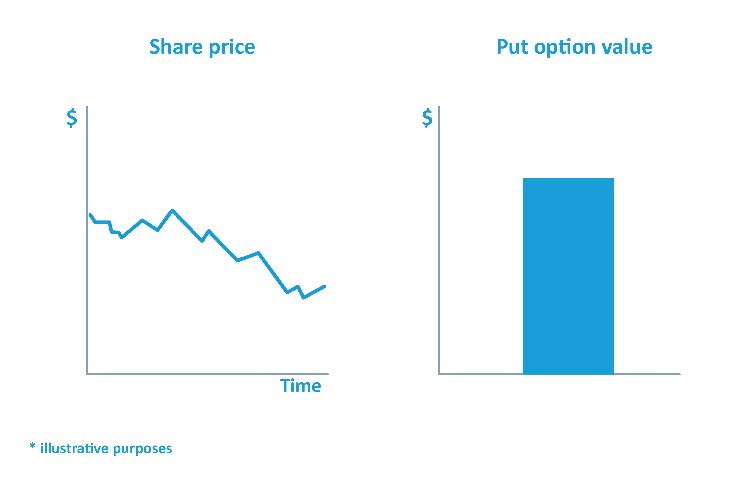

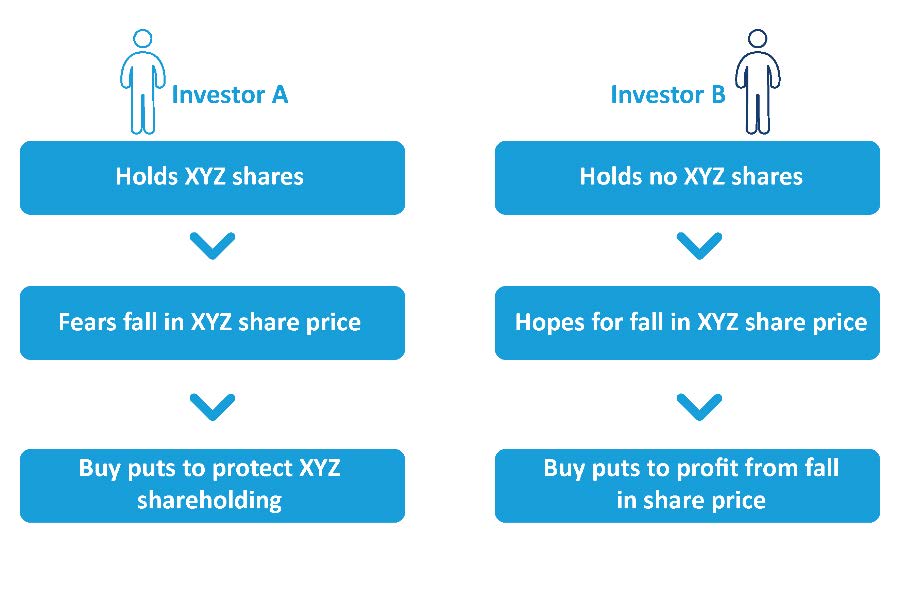

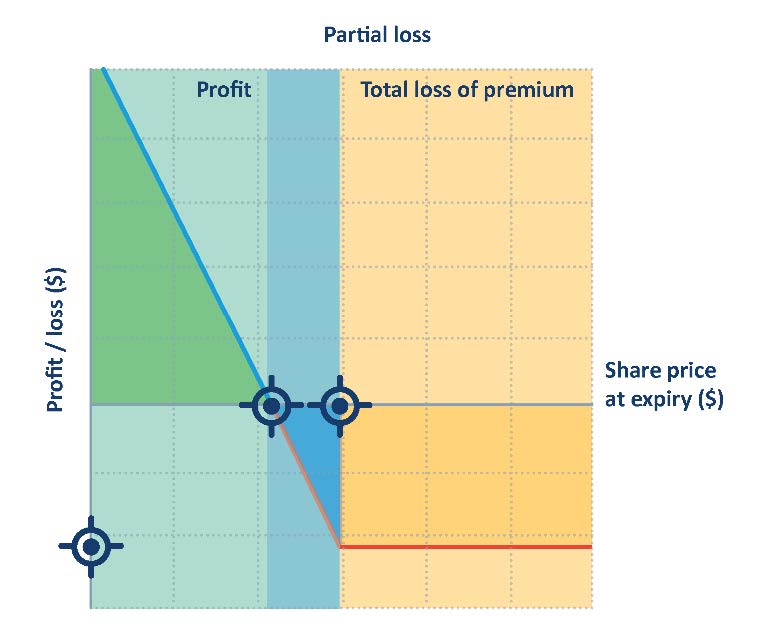

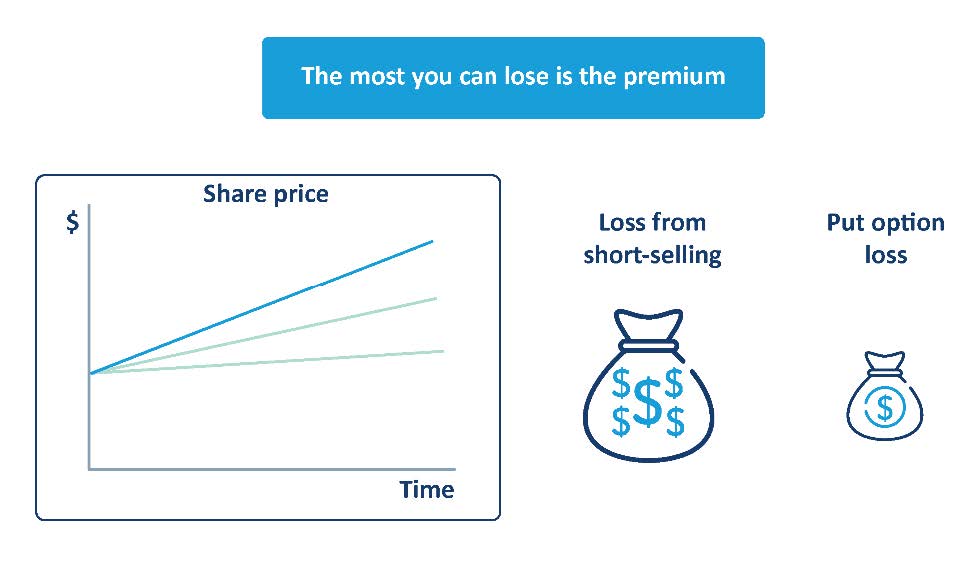

A put option is one of the few ways you can profit from a falling share price with limited risk.

Short selling shares is another way, but involves unlimited risk. There are significant restrictions on short selling shares on ASX, and in addition, some brokers do not permit short selling by retail clients.

