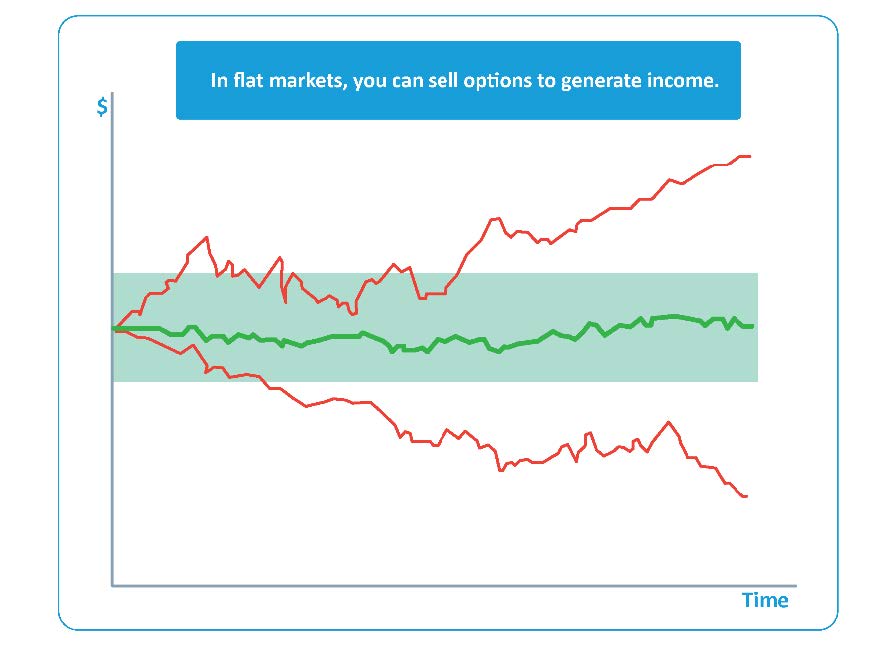

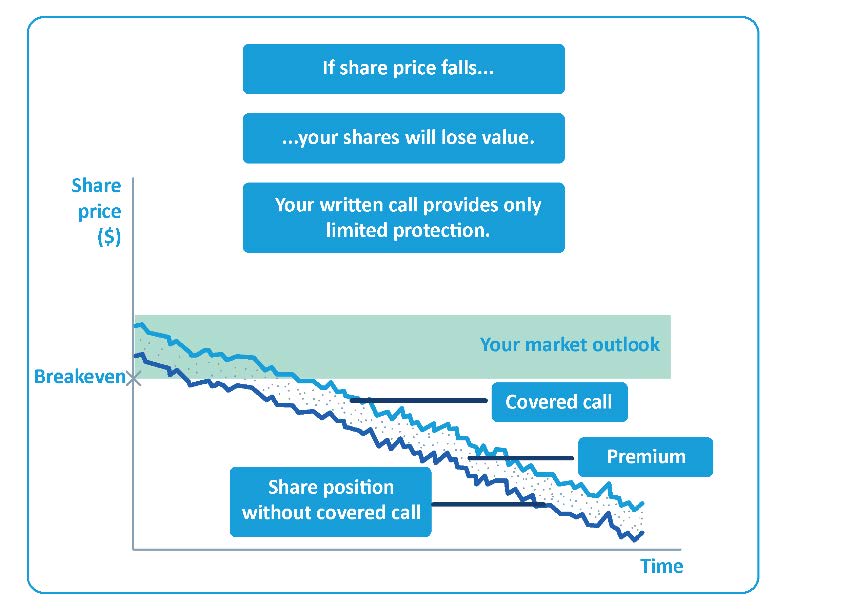

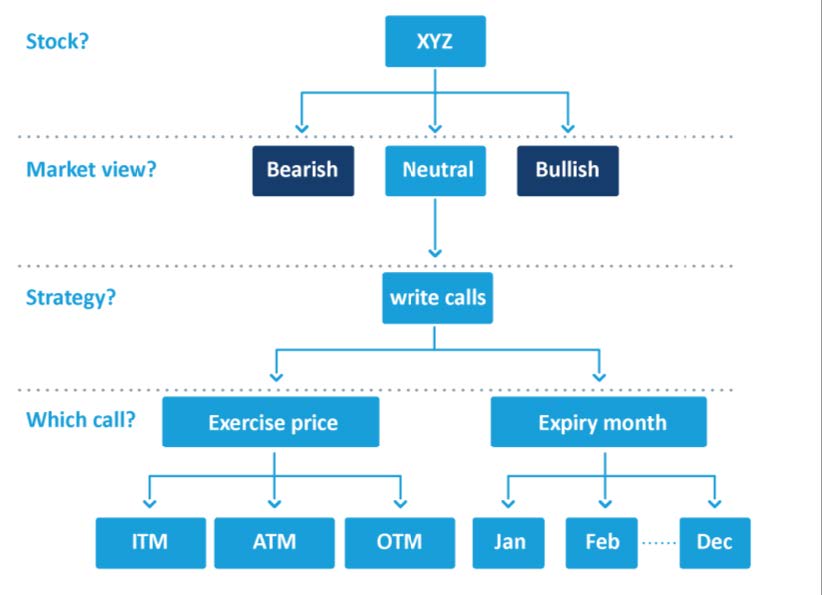

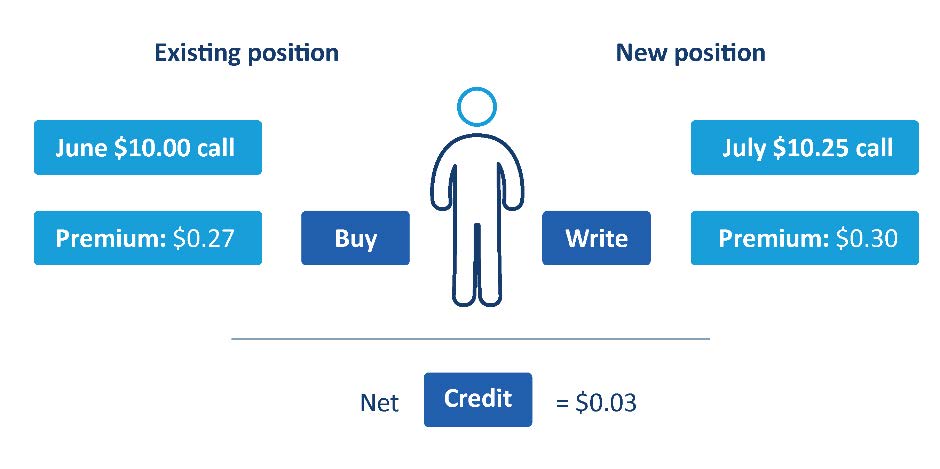

Writing a call is one of the few ways you can make money from your shares when the market is flat.

