Module 1: Introduction to options

An introduction to the basics of option trading. Why trade options? What are options, and who uses them? This module goes through the basic features of options, and explains how they differ from shares.

Module 1: Introduction to options

An introduction to the basics of option trading. Why trade options? What are options, and who uses them? This module goes through the basic features of options, and explains how they differ from shares.

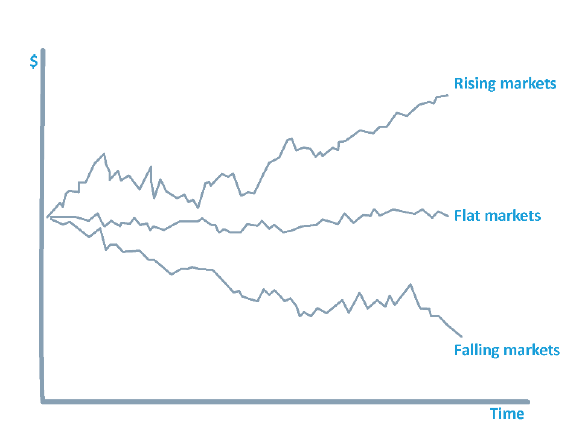

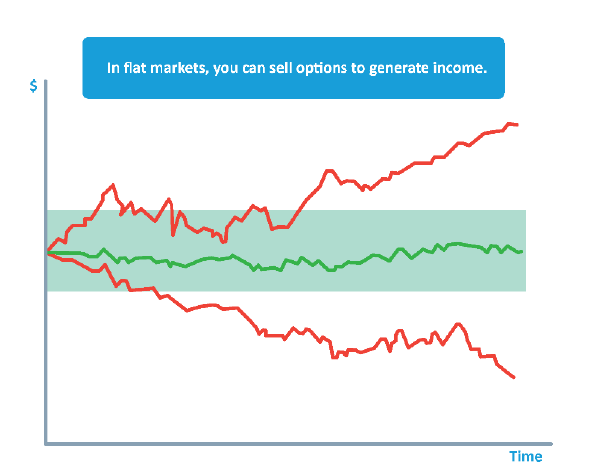

Options appeal to a wide range of investors and traders, and allow you to construct strategies to suit any view of the market - bullish, bearish or neutral.

You can use options to

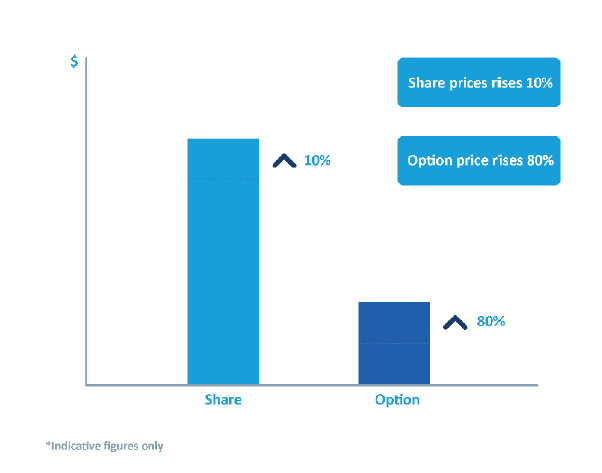

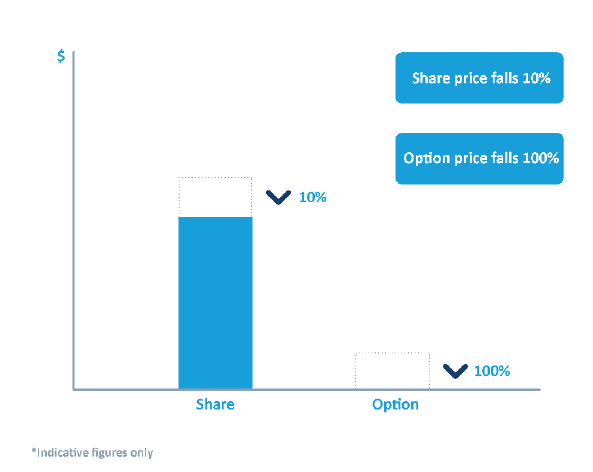

Leverage (also called gearing) means you get a relatively large exposure for a relatively small cost. Options over shares, for example, cost less than the shares themselves.