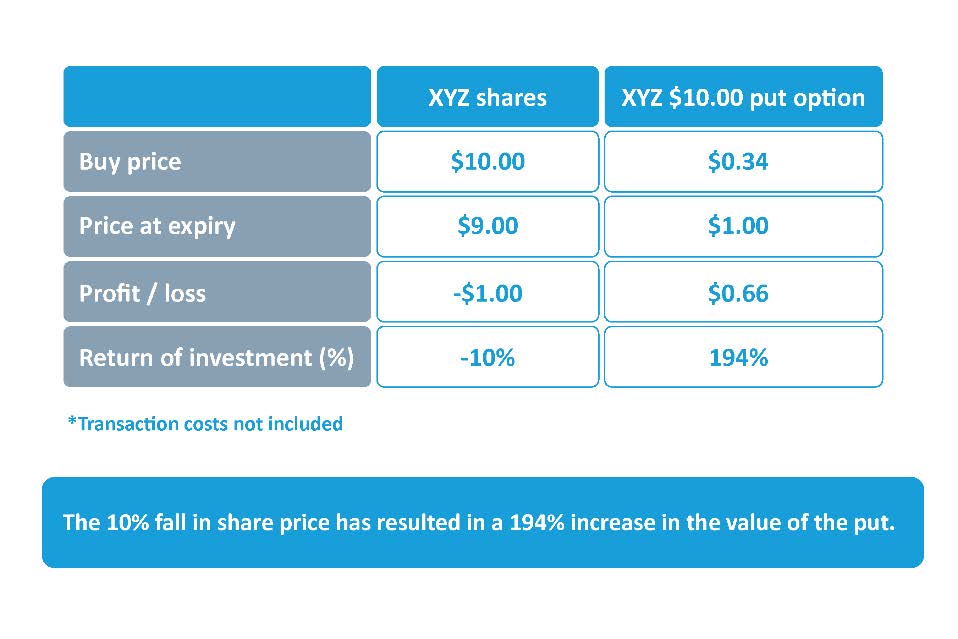

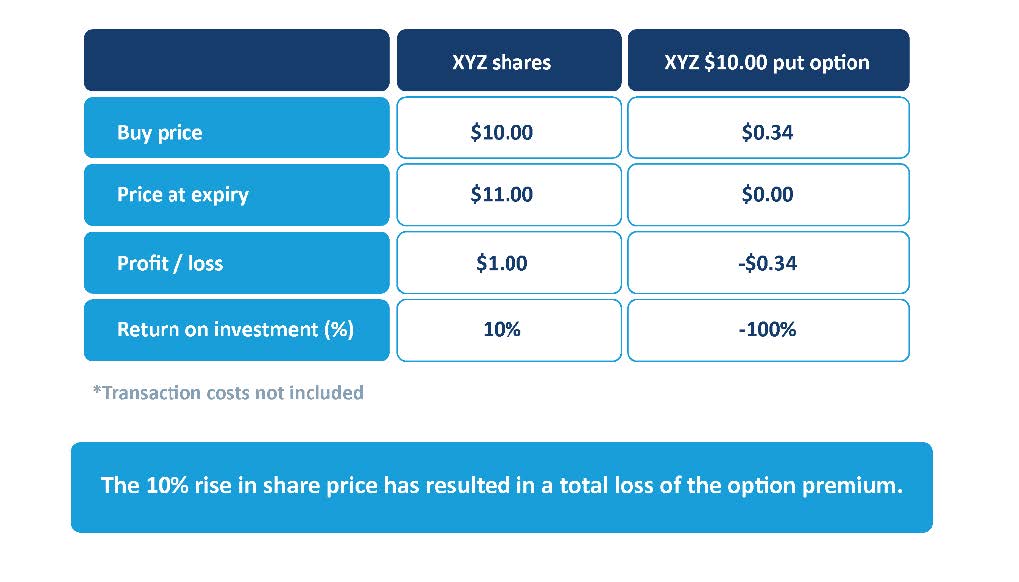

Buying a put option is as straightforward as buying a call option, involves limited risk and offers leveraged exposure to a falling share price.

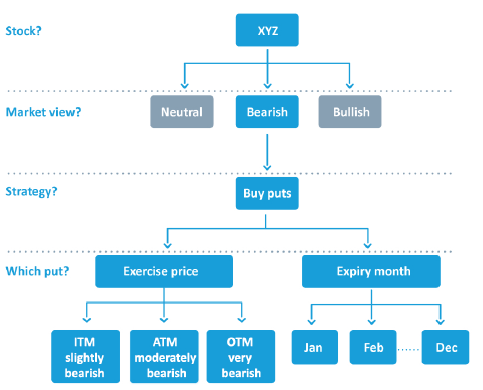

Buying puts to profit from a falling share price can be compared to buying calls to profit from a rising share price.