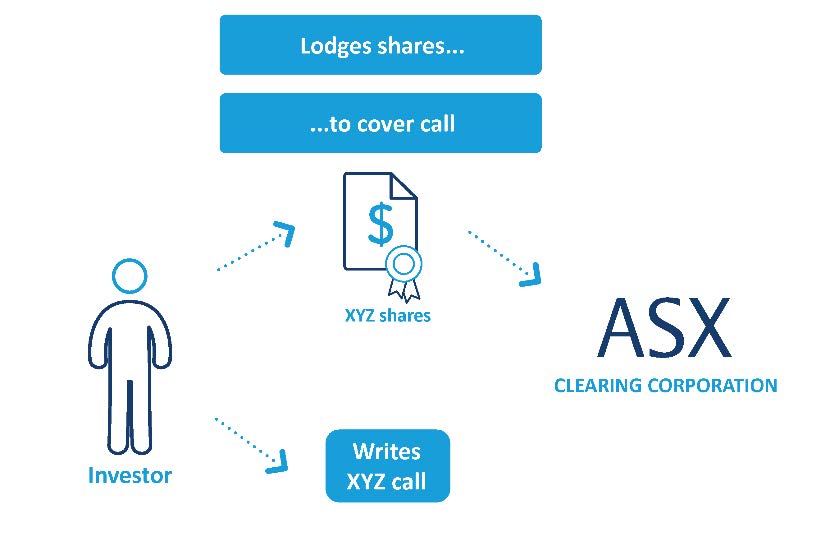

Time decay and a fall in volatility work in favour of the written call. Writing a call:

- generates premium income

- provides limited protection

- can result in a sale price higher than the share price at the time of writing the option.