Small share price movements result in proportionally larger changes in the option price.

If the share price moves favourably, your percentage returns from an option are usually greater than the movement in the share price. If the share price moves in the wrong direction, your losses will also be magnified.

Buying an option buys you time. An option gives you the right

You have until the end of the option's life to decide whether to go ahead with the share purchase or sale.

Even though you can defer your decision to buy or sell, you lock in your purchase or sale price at the time you buy the option.

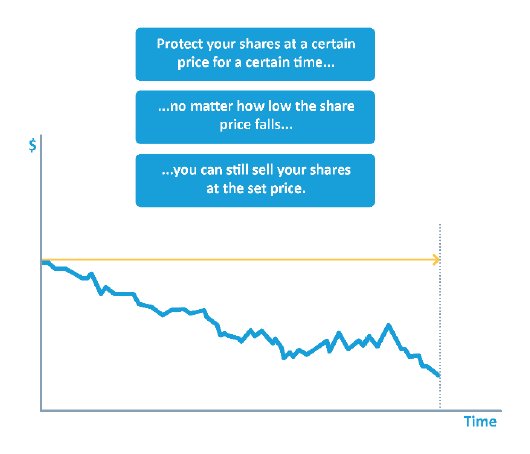

You can use options to protect your shares from a fall in value.

One type of option (the 'put' option) gives you the right, for a certain period of time, to sell shares for a specified price. No matter how low the share price falls during the life of the option, your shares are protected at that level.

If the share price rises, you don't have to sell your shares, and all you have lost is the cost of the option.

Buying put options against shares you hold can be compared to buying insurance for your house or car.

This use of options is discussed in Module 7: Protect your shares.

Selling (writing) options is a way of generating income from your shares.

This strategy can be effective if you think a share is unlikely to move a long way from its current price for a period of time.

When you sell an option, you are paid a premium by the option buyer. You can think of this premium as like an extra dividend on your shares.

This use of options is discussed in Module 8: Earn income from your shares.

Options appeal to investors who like to be closely involved with their investments, as they generally require a greater commitment than shares.

Many options strategies call for regular monitoring and decision-making, so they suit investors who take a 'hands-on' approach.

Options are attractive to:

XYZ June $10.00 Call option @ $0.42

This option gives you:

- the right, but not the obligation

- to buy

- 100 shares in company XYZ

- for $10.00 per share

- at any time up until the option expiry date in June.

For this option, you pay $0.42 per share i.e. $42 for the option.

Let's assume XYZ shares are currently trading at $10.00, and it is the start of May.

Why might you buy this option?

You would only buy this call option if you think the XYZ share price will rise over the option's life.

There are several reasons to buy an XYZ call.

Leverage: Ignoring all other factors, if XYZ shares go up, your percentage returns from the option are likely to be greater than the rise in the share price. The higher the shares rise over the life of the option, the greater your profit will be. (However, if the shares fall, you will lose some or all of the money you paid for the option.)

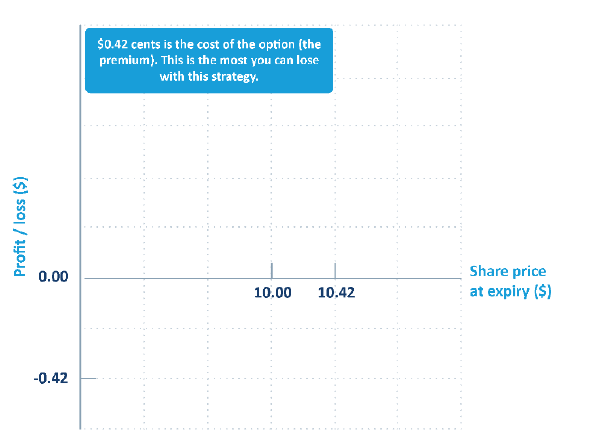

Limited risk: The most you can lose is what you paid for the option. In this case, you have $0.42 per share at risk - compared to $10.00 if you bought XYZ shares.

