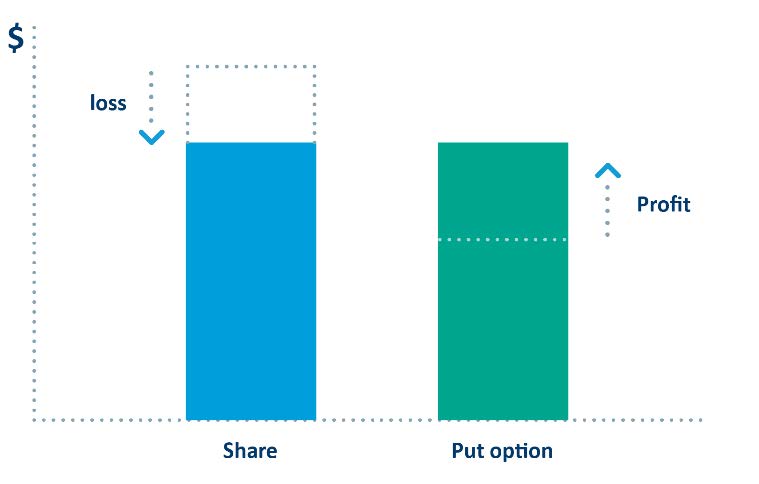

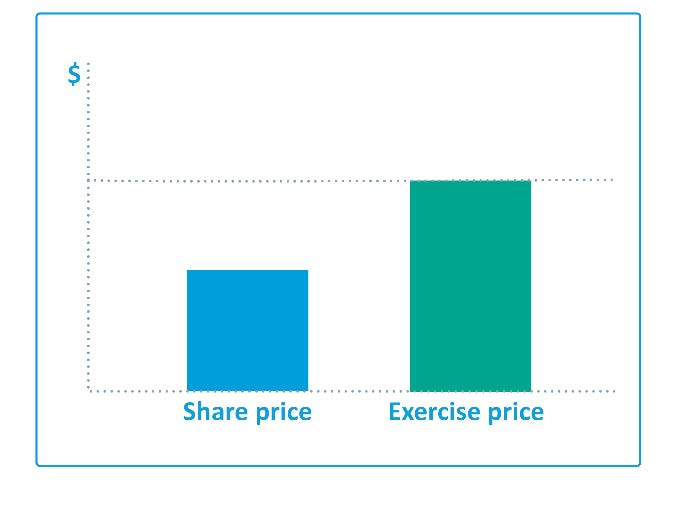

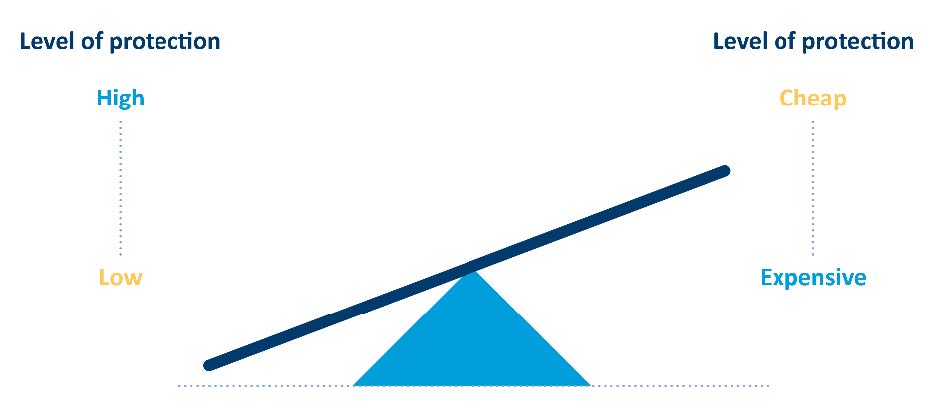

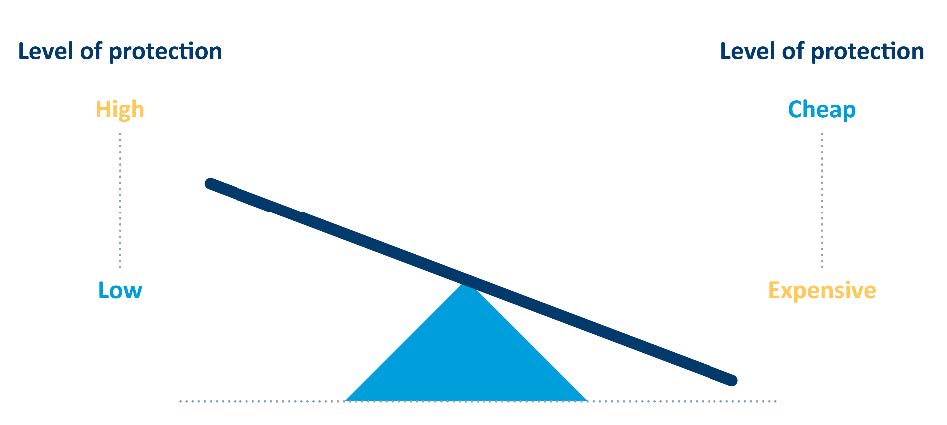

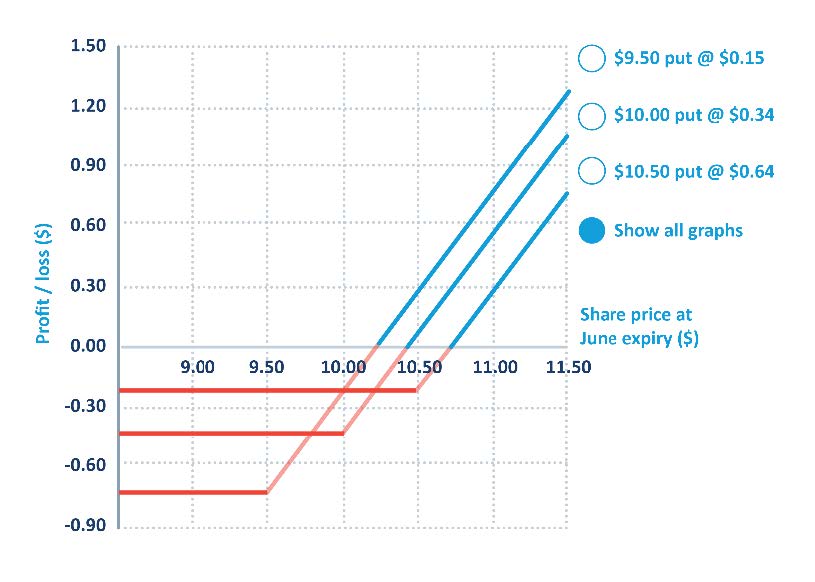

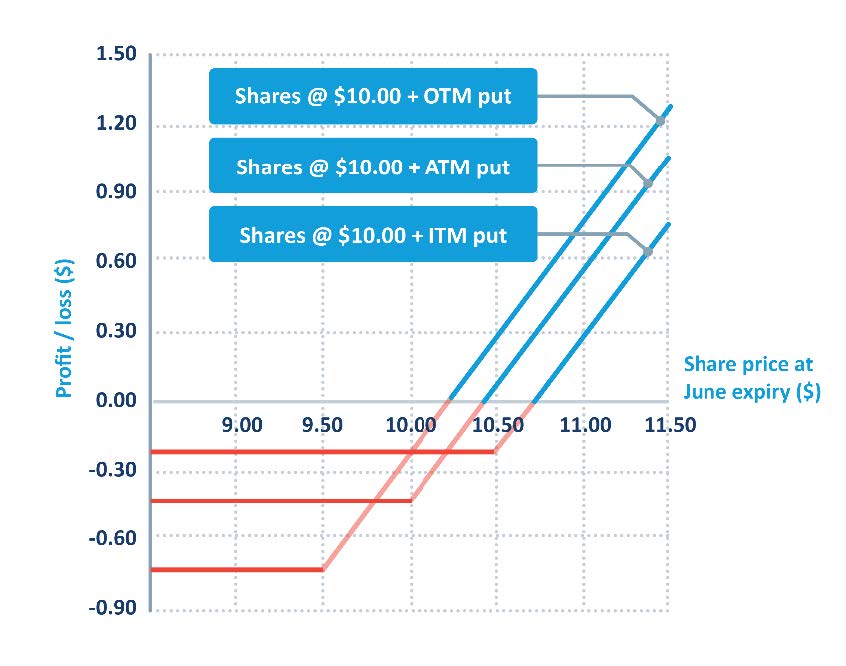

The higher the exercise price, the better your protection, as you lock in a higher sale price for your shares.

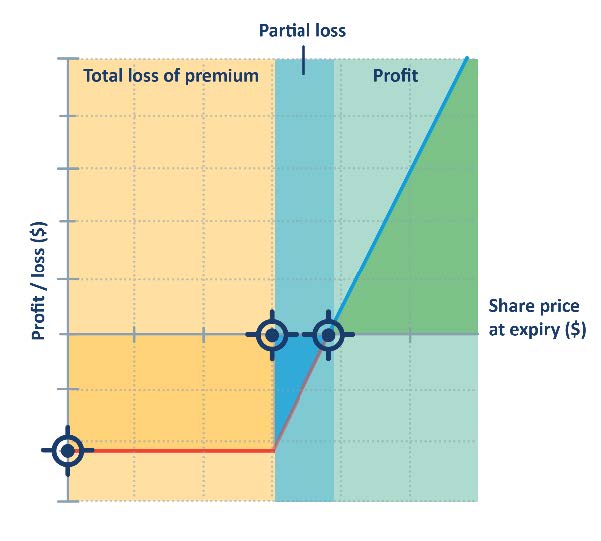