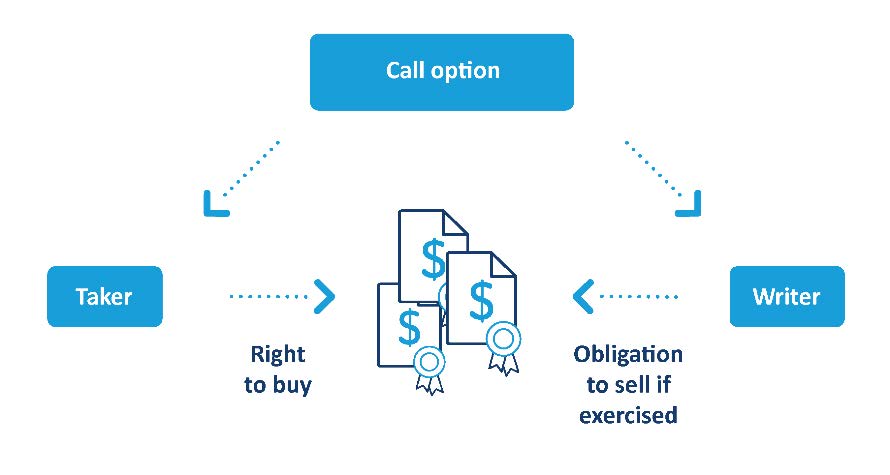

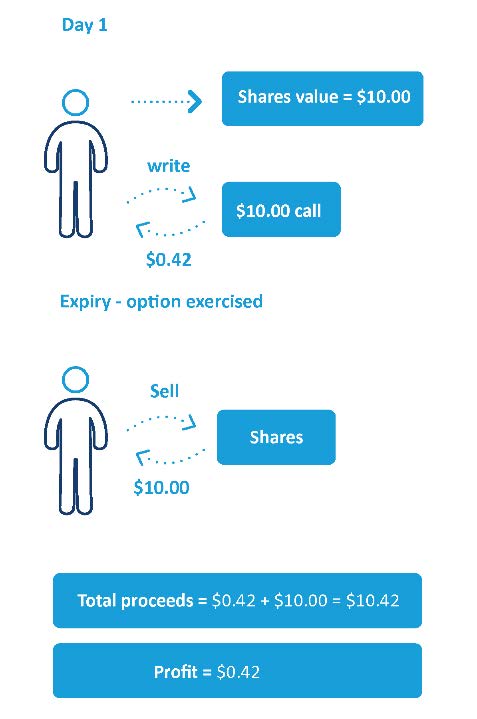

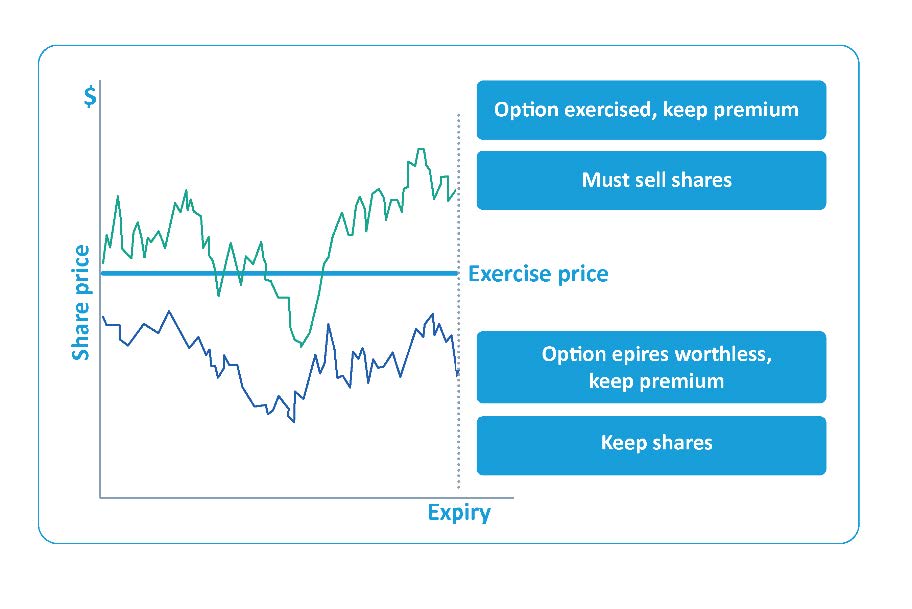

If the call is exercised, you must deliver the shares, for which you receive the exercise price.

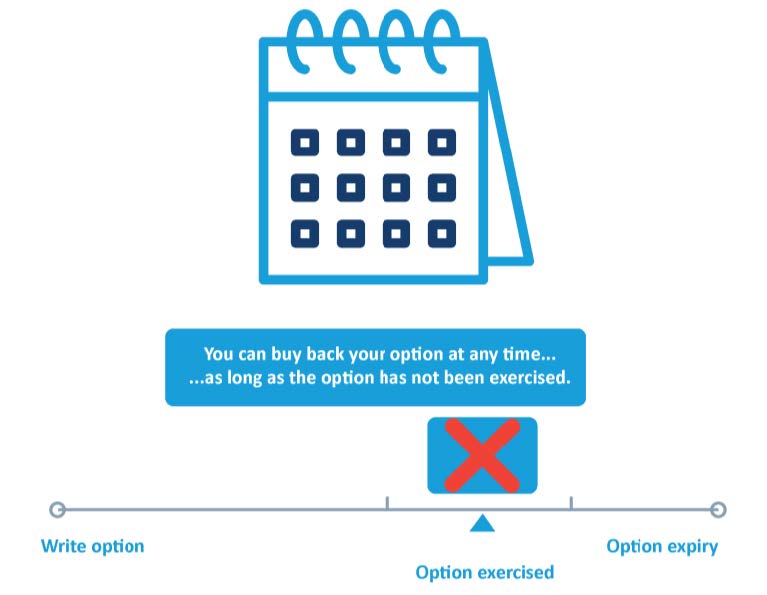

There is the possibility of exercise any time your option is in the money. If at expiry you have not closed out your position, you may be exercised and you must sell your shares at the exercise price.