XYZ June $10.00 Call option @ $0.42

Lock in purchase price for the shares

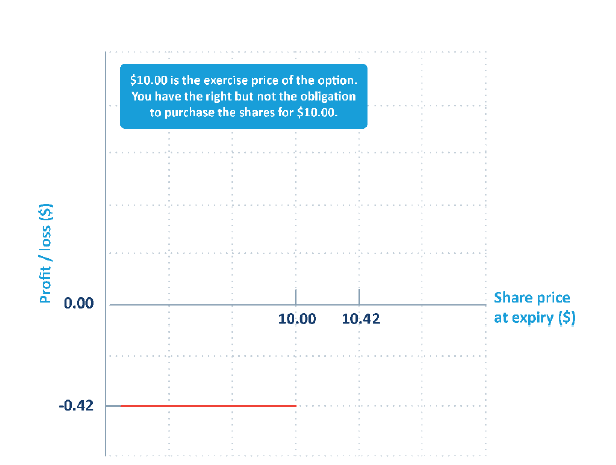

Buying the XYZ call locks in a purchase price of $10.00 per share for the life of the option.

No matter how high the share price rises before the expiry date in June, you have the right to pay $10.00 per share. Regardless of how XYZ performs, you are under no obligation to buy the shares.

Time to decide: You have until the option's expiry date to decide whether to purchase XYZ shares.

This gives you time to change your mind, or to raise funds to pay for the shares.

XYZ June $10.00 Call option @ $0.42)

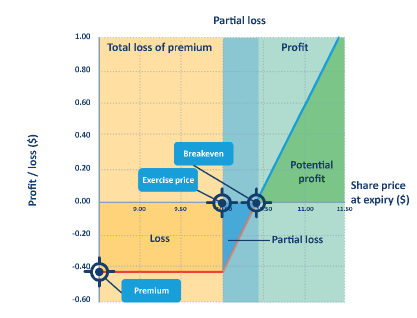

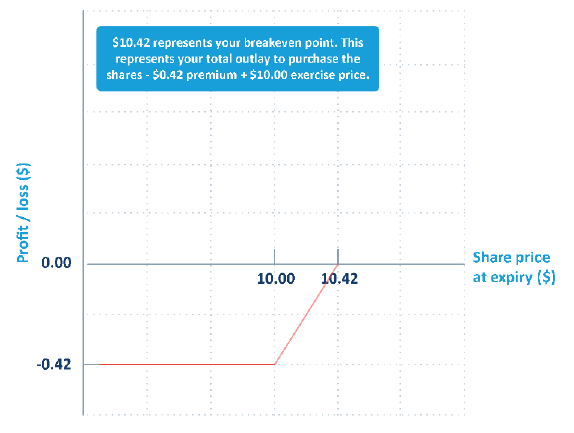

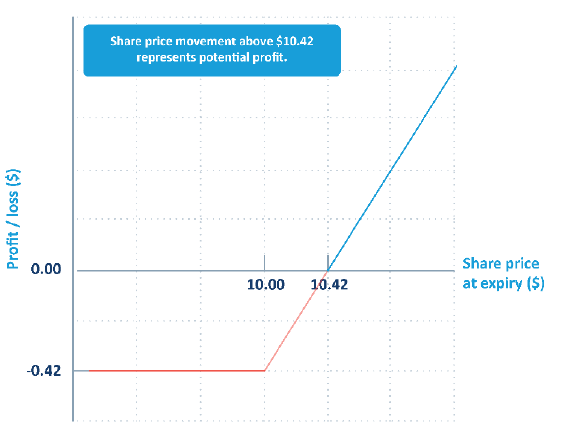

A 'pay-off diagram' or 'profit and loss profile' is commonly used to illustrate the profit and loss potential for an option. The diagram represents the pay-off for that option at expiry. It shows the profit or loss you would make for any given share price at expiry.