However, the higher the exercise price, the more the option costs. If the share price rises, and you do not end up using the protection, the option will expire worthless and you lose the premium you paid.

The more expensive the option, the higher the share price has to rise for you to break even (breakeven = share price + premium paid).

The ITM put provides the best protection, enabling you to sell your shares at $10.50, but the premium is the highest. The share price needs to rise to $10.64 for you to breakeven.

The OTM put costs you only $0.15, but the sale price you guarantee for your shares is $9.50 - $0.50 below the current market price.

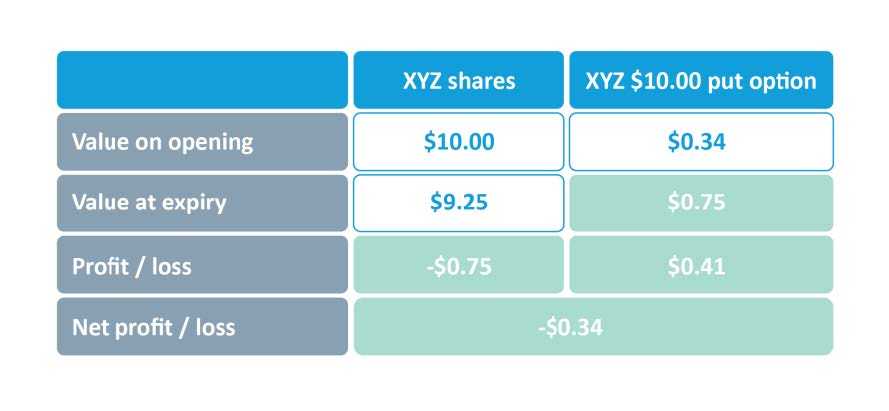

The ATM option may provide a good balance between the level and cost of protection. It secures a sale price equal to the current share price, and costs you $0.34. The breakeven point is $10.34.

Expiry month