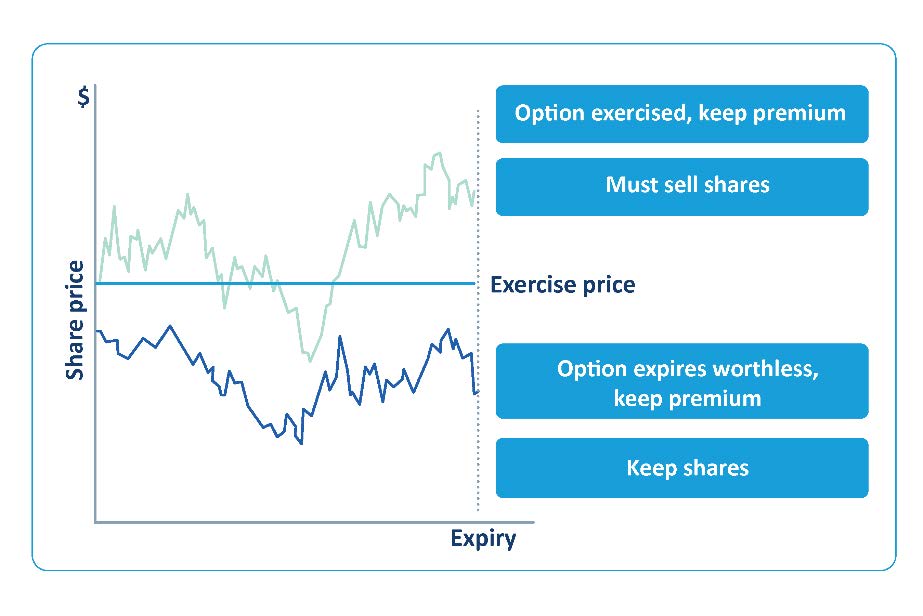

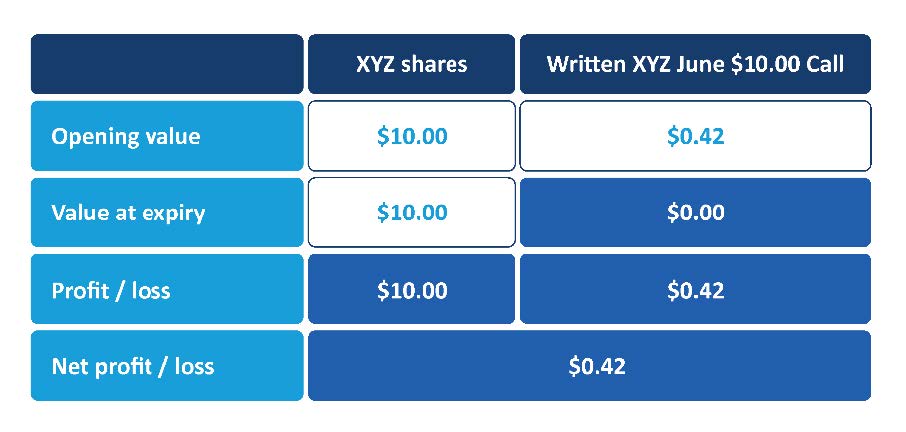

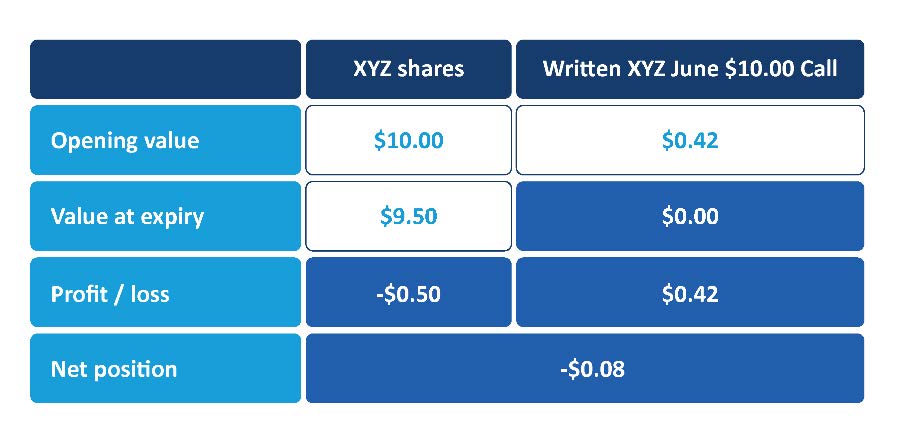

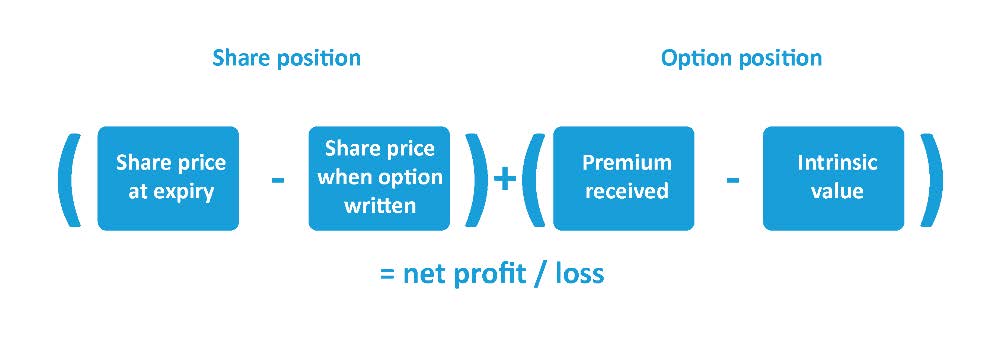

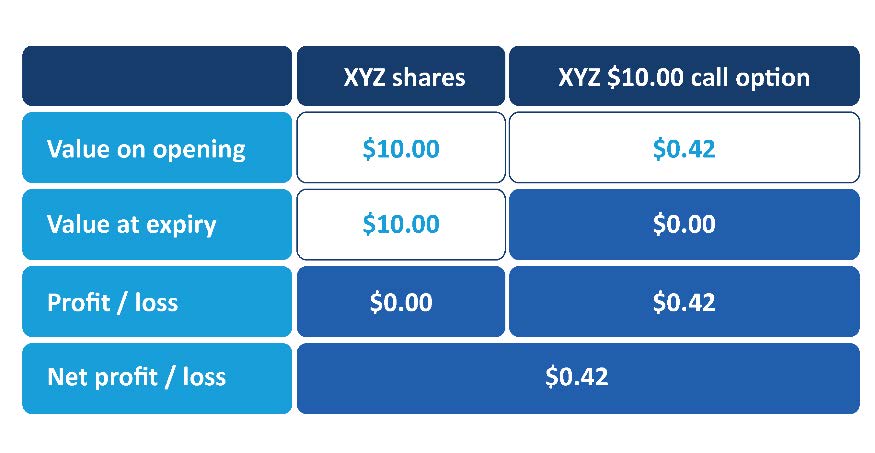

Profits and losses

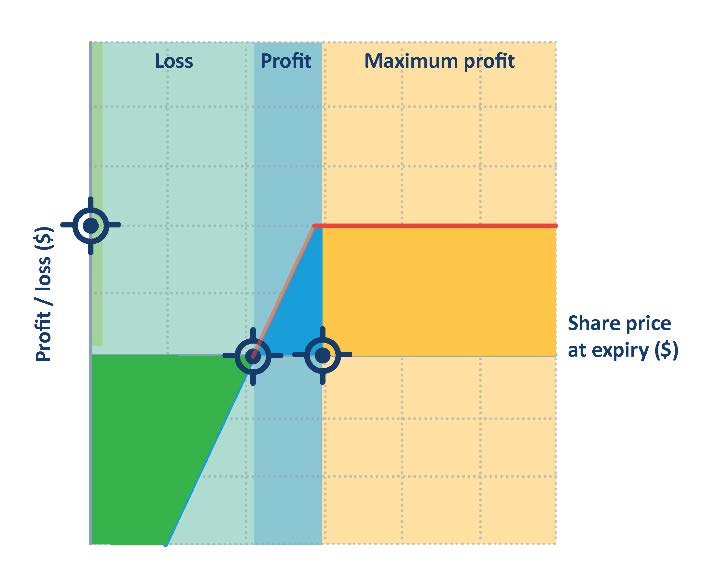