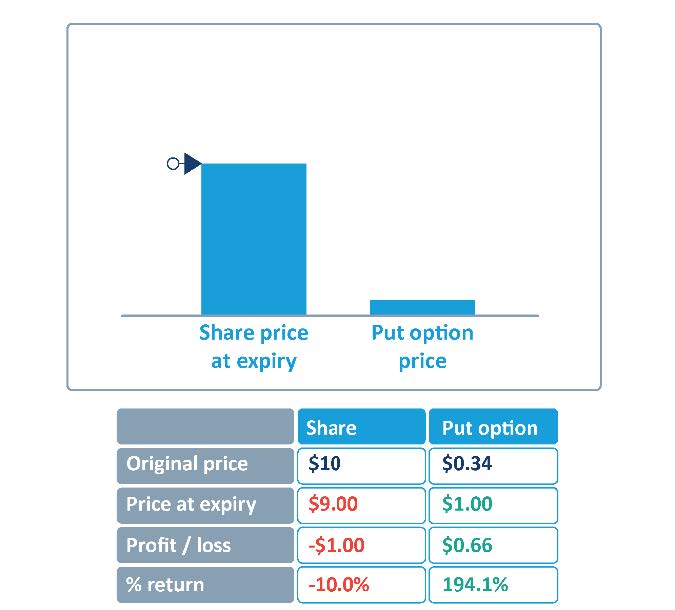

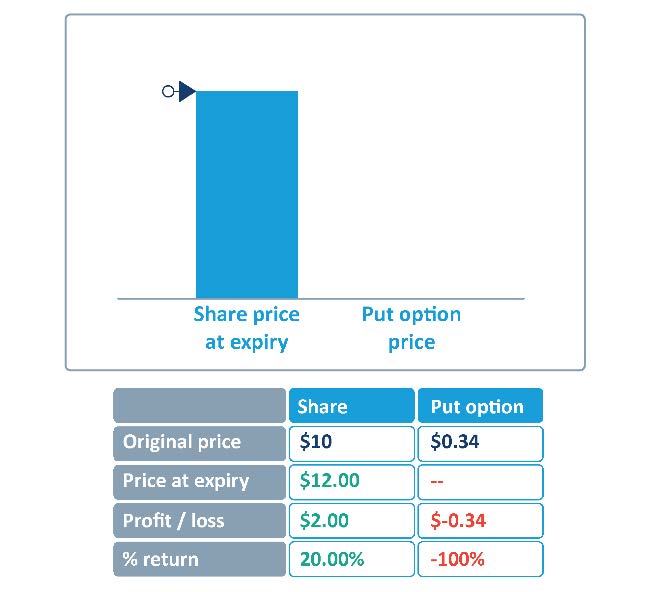

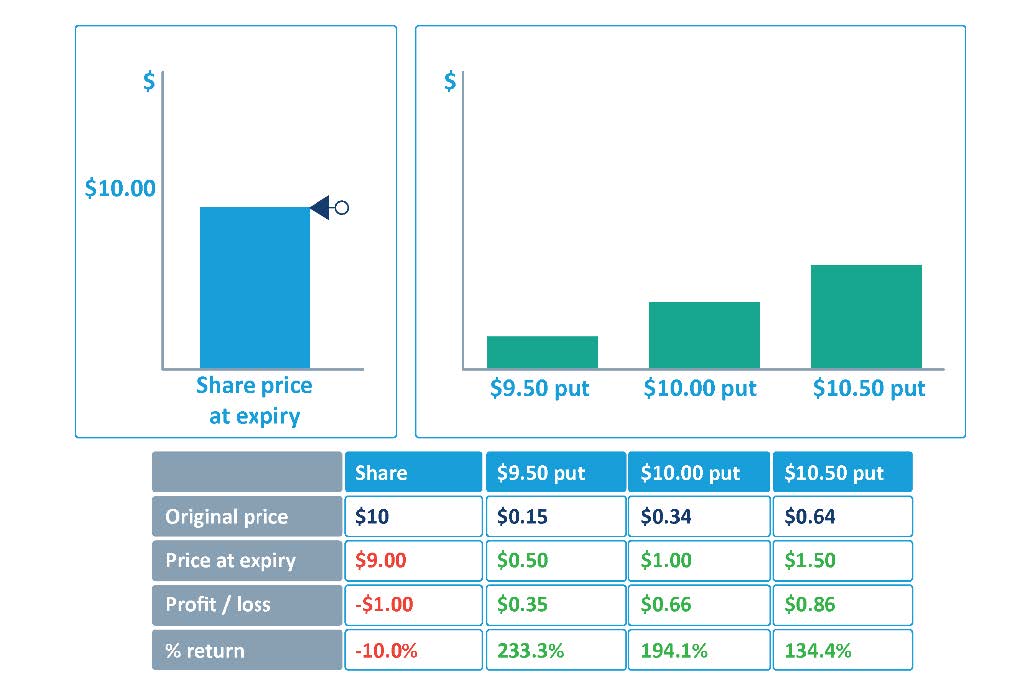

Leveraged exposure

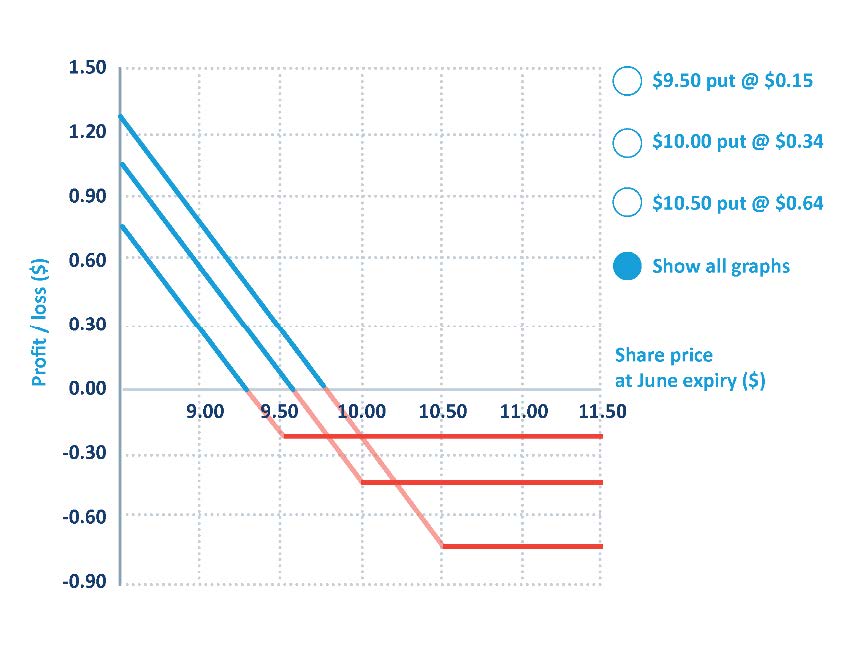