Each option strategy has a unique pay-off diagram shape or profile. The profile for the bought call shows there is

The graphic below builds the bought call option's pay-off diagram step by step.

XYZ June $10.00 Call option @ $0.42

At expiry, how much you make or lose depends on the XYZ share price.

The higher the share price, the more money you make. Profits from buying a call are potentially unlimited.

To make a profit, the share price must rise enough to cover the cost of the option. In this case, the share price must be above $10.42 for you to make money.

If the share price at expiry is below $10.42, you will lose money.

In the worst case, if the share price at expiry is below $10.00, your option will be worthless and you will lose $42 ($0.42 per share).

You don't have to wait until expiry to take action. At any time up until the option expires, you can sell or exercise your option (depending on the style of option).

Sell the option (in the market)

You can do this if the share price has gone up and you want to take profits, or if the share price has gone down and you want to sell while the option is still worth something. This involves re-entering the market and selling an option with the same terms. (More information on selling in Module 10.)

There are certain features common to all options:

These are described in brief next, and in detail in Module 2: What are options?.

XYZ June $10.00 Call @ $0.42

- Option type

- Underlying asset

- Exercise price

- Expiry

- Premium

XYZ June $10.00 Call option @ $0.42

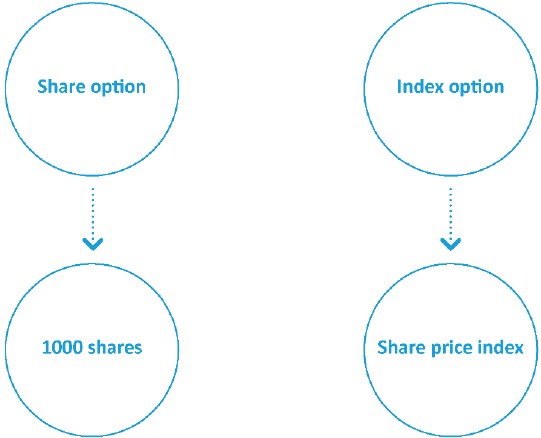

An option gives you the right either to buy, or to sell, some other thing - this is the underlying asset of the option contract (or simply, the 'underlying').

The underlying of the XYZ June $10.00 Call option is XYZ shares.

On ASX, options are traded over shares of certain ASX-listed companies, on Exchange Traded Funds and over three share price indices.

The underlying asset of most ASX share options is 100 shares in the relevant company.

XYZ June $10.00 Call option @ $0.42

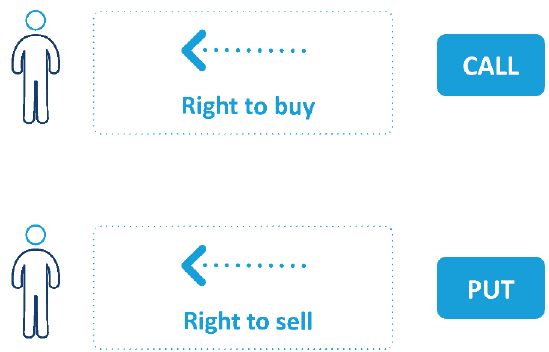

There are two types of option, call options and put options.

A call gives you the right, but not the obligation, to buy the underlying asset.

A put gives you the right, but not the obligation, to sell the underlying asset.

