Module 10: Cheaper stock or extra cash

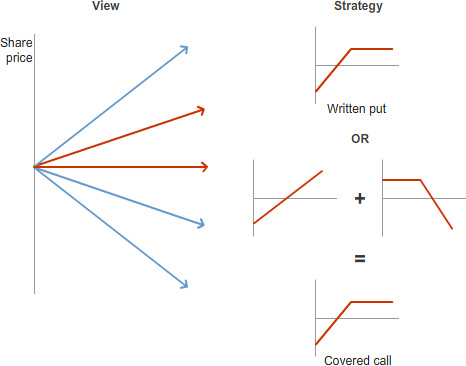

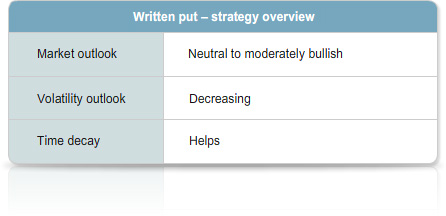

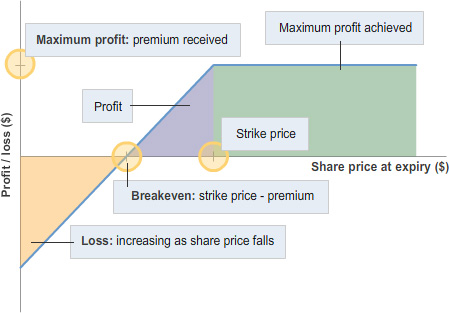

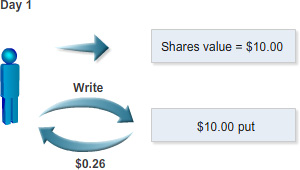

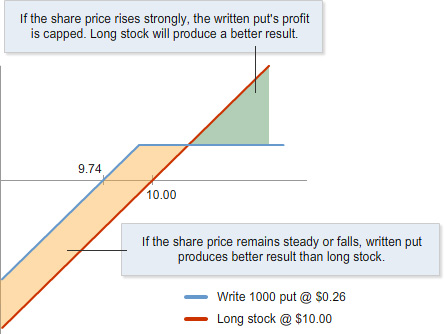

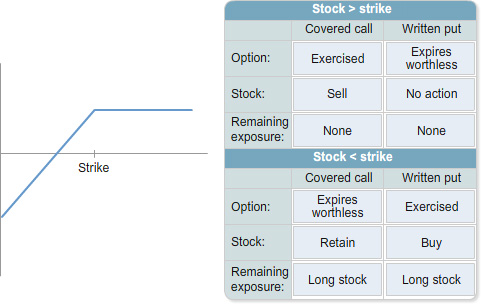

Most option traders are familiar with the covered call and the buy/write. Writing call options over your shares enables you to generate income in flat markets. The premium you receive effectively lowers the acquisition/holding cost of your stock. Fewer traders realise there is another strategy which provides the equivalent exposure, the written put. Although the two strategies provide equivalent exposure, there are more risk management issues associated with the written put than the covered call.