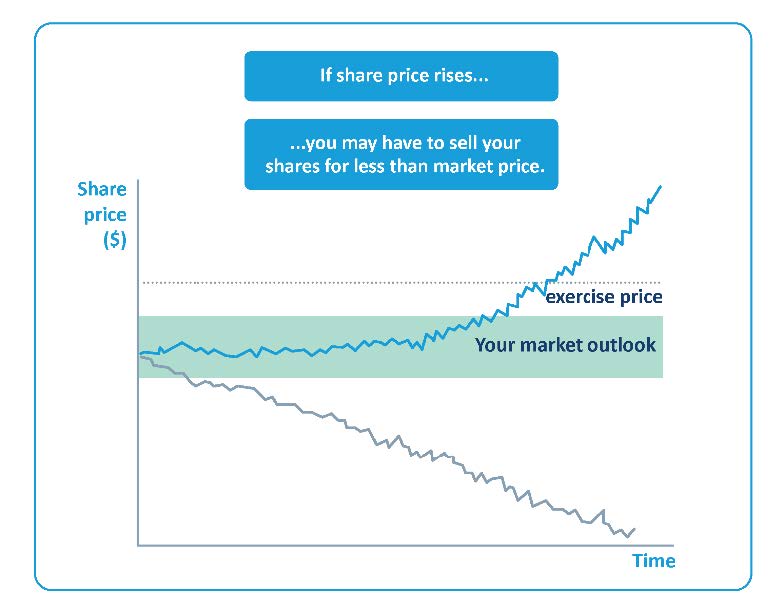

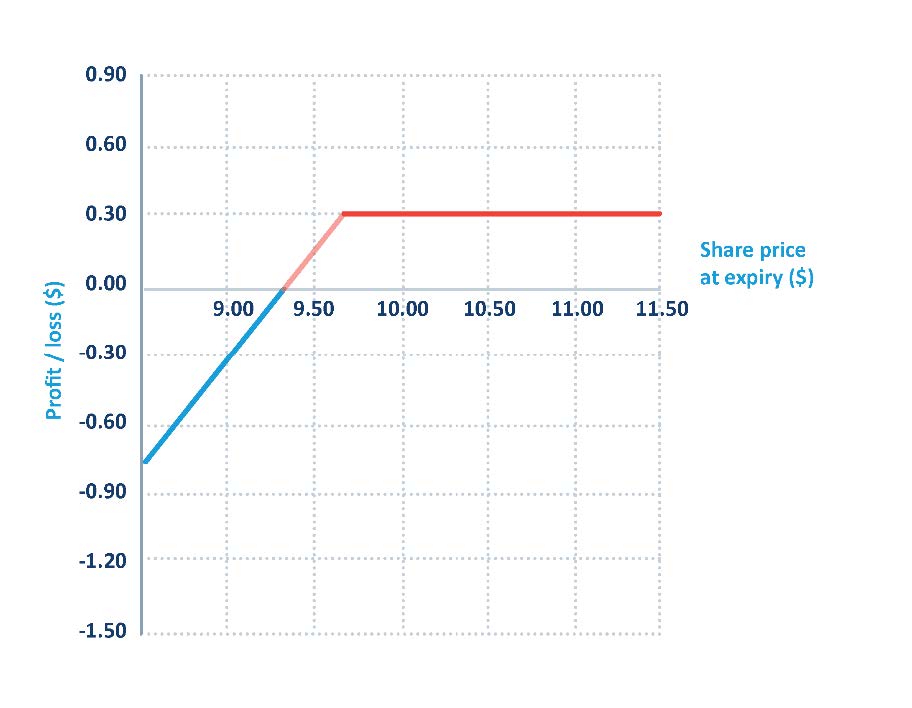

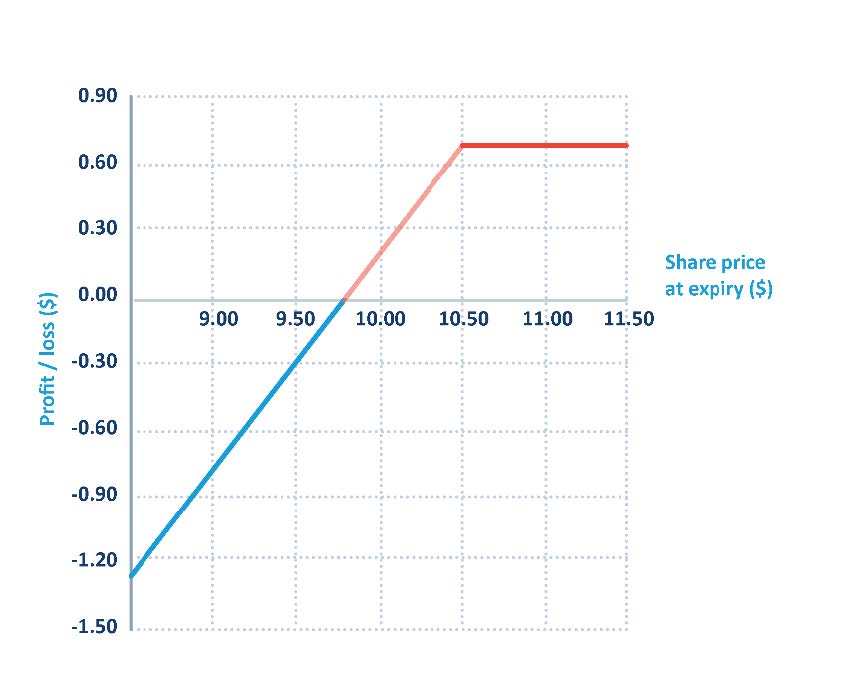

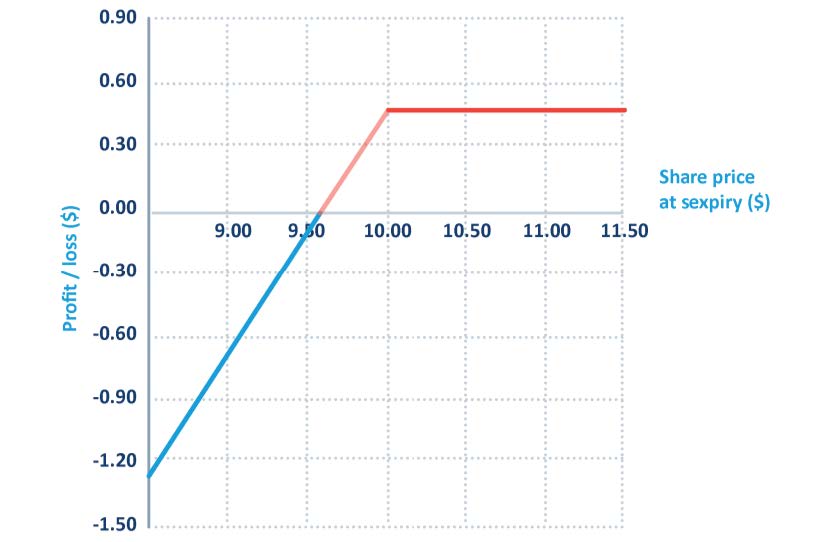

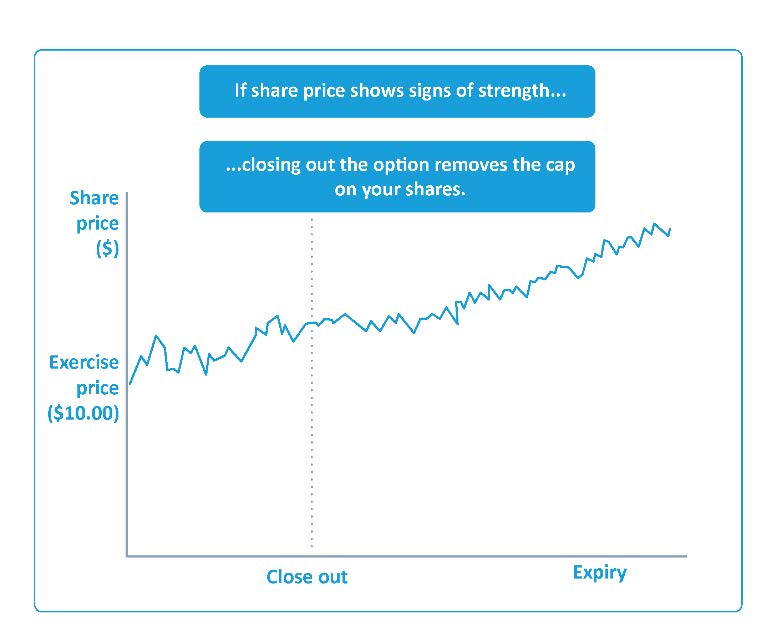

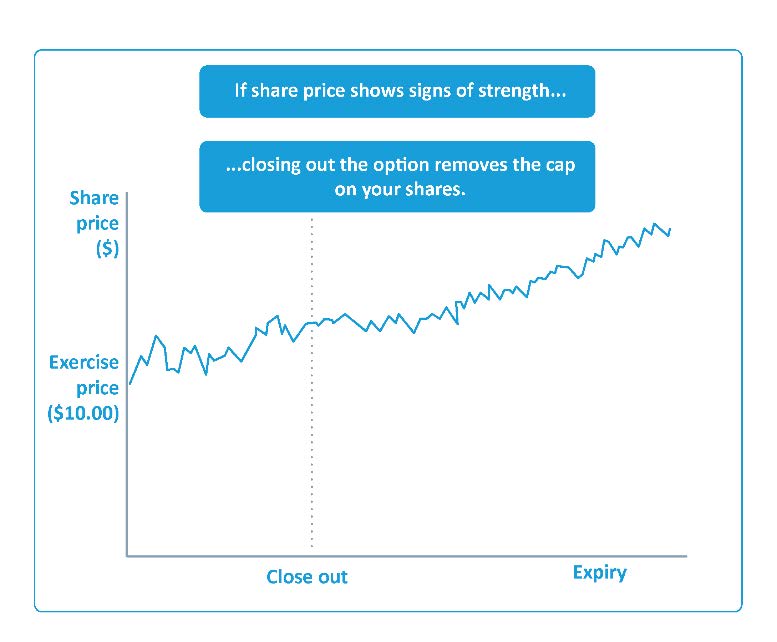