XYZ June $10.00 Call option @ $0.42

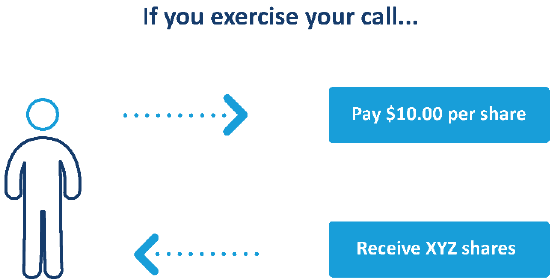

The exercise price (or strike price) is the price at which the underlying will change hands if you exercise the option.

The exercise price of the XYZ June $10.00 call option is $10.00. This is the amount you will pay per share, if you decide to take up your right to buy XYZ shares.

XYZ June $10.00 Call option @ $0.42 All options have a limited life.

The expiry date is the last date you can exercise the option, and the last date it can be traded. At the end of the expiry day, any unexercised options are cancelled.

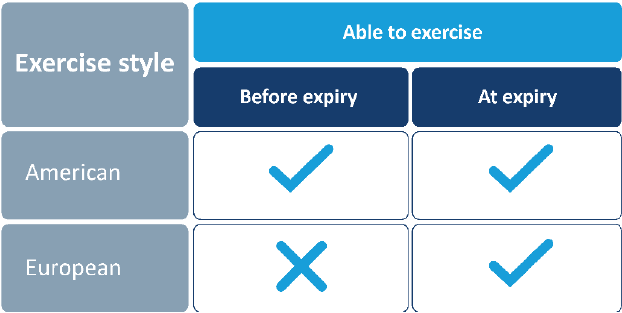

An option is either American exercise or European exercise.

You can exercise an American style option at any time. A European style option may be exercised only on the expiry date.

Stock options listed on ASX are usually American exercise, while index options are European exercise.

Note: All options may be sold at any time until expiry on market.

XYZ June $10.00 Call option @ $0.42

The premium is the price of the option, paid by the option buyer to the option seller.

It is determined by supply and demand. When the highest price bid meets the lowest price asked, the trade takes place.

The premium of ASX stock options is expressed in cents per share. To work out the cost of one option contract, multiply by the number of shares per contract (usually 100).

So one XYZ June $10.00 call option @ $0.42 will cost the buyer $42.

Shares and options are both traded on ASX.

There are, however, some fundamental differences in the nature of the two instruments, the way they are traded, and the interests of parties to a trade.

If you have only traded shares before, and are new to options, it is important to take some time to understand these differences.

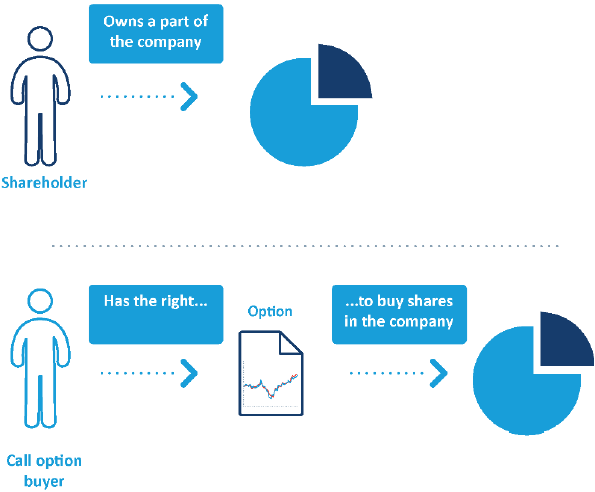

A share represents ownership of a part of a company. When you buy a share, you buy a part of the company - its assets, liabilities and earnings.

The title you hold to your share is evidence of that ownership.

When you buy an option, you do not buy a physical asset. You buy the right to do something - the right to buy the asset underlying the option contract (in the case of a call), or the right to sell the asset (in the case of a put).

It is not until you exercise your right that you acquire or surrender ownership of the asset itself.