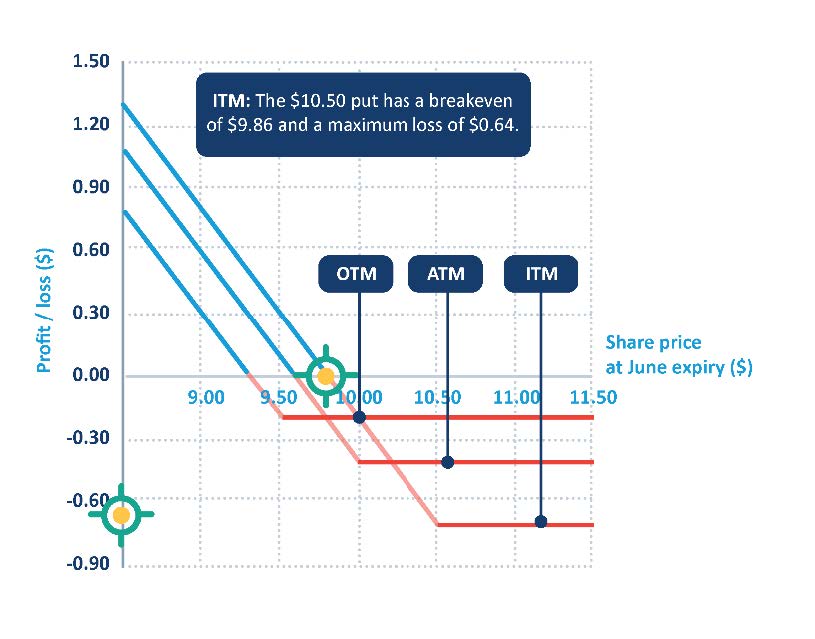

Leverage means a relatively large exposure for a relatively small cost. A small movement in the share price results in a larger change, in percentage terms, in the option price.