There is a cap on profit potential with the covered call strategy. In the case of a strong share price rally, the strategy underperforms the simple buy and hold stock strategy.

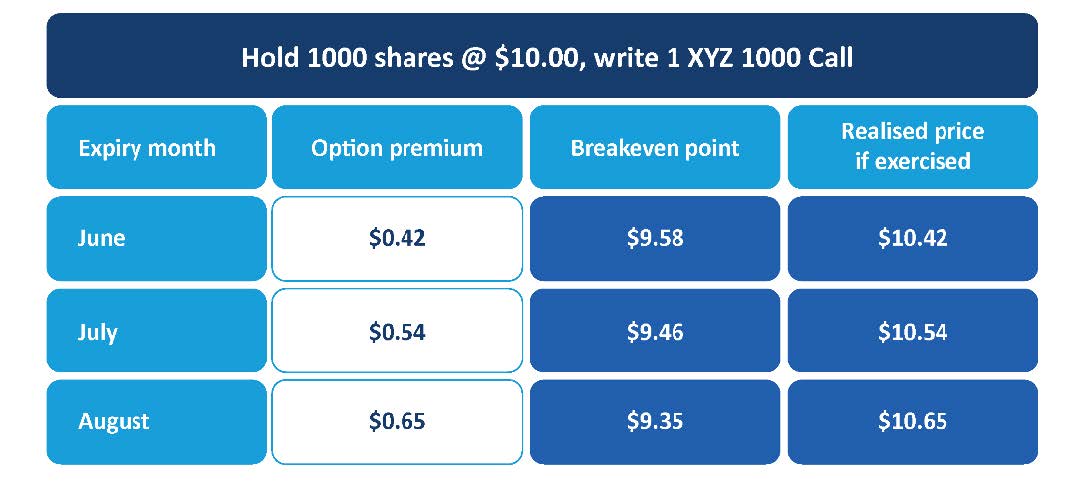

The most profit you can make is the premium you receive plus the difference between