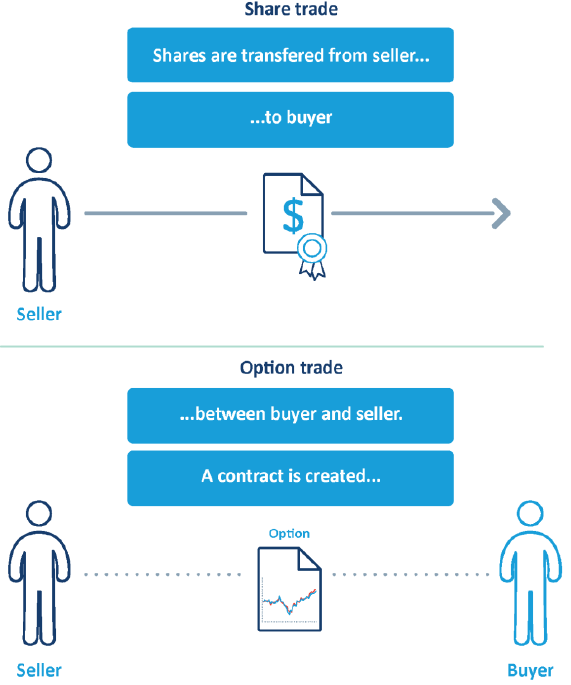

When a share is traded on ASX, there is a transfer of title between the two parties to the trade.

On settlement, ownership of the share is transferred from the seller to the buyer. Title to the share is recorded on the share register.

An option trade creates a contract between the buyer and seller. The contract is then registered with ASX Clear Pty Limited.

Following the transfer of title, the seller of the share no longer has an interest, while the buyer holds title to the share.

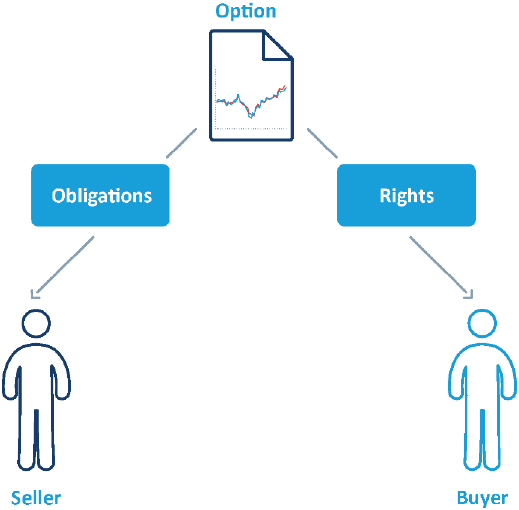

Both parties to an option trade, however, have ongoing rights or obligations, which continue until the option contract is closed out, exercised, or expires.

The buyer has the right to exercise the option.

The seller has the obligations imposed by the option contract. These obligations will be discussed in later modules.

It's useful to know some terms commonly used in the options market.

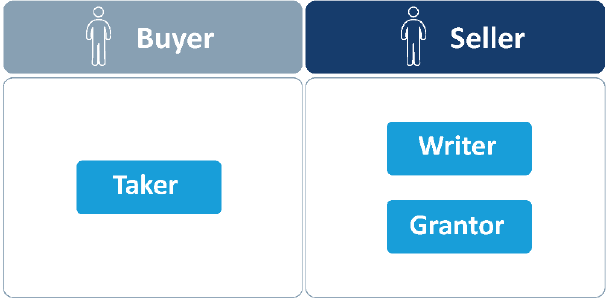

Buying an option is also described as 'taking' an option. The option buyer may be referred to as the option taker.

Selling an option to open a position is also described as 'writing' (or less commonly, 'granting') an option. The option seller may be referred to as the option writer or grantor.

Other option terminology will be introduced in subsequent modules.

You can use options to:

Options are used by:

An option gives the buyer the right to do something:

The option specifies:

Buying a call implies you have a bullish view on the shares.

Practical examples of option strategies are given throughout this module

Option prices used in the examples were calculated using a binomial pricing model.

Unless specified otherwise, prices are based on the following:

Keeping these assumptions constant in all examples should make it easier to compare the different strategies presented.