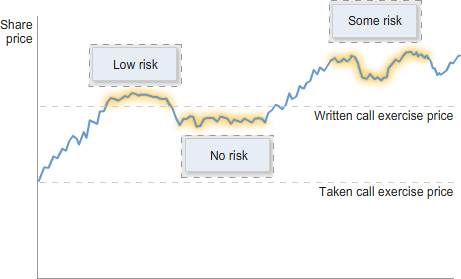

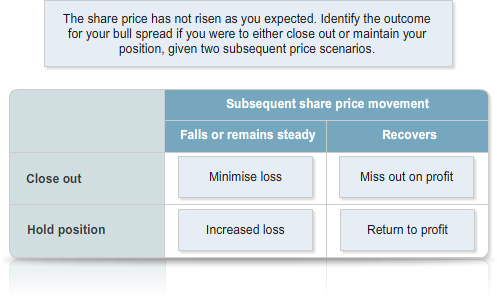

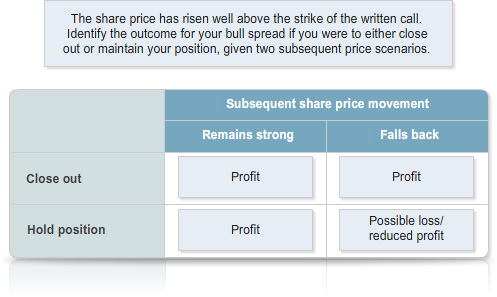

You don't have to wait until expiry to exit your position - you can close out the spread on market at any time.

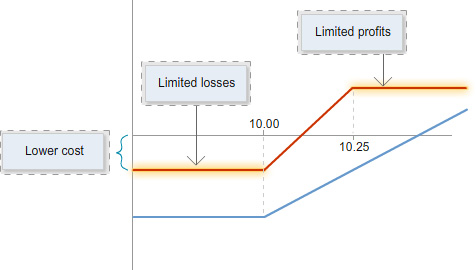

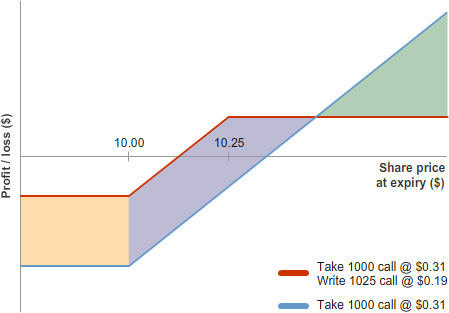

It is not possible in advance to know what your spread will be worth prior to expiry, but if the share price rises, both calls should increase in value.

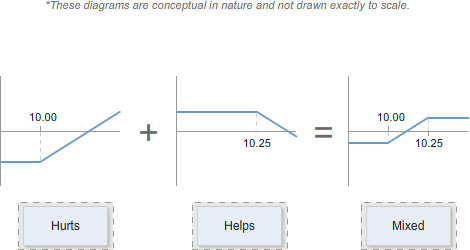

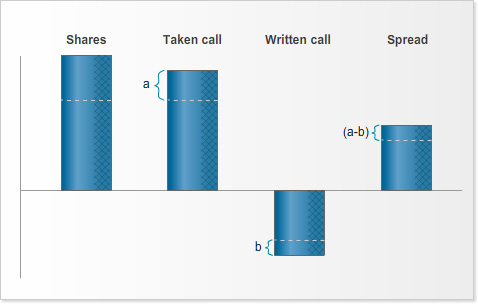

The taken call should rise in value by more than the written call, due to the difference in the deltas of the two options. The net effect is that the spread increases in value.

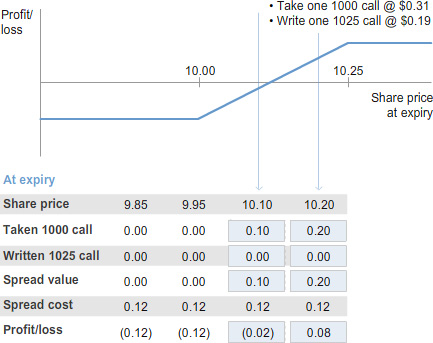

The taken call in our example might have a delta around 0.55, and the written call a delta of around 0.4, giving a position delta of 0.15.

For a $0.10 rise in the stock price, the spread should rise in value by about $0.015.