the exercise price and the share price when you write the call. You make this profit if at expiry the share price is above the exercise price.

If the share price falls, you are still exposed to the loss in value of your shares, but the premium you receive reduces that loss.

In deciding which call to write:

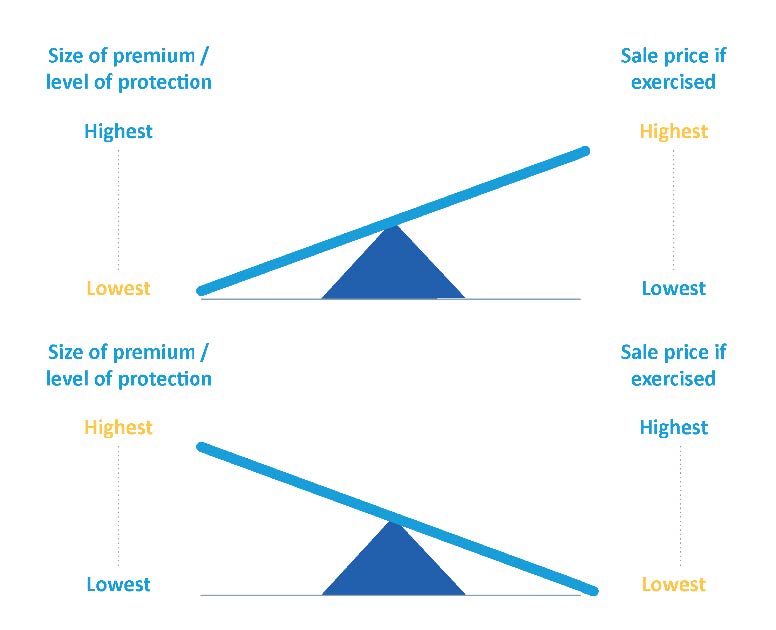

- ITM calls give you the largest premium and greatest protection.

- OTM calls result in the highest realised price if exercised.

- ATM calls provide the most income if the share price stays steady