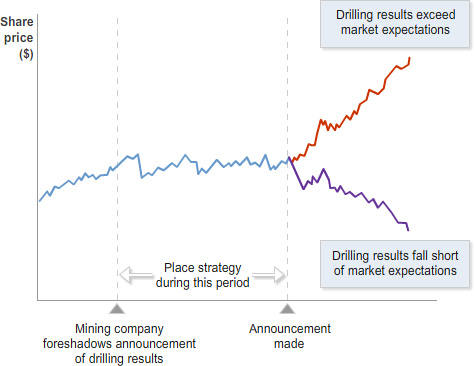

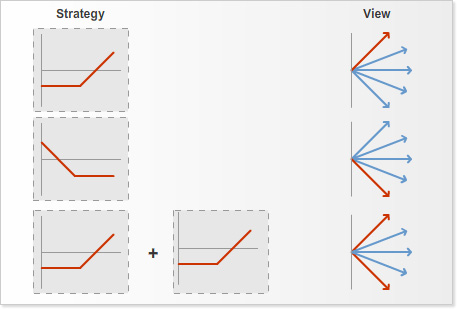

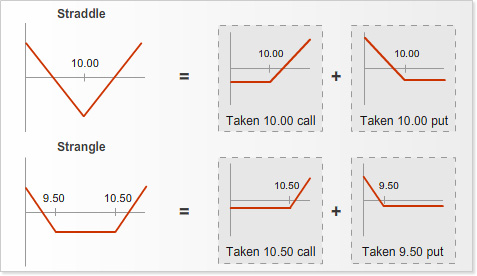

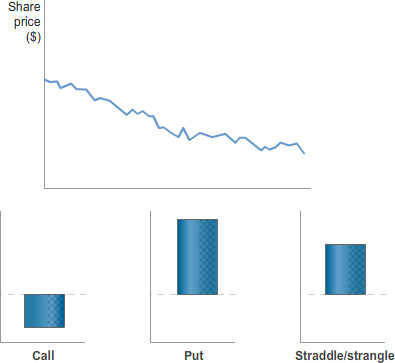

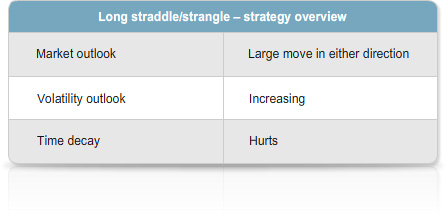

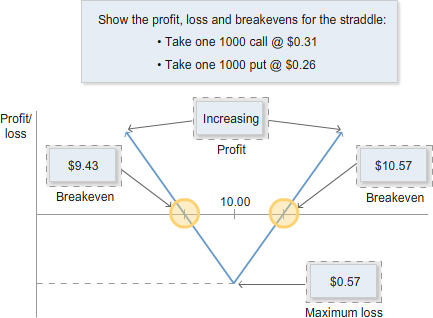

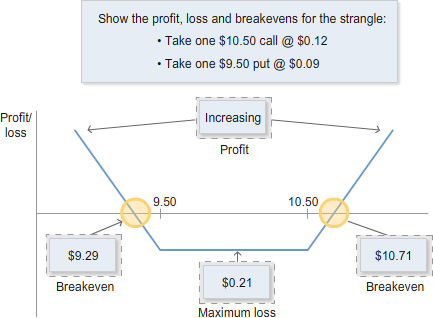

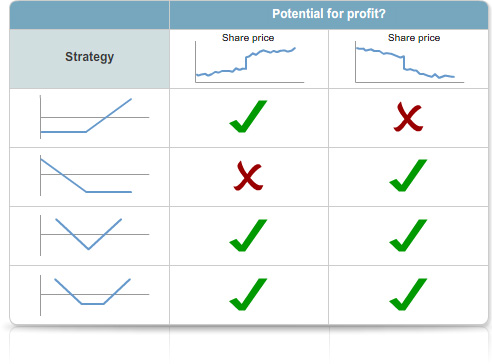

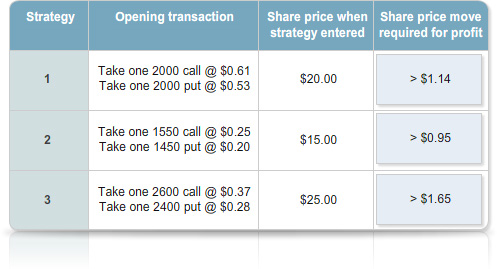

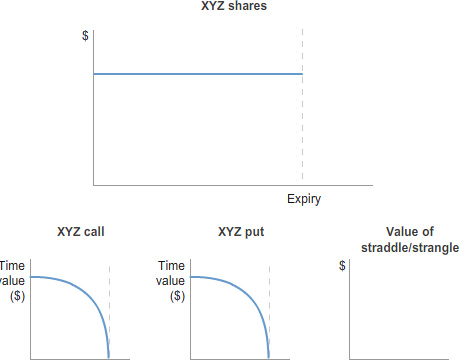

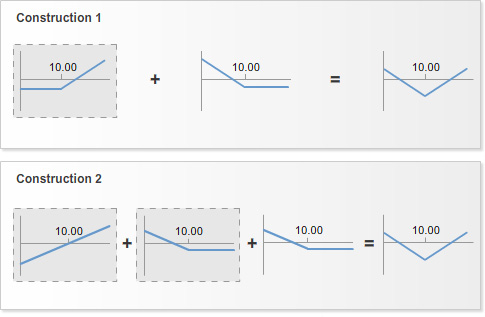

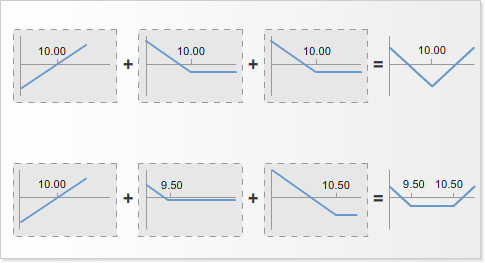

A simple directional view can be traded using one of the 'basic' option strategies. A bullish trader might buy a call, while a bearish trader might buy a put. But what if you think a stock might be about to make a big move - but you don't know in which direction? Is there a strategy that enables you to profit, whether the stock price moves up or down? Before considering this question, it is worth asking when you might hold such a view.